The State Of Venture Debt Post-SVB Collaps with SVP of Pacific Western Bank, Mark diTargiani

SaaStr

APRIL 11, 2023

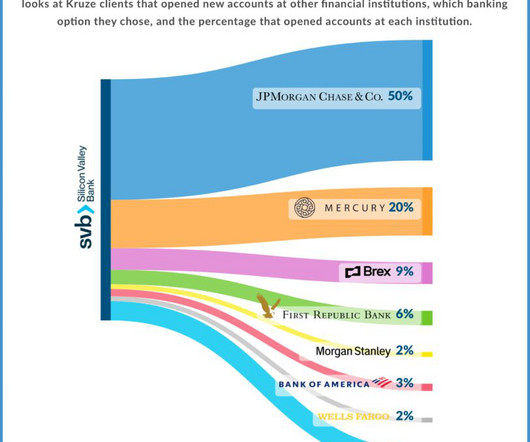

saw the second-largest bank failure in its history. Silicon Valley Bank specialized in venture capital-backed startups, primarily in tech. Understandably, the collapse of a venture bank where companies could lose billions of dollars was staggering. In situations like banks collapsing, people will ask a lot of questions.

Let's personalize your content