Shopify Says eCommerce is Back. But AWS Says Cloud Under More Scrutiny.

SaaStr

OCTOBER 28, 2022

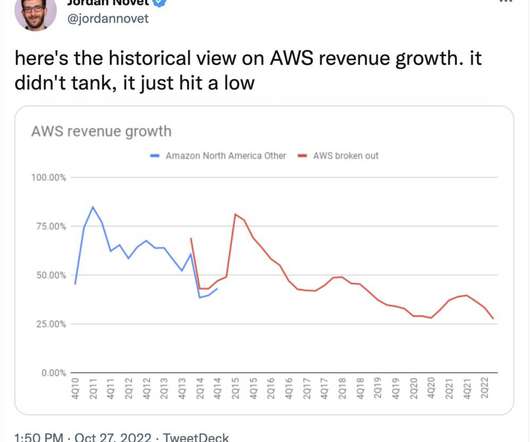

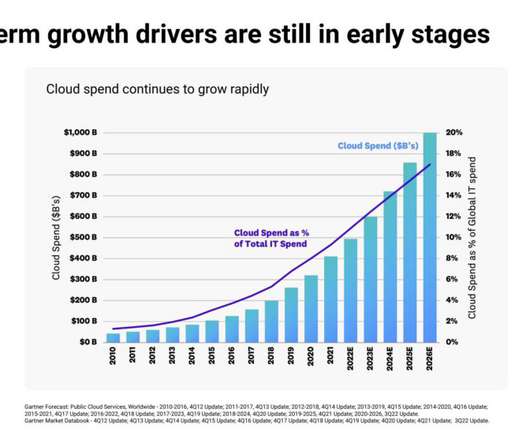

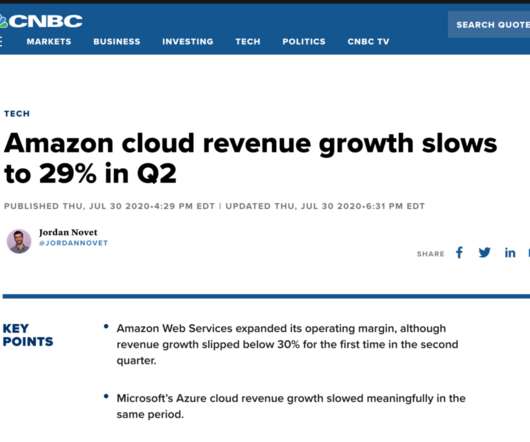

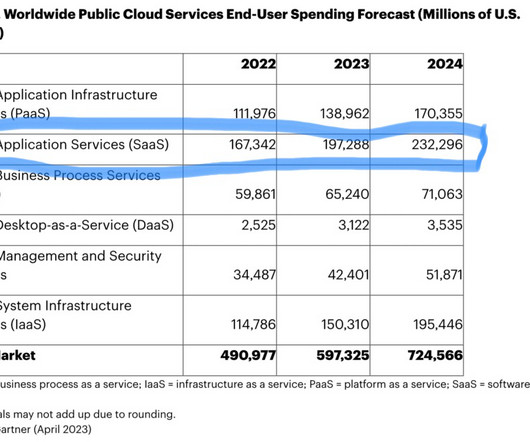

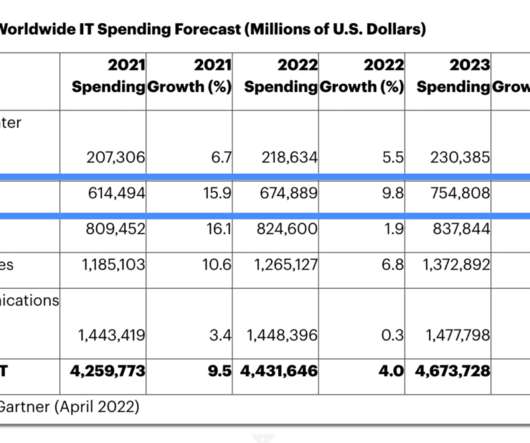

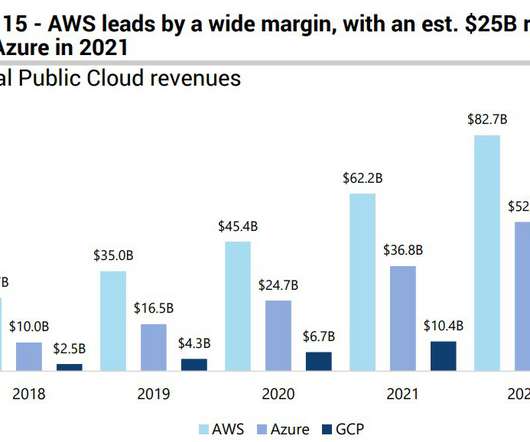

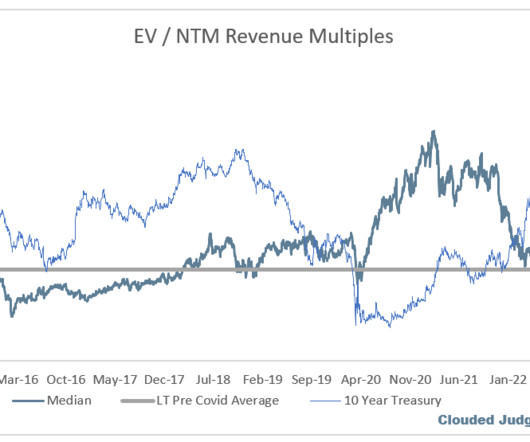

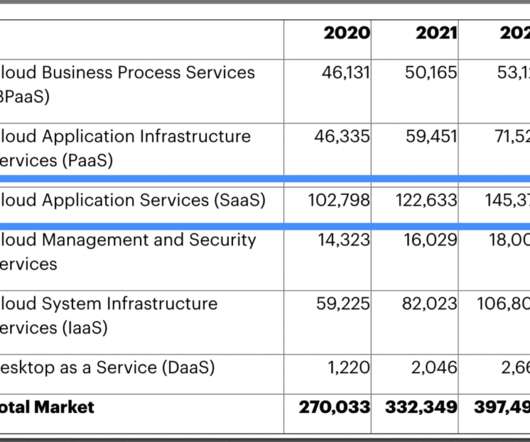

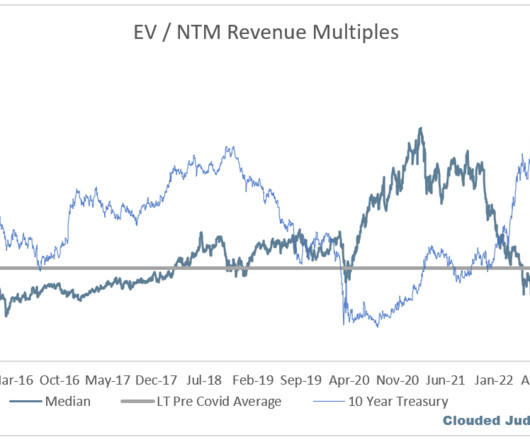

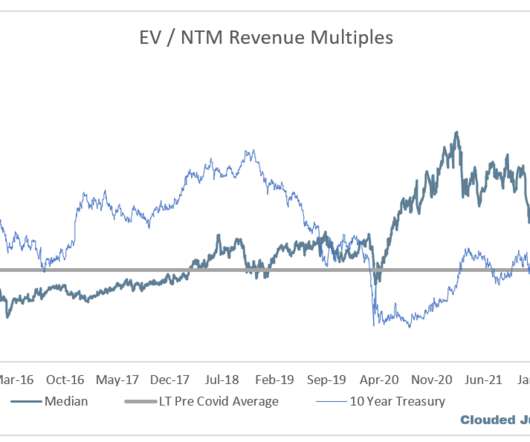

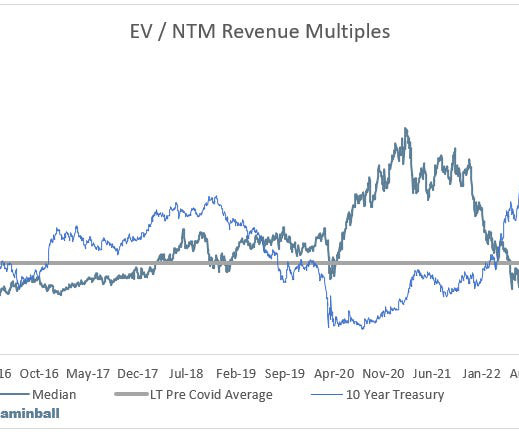

o this was an interesting week in terms of reading the tea leaves on what’s going on in SaaS, Cloud, the economy, and all that. Second, AWS, Azure and Google Cloud all grew nicely, and are still growing like a weed — but the growth rate slowed. But AWS Says Cloud Under More Scrutiny. Perhaps as it should be.

Let's personalize your content