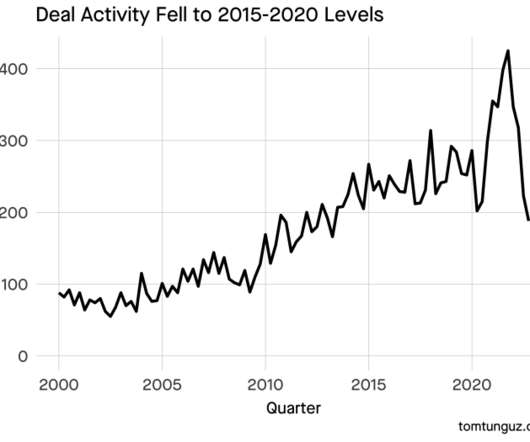

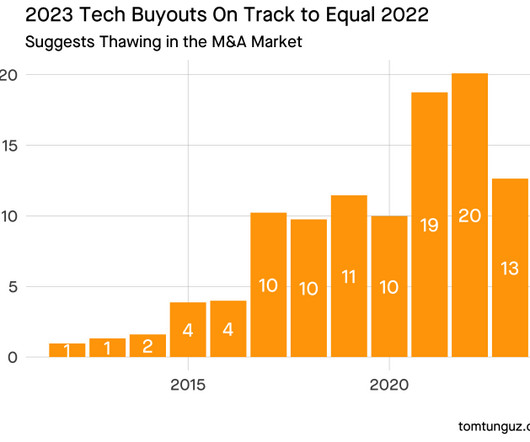

Do PE Acquisitions of Public Startups Imply We've Hit a Pricing Bottom?

Tom Tunguz

AUGUST 7, 2022

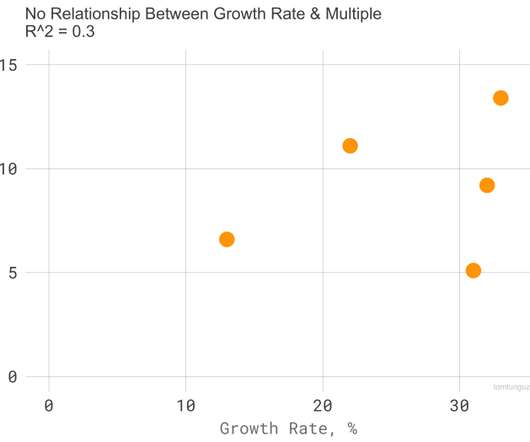

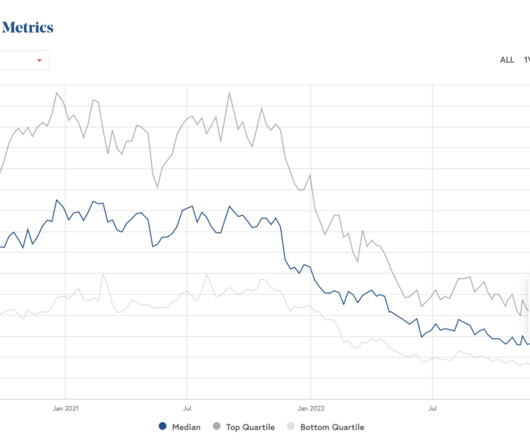

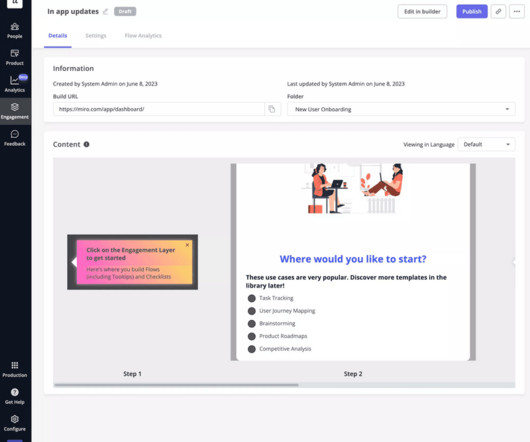

Since these transactions’ details are public, we can use them to infer how the private software market values companies. But no relationship exists between the Nasdaq’s price level & multiples. The more free cash the company produces, the lower the acquisition multiple. Growth Rate. FCF Margin. Ping Identity.

Let's personalize your content