Can You Still Get Acquired for a Decent Price if Growth Has Slowed or Even Stopped? Yeah, Sometimes

SaaStr

MARCH 29, 2024

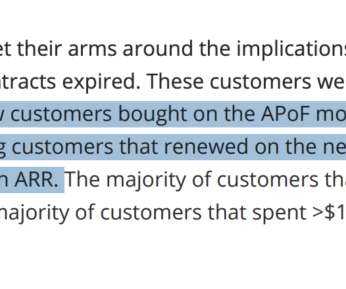

So the other day a CEO reached out to me about advice on an acquisition. I’d actually invested in the #1 in the space, which today is at $200m+ ARR. The post Can You Still Get Acquired for a Decent Price if Growth Has Slowed or Even Stopped? So I knew the space fairly well. But sometimes.

Let's personalize your content