Do PE Acquisitions of Public Startups Imply We've Hit a Pricing Bottom?

Tom Tunguz

AUGUST 7, 2022

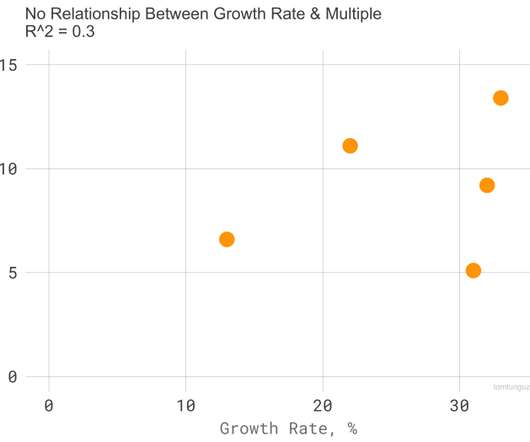

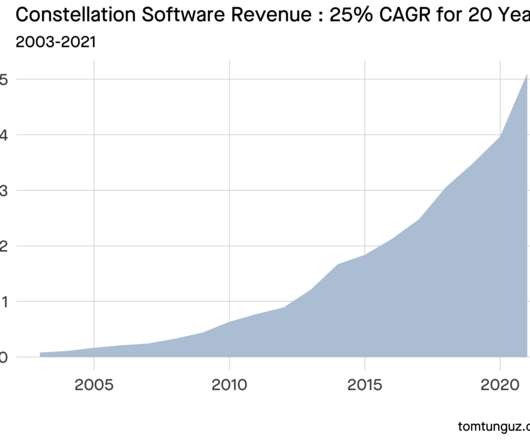

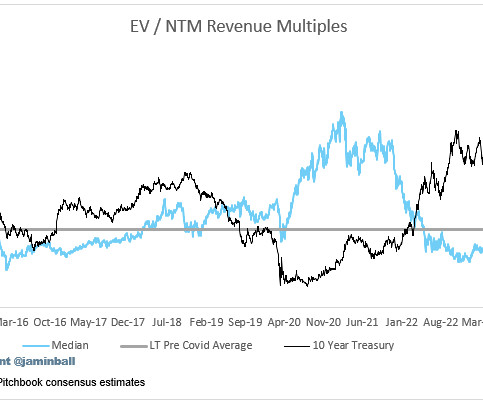

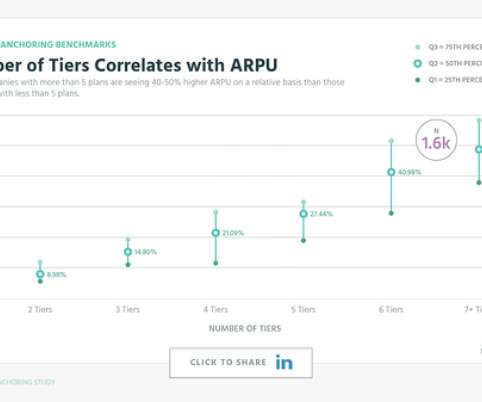

In the last decade, a software company’s revenue growth correlated most highly to its valuation multiple. But no relationship exists between the Nasdaq’s price level & multiples. Curiously, free-cash flow margin correlates to forward-revenue/EV multiples at -0.996. Growth Rate. FCF Margin. Ping Identity.

Let's personalize your content