Technology & Innovation

CFO tools: A FinOps tech stack checklist for SaaS CFOs

Having the best tech stack in finance should be a CFO’s top priority. Do you know what to look for? This checklist will help you build the ideal CFO tech stack.

When it comes to CFO software, it pays to be a forward-thinker as well as someone who sets high standards and strives for quality. The SaaS industry is too competitive for corporate leaders to get complacent about their finance tech stack.

Selecting the right CFO tech stack to help your accounting department and business as a whole thrive is a gift that keeps on giving. If you choose well upfront, you can set the foundation for long-term company-wide profitability and seamless scaling.

What is finance tech stack?

A finance tech stack consists of the tools that CFOs and their teams need in order to confidently and consistently create and utilize real-time financial reports and SaaS-specific metrics.

Ultimately, the right CFO software helps fast growing SaaS companies focus on securing more funding by enabling cross-functional teams to shift from manual, spreadsheet processes to more analytical and strategically aligned work.

But what exactly should you expect of your SaaS finance tech stack? And which key features and requirements should a CFO consider when choosing a finance tech stack?

CFO software checklist: A guide to building your finance tech stack

Do you know what to look for when building your finance tech stack? Having the best tech stack in finance should be a CFOs top priority, so we put together a CFO software checklist to help you put the right tools in place at the right time.

Start with a powerful general ledger (GL)

As CFO, you need to do everything possible to remove potential problems and snag points from your general ledger (GL). Automating your GL would give you access to robust benefits, such as:

- Continuous closing: The manual monthly close cycle is all too often a rushed, messy, and error-prone process. Automated accounting software sidesteps this by continuously closing your books as each new transaction occurs, rather than relying on a team of people to do it all at once every month.

- Effortless currency flexibility: Modern companies need seamless GL flexibility. Supporting international transactions with currency flexibility is a big piece of that equation.

- Detailed data drill-down: Many manual GL software options are shallow on their data, meaning that they don’t allow you to “dig deeper” into the details of your transactions, metrics, cash flow, and the other numerical aspects of your customer relationships.

Once your GL is squared away, what’s next on your CFO software tech stack checklist?

Know your billing use case

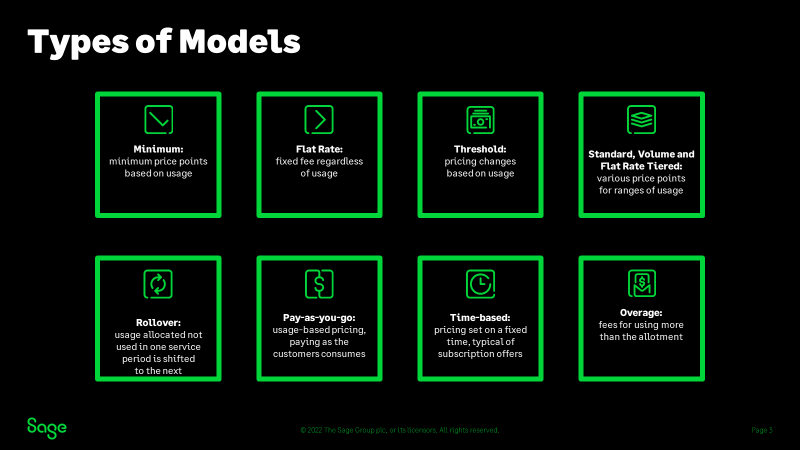

SaaS and recurring revenue billing lends itself to a plethora of different use cases. This is essential to understand when selecting your CFO software or tech stack, no matter what stage of the maturity lifecycle your company is in.

Automation can help you achieve two different goals around your billing:

- Certainty: Automated forecasting will allow you to run detailed billing and payment forecasts to confidently select the right billing model for your business. And just as importantly, automated reporting will enable you to translate that sense of certainty and confidence to your next board meeting.

- Long-term effectiveness: Choosing the right billing model upfront is no joke. Recurring revenue cash flow, by its very nature, has a sort of “trickle-down” effect over time. Selecting a suboptimal billing method and then repeatedly billing customers month after month can’t help but have long-term “invisible costs” in the form of lost cash.

What should your third major expectation be of your finance tech stack?

Know your revenue recognition scenario

ASC 606 and similar revenue recognition compliance standards can be a real headache if you rely on manual processes.

Especially for publicly traded companies, it’s an integral part of the accounting process and the official declaration of revenue figures. It helps keep companies honest.

However, that doesn’t necessarily make these regulations straightforward or simple. ASC 606 or IFRS15 involves an array of steps that must be followed for revenue recognition purposes.

Relying on spreadsheets or manual CFO software makes potentially costly errors much more likely.

Automated accounting software can help you stay on top of your disclosure obligations for ASC 606.

Cloud-based reporting data

CFOs who rely on manually run departments encounter a common problem: Data is slow in being compiled, inaccurate, or both.

This is because manual teams often gather reporting data through inefficient methods like email chains and internal communication channels. That’s just asking for trouble.

Automated accounting CFO software leverages a single source of truth (SSOT). When you automate your CFO tools, all the data you and your team members need will be available from a centralized location stored securely in the cloud.

Investing in modern CFO software can tremendously ease the burden of data gathering and compilation for projects and meetings.

Anticipating sales expectations

Your finance tech stack can assist you in spotting sales exception trends so you can prepare a plan to handle them.

Whether SaaS or not, every company has those elusive market segments: groups of prospects you know could make strong customers, but they always seem to slip through the cracks for one reason or another.

With automated CFO software, you’ll be able to seamlessly track your sales data in depth to see where your reps are hitting snags.

Once you’ve pinpointed where the problem segments are, you’ll be able to equip your sales staff with concrete and proactive responses to these situations.

Spotting sales trends and taking the appropriate measures is much simpler when you’ve invested in CFO software that can help you along the way.

Compliance

If you rely on manual accounting tools, you’ll introduce additional issues and complexities around compliance.

If you get audited, will you be able to prove that you have all the proper control and approval architecture in place for transactions, SOX compliance, and going public?

One of the most convenient things about cloud-based CFO software is that it enables you to set up detailed audit trails.

You’ll be able to automatically log and perpetually store specific details about when each transaction was initiated, note when specific changes occur and why they occur, and more.

With the right CFO tech stack, you’ll never need to worry about an audit again. Even if you do have to submit to a compliance audit, you won’t need to have an ounce of anxiety about it.

CFO software for modern SaaS companies

As a finance leader, you have a lot on your mind, naturally. But one thing that you shouldn’t be worrying about is your tech stack. There is a new way to create your stack that you can begin leveraging right now.

To learn even more about why automation is the new standard for the CFO tech stack, check out our ebook on how Quickbooks isnt keeping pace with CFO needs.

Ask the author a question or share your advice