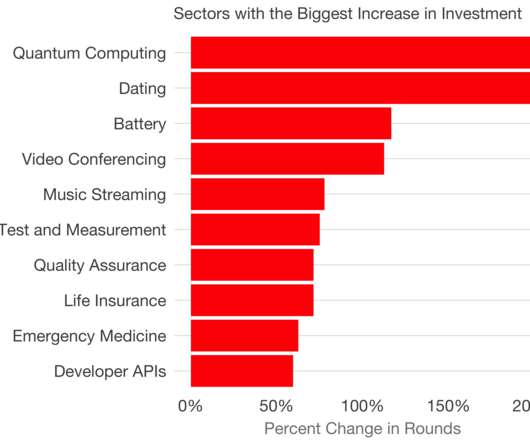

SaaS Fundraising in 2017

Tom Tunguz

JUNE 11, 2017

Comparing 2017 averages to seven year highs, we observe Series A, Series B, and Series Seed round sizes are effectively at their all-time highs, ignoring some minor differences. In 2016, venture capitalists reduced their investment in staff companies by 1 ⁄ 3 , falling to $2.8 billion from $4.2

Let's personalize your content