How Correlated are the Web 2 and Web 3 Software Markets?

Tom Tunguz

JANUARY 12, 2022

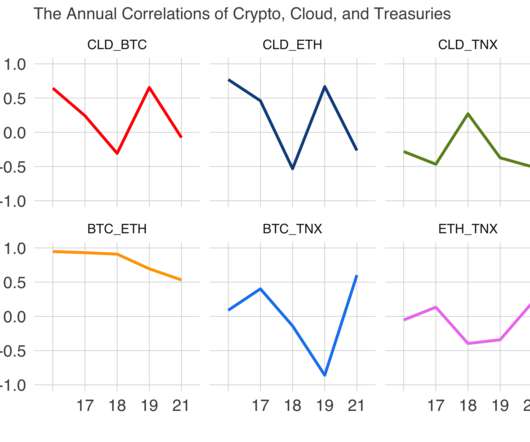

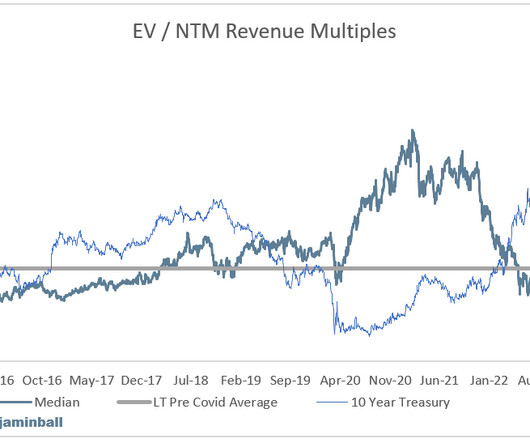

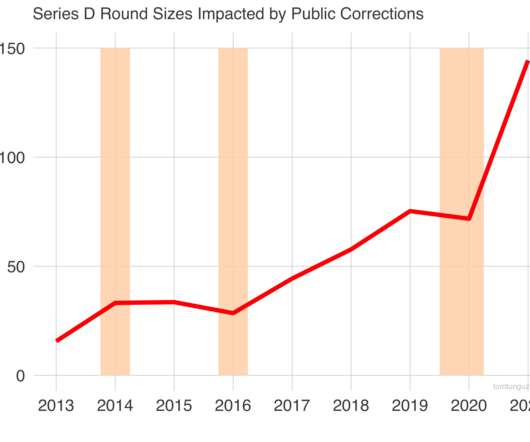

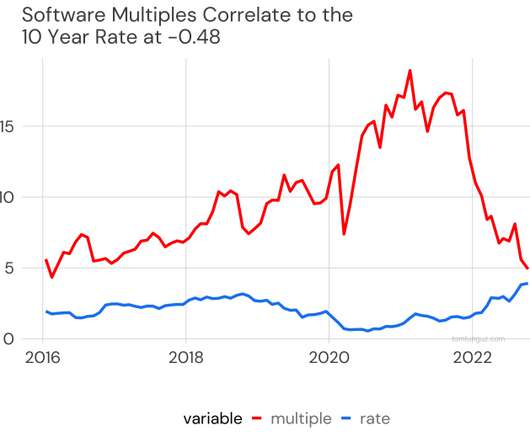

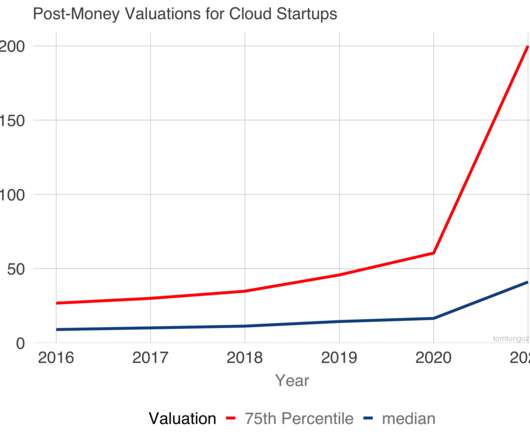

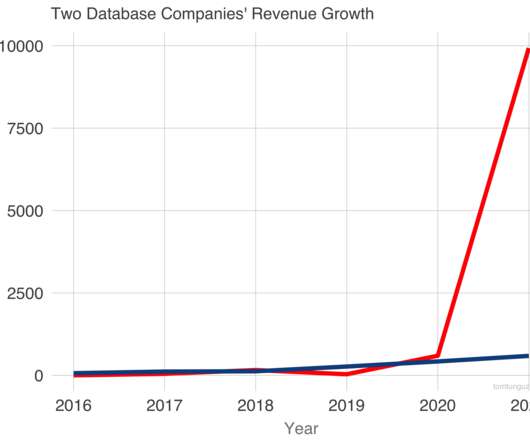

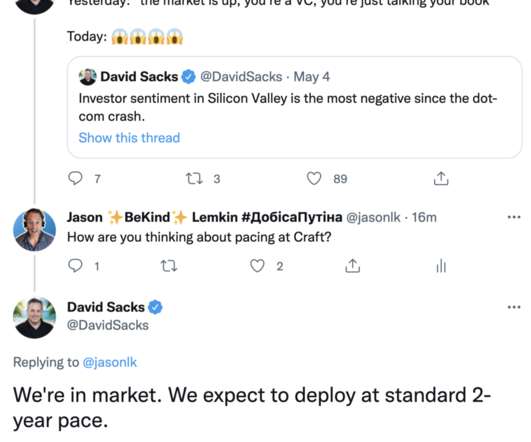

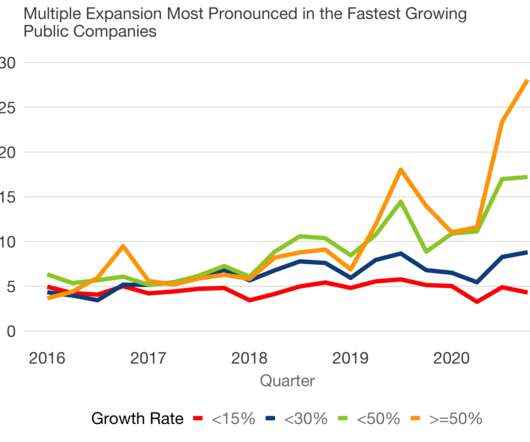

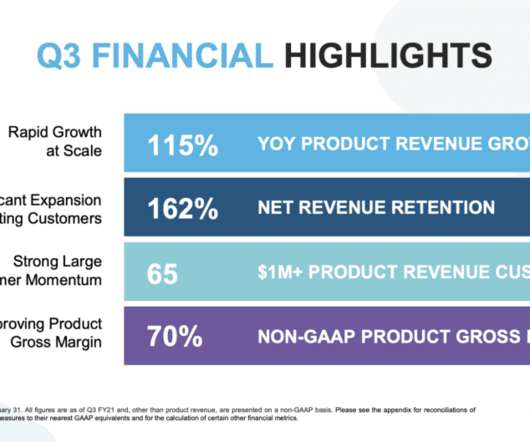

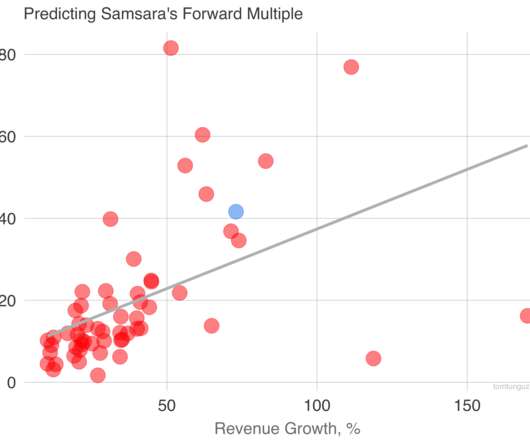

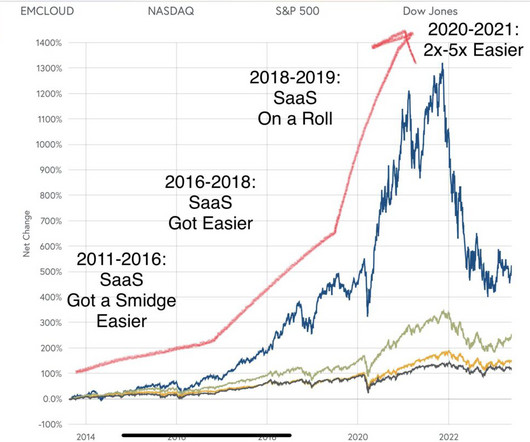

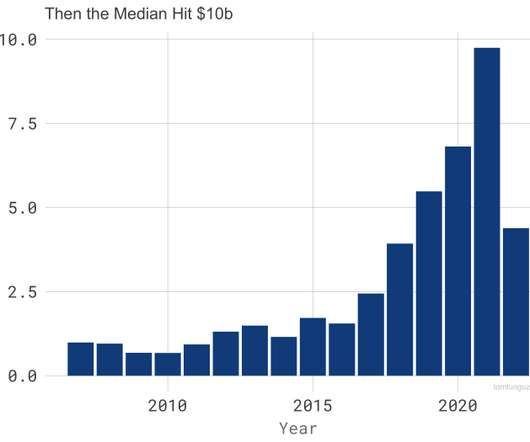

In the last few weeks, public software company multiples have halved. Beyond the most recent cycle, how often do the web2 and web3 software markets move in synchrony? Beyond the most recent cycle, how often do the web2 and web3 software markets move in synchrony? The cryptocoins appreciated much more than software.

Let's personalize your content