Q1 2016 Startup Investment Trends

Tom Tunguz

MARCH 31, 2016

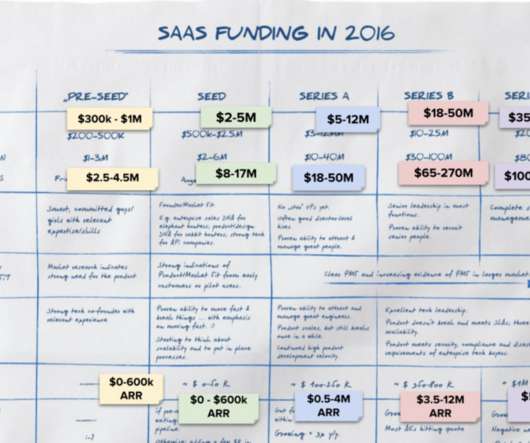

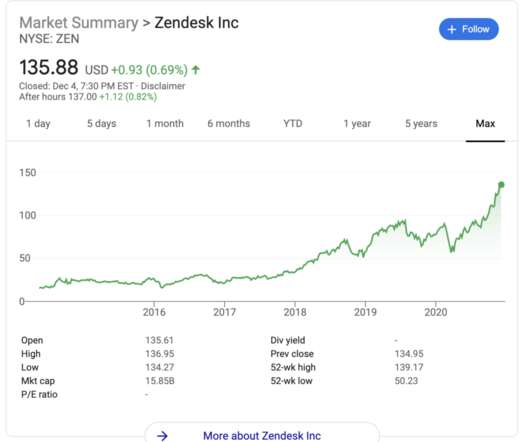

Q1 venture capital investment remains steady relative to Q4 2015 at about $15 billion, but down from the near records attained in 2015. So, on a historical basis, venture capitalists are still investing at rates substantially above average. 2016 is off to a slower start than 2015. 2016 is off to a slower start than 2015.

Let's personalize your content