Startup Investment Trends in 2015

Tom Tunguz

JULY 8, 2015

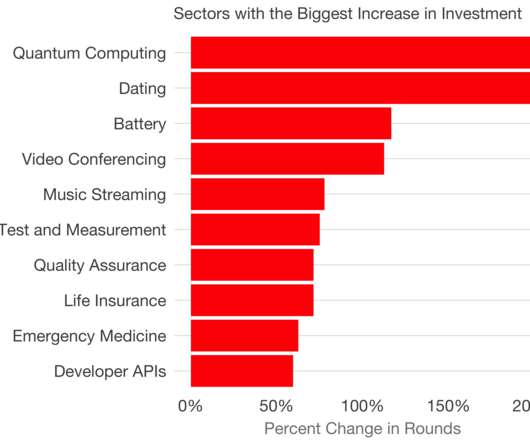

In the last six months, VCs have invested more than $57B according to Mattermark data , which puts 2015 on pace to exceed 2000 as the year the most venture capital will be deployed, ever. If we compare the seed investment patterns to the growth investment patterns, a few other trends pop out of the data.

Let's personalize your content