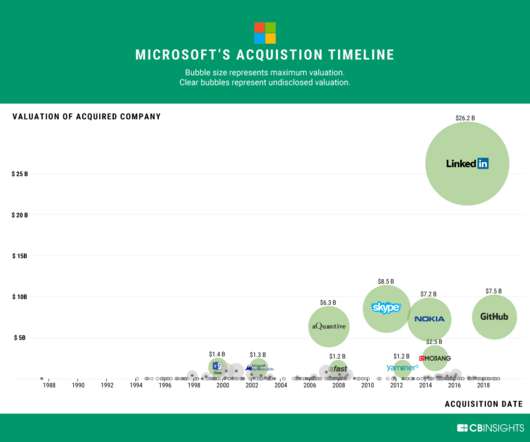

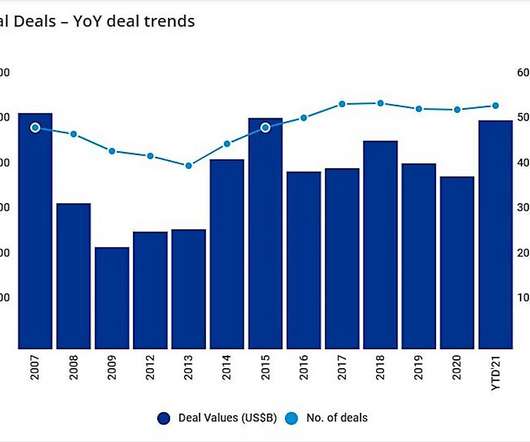

Trends In Startup Acquisition Market in 2015

Tom Tunguz

JUNE 29, 2015

This time last year, I analyzed the state of the startup acquisition market. First, the larger acquisitions were becoming larger. Second, that the total number of acquisitions in 2014 would achieve a 5 year high. As of mid-2015, the first trend continues while the second seems to have faltered. Two key trends surfaced.

Let's personalize your content