The Figures that Will Move the Venture Capital Market in the Next 5 Years

Tom Tunguz

JUNE 5, 2021

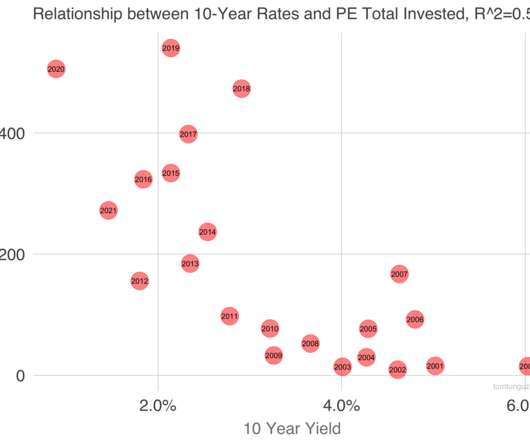

What does it mean for venture capital and Startupland? Let’s examine the relationship between total venture capital investment and the 10 year Treasury in some detail. The y-axis tracks enture capital investment by year and the year of the data point resides in the reddish circle.

Let's personalize your content