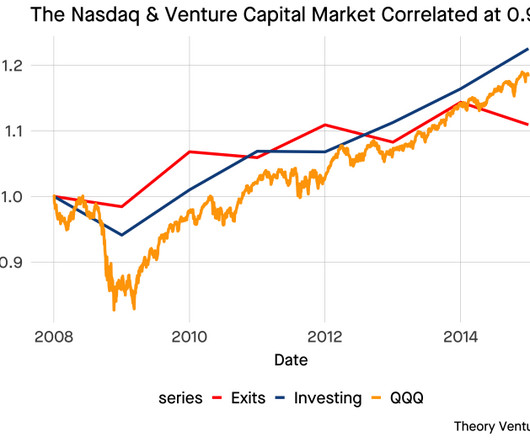

How Will a Venture Capital Recovery Feel? Observations from 2008

Tom Tunguz

AUGUST 6, 2023

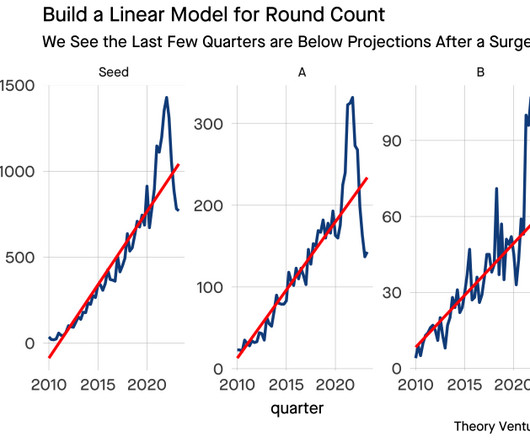

What will a venture capital turnaround feel like? In 2008, I had just become a venture capitalist. Then GreenDot’s IPO in Q2 2010 at $1.4b Will it be gradual or sudden? What will change the sentiment in the market? Three months later, Lehman fell & the Global Financial Crisis started. at $1.5b.

Let's personalize your content