Mean Reversion: When Will Startup Investing Return to Normal?

Tom Tunguz

AUGUST 20, 2023

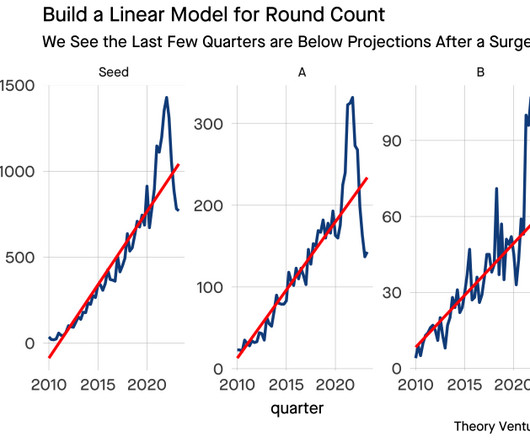

The red is a linear model based on data from 2010 to 2018 that predicts activity rates for each financing series of US & Canadian software companies. [1] By looking at the cumulative rounds since 2010, we can see that Seed, A, & B volumes all trended meaningfully above their predicted counts.

Let's personalize your content