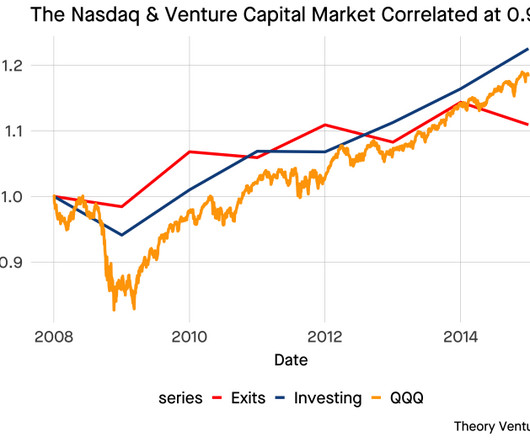

How Will a Venture Capital Recovery Feel? Observations from 2008

Tom Tunguz

AUGUST 6, 2023

Then GreenDot’s IPO in Q2 2010 at $1.4b We do see some initial signs with the Mosaic acquisition & the New Relic take-private. Companies chewed gravel, gritting out each quarter. About 5 quarters later, the exit market offered a little sprig of hope. In Q4 2009, Amazon acquired Zappos for $1b.

Let's personalize your content