Doubling Down: Peter Specht, Partner at Creandum

SaaStr

MARCH 7, 2024

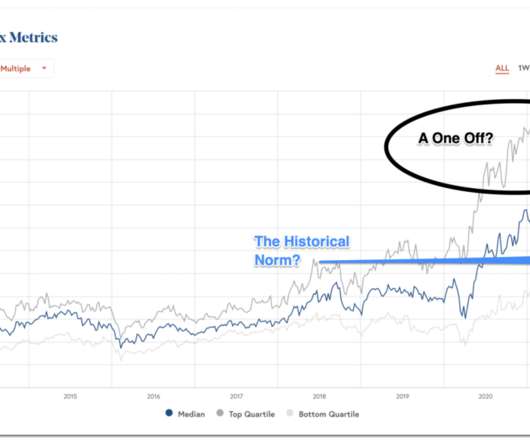

Be that in the early stages when one iterates on product market fit and finding the right ICP or later on when you scale your GTM. Creandum led the first institutional round in 2008 and it became Europe’s largest tech company to go public ten years later. So I’m going for something else. Focus and double down on things that work.

Let's personalize your content