Ask anyone in Fintech SaaS about the shifts of the last 18 months and you’ll hear stories about investment shortages, rising churn rates, and market consolidation. Gone are the days of the free-money era. Interest rates are sky-high and the pool of cash is drying up.

This presents a significant challenge to Fintech SaaS founders. How can they thrive and survive when the landscape is so crippling? Our latest Fintech SaaS series intends to find out.

In lots of ways, Panintelligence’s 15-year-long journey mirrors the evolution of Fintech SaaS. Our own SaaS originated as an internal solution for a leading payment gateway provider. That’s why we’re sharing our expertise in the field with extensive industry insight from Fintech’s in the trenches—like FINBOURNE, incuto, Lenvi, Mutual Vision, OnePay, techUK, and Tred.

It’s our hope that this series not only informs Fintech SaaS founders, but inspires the tidal wave of innovation that's on the horizon.

Let's get into it!

The origins of Fintech SaaS

From its origins as a B2C payment enabler to a staple across insurance, lending, compliance and more, Fintech SaaS now boasts a solid foothold within B2B and B2B2X markets. In fact, you could say the entire Fintech industry is rapidly transforming into a sector almost exclusively served by SaaS, with over 5.4k* Fintech SaaS companies operating globally.

New SaaS Fintech technologies, products, and services emerge every year. Over 400* SaaS Fintech products have been added to G2 from 2020 to now. Combine this with the 4.6/5 average rating that SaaS Fintechs boast on the software review site, and it was only a matter of time before the SaaS paradigm became an inevitability, rather than an option, for Fintech.

But a key challenge impacting the Fintech scene is investment—or lack of. As of October 2023, there’s been a 51% drop in funding in Fintech companies compared to the same period in 2022.

Despite the market widely agreeing that this is a short-term anomaly in an otherwise upward long-term trajectory, the reduction in investment has caused competition to swell.

But then came AI.

There’s a lot to be said about the rise of advanced AI like Causal AI, but one of the undercurrents is that it’s hard to embed. The benefits of AI have been well covered, but the analytics required to apply it risk congestion for internal teams.

The bottom line: The constant stream of new and emerging challenges are threatening some of the sector’s most well-established players every single day, motivating VPs of Product to react, review, and revolutionize.

The quest to disrupt is on; the questions are on our lips.

- Which Fintech segment will trailblaze ahead of the others?

- What technology will cause the most disruption to the industry?

- Is artificial intelligence (AI) the sector’s friend or foe?

Let’s explore these key questions and more. But first, what does Fintech SaaS growth look like today and where funding is being channeled?

Fintech SaaS growth rates

Fintech revenues are projected to increase sixfold by the decade’s end, reaching $1.5 trillion. Such mammoth growth is matched by the Fintech SaaS market, set to hit $949 billion by 2028. That’s a CAGR of around 17%* from 2021, despite the current dip in investment in the sector.

Global Fintech revenue growth by region, 2021 to 2030

Growth multiple (X), 2030 revenues ($B)

(2021 to 2030 global Fintech revenue growth by region. Source: BCG, 2023)

Taking a closer look at exactly where this funding is being channeled, B2B Fintech SaaS comes out in pole position. Highly resilient and undeniably adaptable, SaaS can rise and respond to the changing tides of the Fintech market with ease.

Its ability to seamlessly integrate into a business’s operations and applications is no longer a need—it’s a want, a must—making SaaS the enabler of customizable and configurable financial services that meets the demands of modern-day business. SaaS well and truly has the financial sector in its hands.

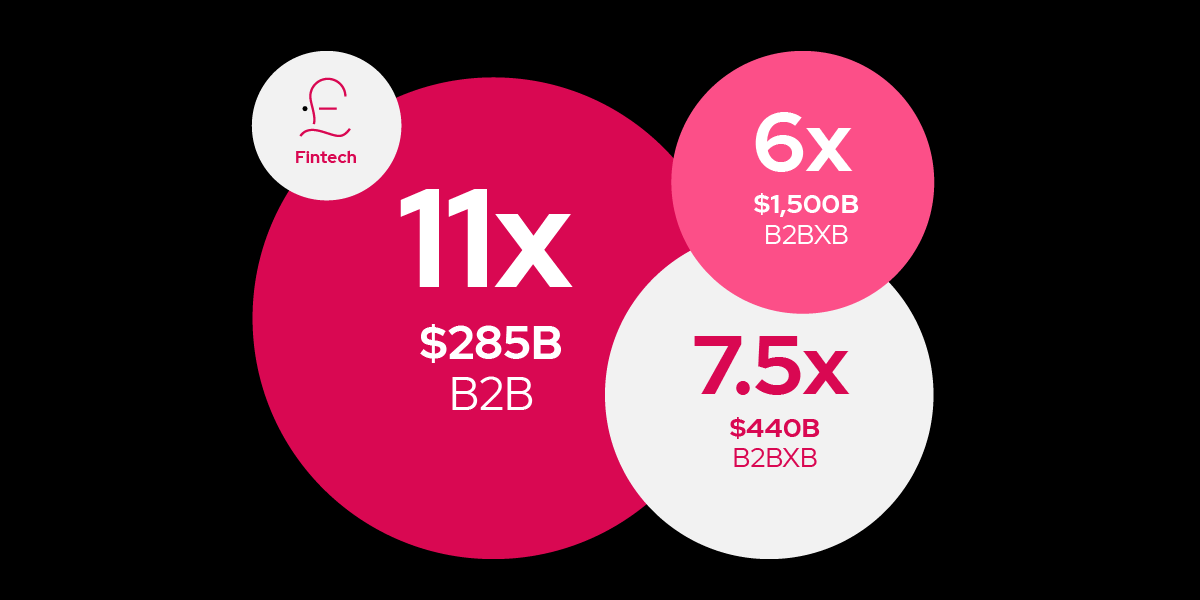

Looking ahead, there’s no doubt of a prosperous future for Fintech SaaS. B2B Fintech revenue is expected to grow eleven-fold by 2030, by 2030, reaching a value of $285 billion. The B2B2X Fintech space, however, is the one poised to make the next big impact.

Despite predicted growth being smaller than its B2B sister, the B2B2X market is projected to generate revenues of circa $440 billion by the close of the decade. Embedded finance has become second nature to end-users, who are increasingly—and arguably, subconsciously—reveling in the ‘invisible’ nature of their financial transactions.

All made possible by Fintech SaaS.

Global Fintech revenue growth by space, 2021 to 2030

Growth multiple (X)

(2021 to 2023 global Fintech revenue growth by space. Source: BCG, 2023)

The Fintech SaaS investment landscape

As of October 2023, $2.13bn* in Fintech SaaS equity funding has been raised across 122 rounds. Comparing this to the same period in 2022, over double ($4.38bn) was raised in just under double the number of rounds (231).

Yet comparisons between the last few years aren’t so black-and-white. 2021 saw a surge in investment off the back of the Covid-19 pandemic – just as the 2008 financial crisis spurred customer demand for new waves of non-traditional banking and FS, the pandemic could be seen as the springboard that propelled Fintech SaaS to new heights.

Investment in SaaS rocketed, and the turn of the decade pushed us over the precipice into the Fintech revolution that had long been building.

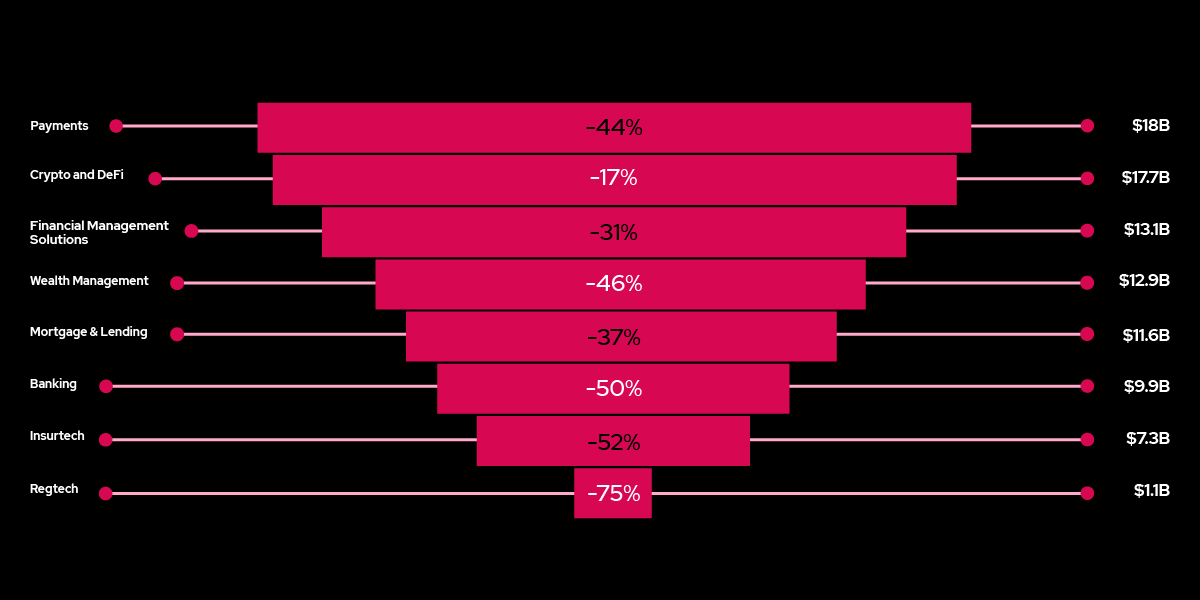

Fast-forward to today, and while funding in Fintech itself might be down, there are two segments retaining significant strongholds over investments in the market: payments and crypto. Though the former recorded almost a 50% decrease in funding in 2022, the ongoing digital transformation combined with the ease of sending and receiving money from your pocket continues to open a realm of opportunity for payment providers—and the businesses and consumers they serve.

Fintech funding by segment in 2022

(Fintech funding by segment in 2022 compared to 2021. Source: Dealroom 2023: Fintech 2022 report)

In the same year, it may come as a surprise to see that Regtech was the lowest-funded segment. With more Fintechs, more Fintech SaaS, and a hugely fluctuating FS sector, it’s fair to have assumed that investments in regulatory tech would be rife.

But just as new Fintech sparks new opportunities, it also sparks new concerns. As the boundaries of the types and amounts of data we can store, move, and manage are pushed, it’s certainly a segment to watch.

Fintech SaaS investment challenges

Thanks to the ongoing effects of the Covid-19 pandemic, investors seemingly had their hands on an abundance of cash. The question was, where to put it? One word: Fintech. Perhaps the obvious choice, but the necessary choice nonetheless.

But as Andy Thornley from techUK puts it, every mountain has its peak;

The last 18 months have threatened to unravel the work of the investment landscape. Fintechs that had burst onto a scene that promised prosperity now found themselves in tough territory.

As Tom McHugh from FINBOURNE points out, geopolitical challenges combined with eye-wateringly high interest rates and one crisis after another caused the strings on investor moneybags to be drawn tight; “The reason for slowing investment is really simple—it’s purely to do with the interest rate curve. High interest rates have a very negative impact on companies, so investment right now just isn’t at the volume that it used to be.”

Barriers to investment

Indeed, the dizzy heights that both interest rates and inflation hit during 2023 have put yet another dent in the investment landscape. Though September saw the Bank of England hold its policy interest rate at 5.25%, the highest borrowing level since 2008, European Fintechs that were once used to taking home the most VC funding year-on-year are now up against a tirade of barriers.

As Richard Carter at Lenvi puts it; “one of the main barriers to getting investment is down to scale—it’s one thing being able to roll out a proposition, but another to get it to a position that could justify external investment is another matter.”

Optimists would argue that times of challenge present opportunity—there’s evidence later in this post of the same. But there’s one challenge that’s rarely avoidable when it comes to slowing investment: risk appetite, namely lack of.

Richard adds; “In the tighter environment, there needs to be a really strong investment case. And you can see that some of these propositions, whilst they may add value to the end customer, they just won’t get the funding they need because it's a bit of a risk—and no-one's willing to take that much of a risk right now.”

Our view? SaaS itself is in a cautious recovery from the VC funding slowdown, with many investors saying, ‘we have bottomed out’ to levels we were at pre-Covid. The metrics that matter now all involve efficiencies—to get funding, you need to demonstrate capital efficiency. That’s burn multiples of two or less, if you are at growth stage.’

This is a view shared by the industry too. Neil Harris at OnePay says; “There’s definitely a focus on investing in profitable businesses, who also have aggressive growth plans. Long gone are the days where investors would back a bleeding-edge technology stack.”

Neil believes products need to be trusted and proven as well as profitable, adding;

Unfortunately, a gender divide remains too, as Alex Craven, at Data City, points out; “Women-led Fintech businesses are significantly less likely to secure private investment than in other sectors.”

B2B SaaS Fintechs: The blueprint for success?

Just how can Fintech find that pathway to profitability, then? Investors need immediacy and clarity—and that’s the superpower of SaaS that stands up against almost any backdrop of difficulty.

B2B SaaS, your time has come

53% of all Fintech deals in 2023 involved B2B software

(Fintech deals that involved B2B software in 2023 Source: Dealroom, 2023: Fintech 2022 report)

Sustainable SaaS business models now trump triple-digit growth. If you’re burning less cash, then investors expect slower growth rates. But it still feels like US VCs are holding out for triple digits, even though the average SaaS growth between $2m and $10m has been 20% over the last four quarters.

Simplification has always been the aim of the SaaS game—it’s the name now, too. As Lenvi’s CEO says, it’s about getting Fintech propositions to places that justify the investment. While Fintechs and Fintech SaaS companies look for ways to keep cash and avoid raising new funds at lower valuations, simplification has sown the seeds for a new trend: consolidation.

It’s not news that the investment blueprint hasn’t changed—VCs want profitable, sustainable business models. An estimated 5.4k Fintech SaaS companies operate globally, with 35 unicorns and 96 soonicorns. London leads the way with 405 Fintech SaaS companies, followed by the city that never sleeps—273 call New York home. It’s a noisy space to stand out in.

During this apparent downtime for investments, Fintech is focussing on consolidating multiple products and services into neat, attractive propositions with various profitability pathways for when the tide begins to turn, as explained by the Chief Product Officer at Mutual Vision; “I think the Fintech market is consolidating—only in the last few weeks we’ve seen how different Fintechs that were once specialists in one element now have two, three, four things coming as part of their offering. For instance, if they were a traditional payment provider, they’re now broadening that offering into other related areas.”

The Fintech SaaS superpower

While Fintechs themselves might be experiencing an industry-wide plunge, Fintech SaaS isn’t. It’s an investment correction that’s spurring innovation, and B2B is the place to be. The once-revolutionary B2C Fintech has paved the way for a wave of new-world B2B Fintech that is finally responding to business’s demand for SaaS to serve payments, lending, insurance—you name it, there’s SaaS for it.

Though the focus of investors has somewhat shifted, the landscape of investment has remained rigid. Is it still fit for purpose? Or could now be a pivotal moment for it to respond to modern demands, consumers, and conventions, such as the Fintech SaaS providers themselves have?

“I think my problem with investment is that in order to get investment, there’s a playbook. The playbook involves a management team where one person has worked at Google, another is able to reel off the ambition for the business, and someone else can say they’re going to exit in three years… Unless we fix the problem, then it doesn't feel like the problem is going away,” says Andrew Rabbitt, incuto.

But according to Andrew, it’s not just about the investment playbook. Data plays a key role too; “The barrier to investment in our area is that investors rely solely on the same data points—they’re the only data points they have. The cost-of-living crisis, poverty—that’s a big problem. And doubling our prices/increasing the cost to our customers so that investors can see a growth trajectory that will make us more money come January because then we can exit and sell out just isn’t what we’re about.”

As Andrew found, this means founders often suffer the indignity of choosing freedom over investment; “the investment landscape should have shifted by now – they should have realized that the model of investing against the metrics of your challenger banks is just stupid. And until investors catch up with that, it's just not really that interesting for us.”

The future of Fintech SaaS: It starts (and ends) with data

So, after this deep dive into the Fintech SaaS state of play for 2024, hopefully, you understand the ‘what’ and the ‘why’, now it’s time to work out the ‘how’. How to compete, gain investment, innovate, and boost profits.

Our take is this: What lies at the heart of Fintech SaaS? There is one thing that stands out. One thing that makes you unique. And that one thing is data. Intelligence or data is the beating heart of SaaS Fintech. Your offering will thrive or fail because of good or bad data.

These days, our whole world is made up of data. And that data represents an opportunity to create personalized, actionable insights, that can drive your Fintech forward.

Think of a Fitbit. It doesn’t just count steps and read your heart-rate. It gives you an overview of your health and then recommends actions to keep moving, improve sleep, and overall wellbeing.

That’s what your employees and customers want to see in your business applications.

While you may not have much data at the start of your fintech journey, as you scale and grow with each new user comes more and more data. Everything that comes afterwards—think future dev ops, product innovations, and customer success are all informed by the data you create and collate.

The problem is a lot of businesses are currently not doing enough due diligence on data, or conversely, not getting the most out of data. You might not really know what it’s telling you, or worse, be misled by the data.

To compound the issue, as your data grows so does the demand for access to timely information in the form of visual storyboards, interactive reports, and analytics.

So, will you go down the same path, following the last decade’s playbook? The opportunity for doing data differently is huge. But how do you make the leap from 2014-esque insights to what you’ll need this next decade?

Enter: embedded analytics

We cover this in depth later in the series. But for now, we’ll leave you with this: In our work with customers who have already moved boldly into the new decade of data, we’ve seen what it takes.

Companies today need to progress up to the data maturity curve and move from traditional analytics (delivered by a small group of data scientists) to predictive and embedded analytics. It gives hundreds of people access to data, opposed to five or six analysts in the business who then produce reports for the rest of the business.

With a tool like Panintelligence, it takes all the data you have collated, all the insights, and the information locked in your systems. And turns it into a valuable opportunity:

- Your Dev and DevOps teams will learn how best to architect your data stack to support analytic queries, whether that is real-time against your application or via a dedicated data lake or warehouse.

- Your Product Management team will begin to see (and hopefully hear) how the analytics are helping your customers. They’ll discover which ones are working, which need refining, and how they will also start to garner more feedback about other potential customer requirements.

- And your Customer Success team will start to see their customer success metrics trend in the right direction

Suddenly, business insights aren’t something “out there”. They’re right where you need them, helping your teams to make better decisions, and take action.

The future of Fintech SaaS will be proactive, not reactive. Data is the lifeblood of your fintech and embedded analytics is the enabler to make this happen.