Observations Using LLMs Every Day for Two Months

Tom Tunguz

MAY 29, 2023

plot revenue by year on a line chart with the caption tomtunguz.com and the the line color red with a size of 2 ggplot(revenue_long, aes(x = year, y = revenue/1e3, group = 1)) + geom_line(color = "red", size = 2) + labs(title = "Nvidia Revenue Grew 2.5x row$value),] row = row[!

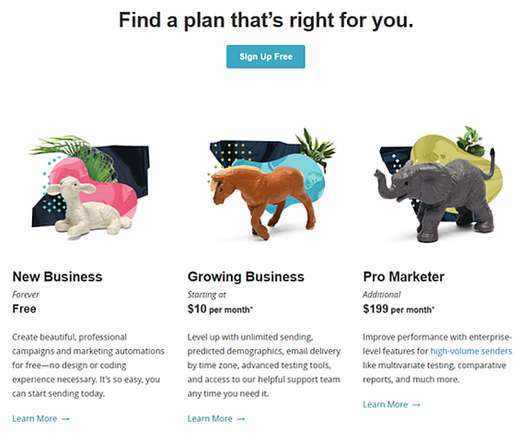

Let's personalize your content