From 0 to $500 Million ARR in 6 years: Learnings from Innovating in Underserved Markets with Samsara CPO Kiren Sekar (Pod 549 + Video)

SaaStr

APRIL 22, 2022

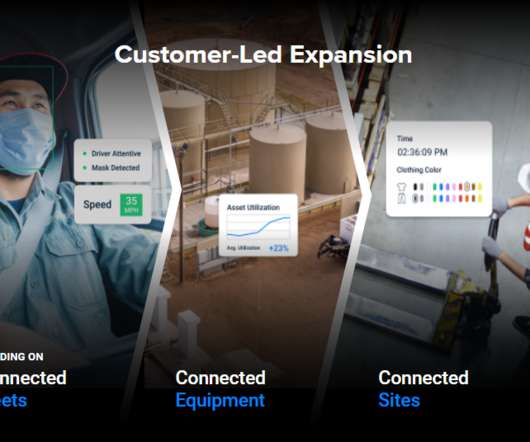

One example is from the earliest days of product development. This also encourages employees not on the product team to take ownership in product development. By 2001, when laptops started to surf the web, about 1 million devices existed. Serve them and make their feedback important for guiding your product development.

Let's personalize your content