Bezos' Shareholder Letter in 2000

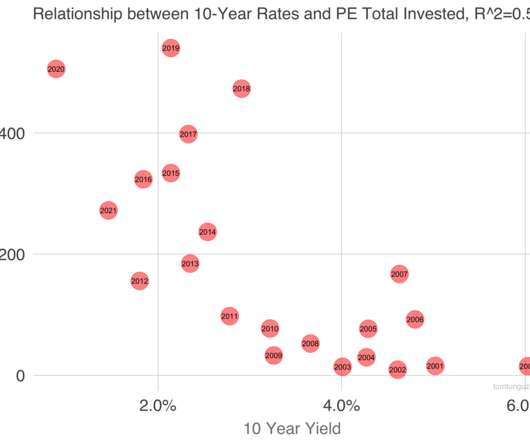

Tom Tunguz

JUNE 19, 2022

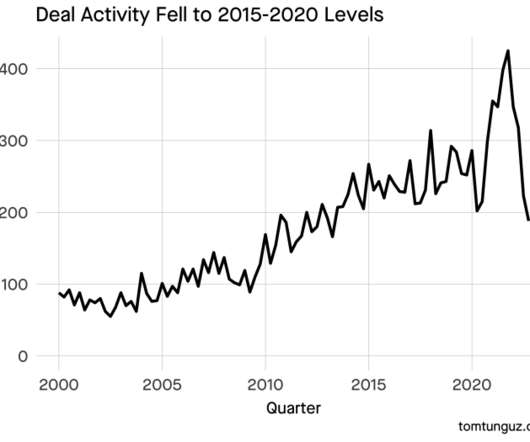

Jeff Bezos wrote this to start his annual shareholder letter in the year 2000. Bezos continued: So, if the company is better positioned today than it was a year ago, why is the stock price so much lower than it was a year ago? All this took patience: Amazon’s share price exceeded the dot-com high Oct 23, 2009, a decade later.

Let's personalize your content