Lan Xuezhao is the Founding Partner at Basis Set Ventures. Today she discusses how everything is changing in the current climate, the rise of war-time founders, having teams work remote, and the supply-chain reimagined

Lan Xuezhao | Founding Partner @ Basis Set Ventures

Good afternoon and good morning wherever you are in the world today watching us at the New New in Venture. Today we are joined by Lan, the founding and managing partner of Basis Set Ventures. Thank you so much Lan.

Thank you. Thank you so much. It’s great chatting with all of you. I have a long presentation here I would like to walk through and would love to answer any questions or ask you any questions. I don’t know how interaction … We’re going to actually have a few questions for you guys, but let’s go through this and see whether we can open up with Q&A.

So just to introduce myself a little bit more, my name’s Lan, I’m the founder and managing partner of Basis Set Ventures. debt ventures. I started Basis Set Ventures in 2017. We are a seed-stage fund that focuses on AI and automation.

We invest in companies that transform the way people work. Most of our portfolio are enterprise companies. The fund is up about $140 million. We mostly do seed-stage investments and a little bit if Series A. The verticals we focus on are obviously the office productivity, dev tools, but also some of the more antiquated industries, including construction, agriculture, manufacturing, et cetera.

So with that, I’m going to go into the formal topic, which is, How is COVID impacting the future of work? First of all, what is the future of work? I’m curious about your thoughts as an audience about future work. I don’t know how I can see your response actually. Should I try to exit this and see if it’s possible? Maybe not. So anyway, so what is the future of work?

The way we think about the future of work is, as an investor, we think about the stack of automation. We’re investing both down and up the stack, anything from infrastructure to the data layer, to algorithm, to application. So pretty much the whole spectrum. And as I mentioned, industry-wise, we look at the professional office workers and also the desk-less workers, including people working in factories, in farms and a lot of different settings.

As an investor, it’s very fascinating to me how COVID is changing the entire spectrum of future of work and not just our office workers, but also people who work in different settings because I think the impact on them is probably even bigger than us. And we’re all fortunate enough to be able to stay at home and do this on Zoom, but a lot of workers are not as fortunate. So I’ll spend a little bit of time talking about that in the presentation.

So on a high level, that’s how we think about future of work and that’s how we make an investment. It’s a pretty broad kind of scope. I’ve been tracking COVID since its early days in January after seeing China getting hit very hard. I’ve been tracking those for several months. It’s very clear that it’s impacting us in many different ways.

Specifically, I think it’s impacting who are we in this market. From the founder’s point of view, in the upmarket, a lot of founders will survive because the market is great. A lot of founders will easily raise money and start a company, have product-market fit, but in a downmarket, the profile of people who are going to thrive will be different, and I’ll give a little bit of an example and talks a little bit about that.

And obviously the second thing, COVID’s changing the way we work. We went from very much going to the office to completely remote. And lastly, I’ll give you an example of how COVID’s changing the infrastructure of our economy in terms of the supply chain.

So it’s changing who wins and how we work and changing infrastructure, so it’s basically, in my view, it’s a pretty complete reset for us in many ways, which brings a lot of challenges and also some opportunities.

So first, for founders, it changed who wins. The way we see this is the rise of the war-time founder are going have some kind of advantage in this market because they’ve just been preparing for this a little bit longer than the founders who maybe only have seen the good times. I’ll spend a little bit of time on the founders side. The rise of war-time founders is what I called it.

Typically, as an investor, the way we look at founders are we look at some of the very obvious attributes, which school you go to, what have you done before? What is your experience? Are you technical? If you’ll read a lot of the memos and interacted with the message, those are some of the most obvious attributes that people look for as an investor.

We think some of the better predictors of founder success in upmarket or down-market are actually these, what we call critical aspects of psychological profiles of the founders, which includes agile thinking, confidence, day-to-day effectiveness, founder market fit, whether a quick learner or not, whether you’re a scrappy or storytelling.

So these are the attributes that are much harder to identify especially given limited amount of time as an investor when you meet founders but extremely important. And it is extremely especially important in a market where certain aspects become more important because we’re, in a downturn. Fundraising is more difficult now.

Business, the customers are getting impacted. Timelines’ longer for fundraising for closing customers and payments get delayed. So certain attributes like agile thinking or day-to-day effectiveness, results-driven, scrappy becomes even more important in this market.

We collected data from 60 founders toward … some are more successful, some are not as successful on these core attributes, and we used the data we collected to kind of group them together to see what kind of profile of founders we can parse out, and what are some of the profiles that are successful and some are not. And what’s a difference between the successful profiles and those who are not?

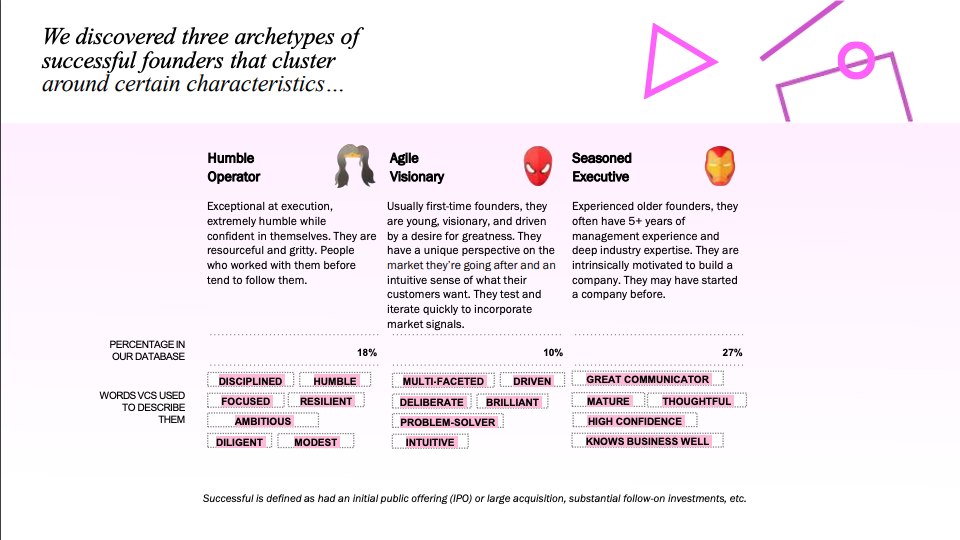

The results are quite interesting. Let me take you through some of the results. So we’ve identified three successful founder archetypes. One is called humble operator, one is called agile visionary, one is called seasoned executive. I’m gonna stay here for a minute. The core differences between these founders are how these attributes as I work through are grouped together.

For example, a humble operator, this is a group of founders who are very strong in execution, is very gritty, very resourceful, and also all tend to be humble. These founders have described their investors as resilient, as ambitious, as modest and diligent.

The second type, agile visionary, these are founders who more tend to be younger, tend to be first-time founders. They’re very much a visionary. They’re very driven by a desire for greatness. They have some unique perspective and they’re very, very quick to respond. Also very strong execution, but they’re described as multifaceted and very driven, and very brilliant.

The third one is seasoned executive. This type of founder has more experience than the previous two. On average, they have more than five years of management experience. Note, this is management experience, not work experience, which is a little bit different. And they’re described by people as a great communicator, mature, thoughtful, high confidence, knows the business well.

These are three types of founders that we identify from the dataset that has certain characteristics that drive them to be successful in our markets. And then there are three types that are struggling. So the first one is called passionate outsider. This is the type of founder who tends to be first time founder, very, very hardworking, but just can’t seem to find product-market fit. They may be a little bit risk-averse, maybe lacking a little of a unique advantage in the market, even though they work very hard, they just didn’t find product market fit.

The second type is the overconfident storyteller. This is the type of founders who are charismatic, very compelling, who are much more likely to be very good at fundraising, but may or may not be strong in execution. So this type of founders we see in upmarket they can raise money because they’re very charming.

They come in a full partnership meeting from an investor, they get all the attention, they raise money, correct? And that’s probably not so much in a down market like this, where investors really care about the metrics and the unit economics. So I think this is the type of founder who actually suffers a little bit more in a downturn.

The last one is called stubborn individualist. These are the type of founders who are stubborn and a little bit slow to adapt to learning from the market and not really empathetic to customers, which make it harder for them to find product-market fit. Now, we call it stubborn, but stubborn doesn’t mean that … some of the most successful entrepreneurs are actually stubborn, like Steve Jobs or very famously stubborn Jeff Bezos.

I think the difference between these individuals and this type of founders is basically whether stubborn in vision but not execution. If customers tell you this is not working, keeping their visions in mind, but change the execution to make sure this works for your customer. That’s how you find product-market fit.

During a downturn, one of the attributes that become really important as we talk to investors is attributes associated with scrappiness or agile thinking. So as you see from the first couple of types of founders, investors overwhelmingly believe founders with grit, with very persistent personality or scrappy, agile are much better positioned to be successful in this market.

Some of the quotes here are from very experienced or decision masters. They value resilience, they value grit, they value making quick adjustments to the plan, they value quick pivot to product, fast learning. So these are attributes we can group them together as persistent, scrappy, and agile as the important attributes.

Two, what’s interesting our dataset is, looking at two types of founders who are great at storytelling, are founders who are very confident and who have founder-market fit. The difference in differentiating these two founders, actually, these are the very attributes we talked about, which is scrappiness and agile thinking, which translates actually into day to day execution.

So if you will compare the two founders, one is the agile visionary, and other is overconfident storyteller, the core difference between these two founders are whether they can be scrappy and find the resources they need to find to execute strongly day to day. And this is the core difference that we found between these two founders.

I think this will translate into even more differences in the market like we’re going through today because execution matters even more. As investors index less on your fundraising abilities, invest less on your confidence with their business, and then as you index more on execution, looking even more at your metrics, these attributes will become more important.

Hard work obviously matters, is one of the attributes that kind of grouped together with these founders, and we all know Zoom is doing really well. And Eric Yuan, I’ve known him since 2015, he’s probably one of the hardest worker we know, and he values hard-working, obviously, that’s something also grouped together with these attributes.

So if you’re a founder, the question is, if you’re a founder who is humble, who are scrappy and who are gritty, who are resourceful, who have all these attributes that we think are going to be successful, does that mean you’re a successful founder? Does it mean that you, for sure, you’re better in this market? The answer is no.

So we compared with two groups of founders, one is a humble operator, very scrappy, very hard-working, very humble, and another what we called the, passionate outsider. Both of them score very high on humility, scrappiness and resourcefulness, and also grit. The difference between these two founders are, if you’re comparing these two, founder market fit and whether a team follows the founders.

What does this mean? A founder who is very hardworking, very scrappy, very resourceful, need a unique advantage in the market that the founder has or someone to kind of supplement the founder to be unique in this market. This means a unique advantage either in the insight or founder market fit in the market that’s specifically a great fit for you. This is more important in a down market like this because execution becomes so critical.

Among founders who have both strong executions, if you have a unique insight, if you have a unique strength in this market, be it customer relationship, be it investor relationship, be it product development skills, in a tough market that sets you apart from your other competition. That makes you even stronger in execution and accuracy of execution will become higher. So that’s the difference between these two founders who are both gritty and also resourceful.

Here’s an investor quote that speaks to that. “This is the point where when the actual understanding of your business matters. For the last 10 years, there are lots of CEOs who could get away having high margin subscriptions software business and not really paying attention to every penny. The thing about a downturn is that every penny actually matters a lot.”

And this speaks to the accuracy in execution. If you execute, you have an advantage in the market and you execute super precisely and make every penny count, your business goes way longer, and you’ll gain more market share to become a bigger business.

Lastly, on the founder, what I want to summarize this for is, this is a market for underdogs. If you have been through tough times, this is the market for you. Founders who grow up with limited resources, founders who have lots of experience dealing with challenges, and went through hard times, they’re likely to be more resilient than hardworking.

And also if you actually happen to have a unique advantage in the market, you’re actually better positioned to win this battle. This is a tough battle for everyone, but if you have actually gotten the practice and have been disadvantaged in some ways, the silver is that you might just have more experience than your competitor who only is through the times and always have the resources that they need.

So I think there’s this to encourage founders who, I certainly think I’m underdog, to encourage people who think the same way like us, and I grew up very poor. I’m definitely first-generation tech, first-generation VC. What I went through was very different from a lot of what the other VCs went through.

I think this is a market for people like us and for us to actually shine because of the practice we’ve already had. That’s on the founder’s side.

The second thing, switching to how COVID is changing the way we work, this is more straightforward than the first one. It changes who will actually win this market.

So in terms of how we work, it’s pretty obvious, as knowledge workers, we’re all going remote. I wrote an article earlier on the different type of models for distributed teams. Initially, all the companies have centralized headquarters. Then we moved towards companies with multiple centralized offices. We have a couple of portfolio companies that have a headquarter office in San Francisco, but R&D office in Berlin, or another office in Mexico or countries in Asia.

That becomes more common in this market to take advantage of the unique technical talents in other markets while still keeping marketing cells in California or United States. So it becomes even more common with COVID. What we’re moving towards is actually the third type of completely distributed model where everyone is distributed. We’ll have a company that has 90 employees and completely distributed, with no headquarters anywhere.

We’re seeing other companies like InVision or actually Twitter, there are some other larger companies who are previously had centralized HQ now is more distributed announcing that they’re adopting this distributed approach. I think Box just announced as well. So we’re moving from a centralized HQ over to a compute distributed model.

And in my view, I think this is not going to be reversed. Once people get used to remote work, there’s certainly a lot of benefits, obviously a lot of challenges, but there are a certain group of people once kind of get comfortable with this, as a portion of the people will be permanently remote, which will allow them to take advantage of the low cost in certain geos and lack of a visa for immigrants, to name a few benefits.

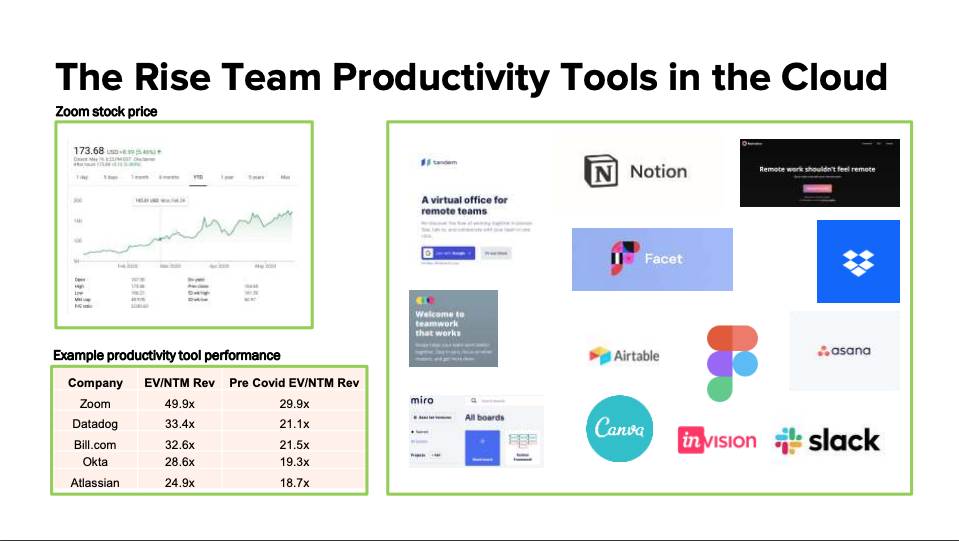

So as we’ve seen, the release of team productivity tools in the cloud also is changing the way we work. Before we were on a lot of systems that don’t allow collaborating with our coworkers, now our team is entirely on Airtable and had been for a year. I used to work at Dropbox, the adoption of cloud-based team collaboration tools have been increasing dramatically in the past month driven my COVID.

I heard that Figma usage was more than double, then Slack, obviously a lot of people are on Slack, and we’ve all seen the jump of Zoom stock. We’re all on Zoom meeting a lot of the time. Data zoom stock all on zoom meetings a lot of times. Datadog, Bill.com and Okta, Atlassian, these are the companies benefiting from the trend.

If you look at the public market, about 20 to 40% of the market’s accounted for by about five companies. And these are five tech companies that are, in some ways, benefiting from COVID while the other companies are actually not doing really well.

So we’re seeing the race of office productivity, collaboration tools, and some of the tech tools benefiting from this market. And this will fundamentally change the way people work because once you get on these tools, it’s so much easier than some of the other tools that we used in the past and it’s very hard to see us going back.

So the last trend I want to talk about is infrastructure.

This is not something that investors typically spend a lot of time on. As a fund, we think this is super important to look beyond office workers, beyond our productivity tools, beyond Zoom, beyond Slack, but look at the real economy. Supply chain is just one of them. A lot of the economy, the real economy is actually getting hit really hard.

Restaurant workers and factory workers, farmers, and some of these healthcare professionals. These other spaces are getting hit pretty hard and I encourage everyone to look at some of the other spaces and help out us as much as possible. I will spend a little bit of time talking about the supply chain because this is an area where we spend a little bit of time looking at it.

Supply chains go through some of the most transformation in the past month driven by COVID. One example where I want to start with is how does supply chain work? Supply chains are extremely complex. I don’t know how many of you have had experience dealing with some kind of supply chain rights.

So take an example of trucking. You see the flow chart, I’m not going to go through every single detail, but you see the flow chart from loading, unloading, transportation, hold at different ports, transporting different geographies and hiring drivers and driver turnover, and then certification paperwork. It’s an extremely operationally complex space. That’s one of the reasons we actually had an extreme shortage in PPE in the previous month of COVID.

The reason for that is the existing supply chain did not have any enough demand. So supply-demand mismatch was pretty severe in the initial time of COVID, and most of the manufacturing of PPE has been outside of the US to this day. And then the lack of transparency/data and financing options made it hard to get the supply from other countries to the United States.

Some of them are driven by regulatory changes and going through custom is extremely complex, and the different certifications, especially for medical supplies is extremely complex. There’s a certification called NIOSH for N95 masks. It takes nine months to go through to certification. So during times like COVID, it just simply not enough time for new factories to go through the certification.

As a result, the existing factories that are with the certification get really high demand and the price gets bid up and it could become super inefficient. There were multiple brokers involved in those. So that’s an example of why the supply chain broke down and the reason why it broke down the way it did.

PPE is just one of the examples. There are also other examples such as toilet papers. A lot of people are stocking toilet papers because the existing supply doesn’t meet the demand and there’s no transparency of how we’re getting these toilet papers directly from the source, and as regulatory changes, not so much as PPE, but there are still some.

Sanitizers and even food, grocery shopping, for the longest time we can’t get enough like eggs or milk. It’s challenging to get enough eggs and milk and some other just basic ingredients because of supply chain problems.

It’s a little bit better now as the existing supply chain catching up and the new supply chain coming online. The new supply chains coming online are taking advantage of going direct. So I’m sure you’ve experienced already a restaurant going direct, selling direct to you versus even going through a third-party platform. Obviously a lot of restaurants going through DoorDash and Uber Eats to get to you, which is another form of direct, with one middleman versus many others.

Distributors, wholesalers are also going direct and selling products to customers, even farmers. The direct from-farm boxes that we’re all ordering, those are another way of going direct. So that’s some of the ways that we’ve experienced already direct in our lives. Even more our medical supplies. I’ve personally talked to about 30 to 40 factories in the past month to help source and donate medical supplies, and I’m going direct and I know a lot of the hospitals and clinics and different resource are also going direct.

So that’s another vertical. How does direct work? Traditionally, if you want to sell something, you go through factories, and then you have sourcing agents. You pay tariffs and all the supply was sitting in a warehouse. If you’re a big brand, you have a brand tax on top of that. And then with that, all the complexity and all the kind of trucking, logistics, transport, which it all costs, right?

Now you can sell either through a physical store or an online store. So that translates into, in a consumer sense, it’s a very expensive product, especially with a branded product, the brand premium is much higher. The second iteration of that model is, there are companies cutting some of the sourcing agents, cutting some of the steps to make other brands directly to good to go consumer.

This is already a short version, which already happening, a lot of B2C brands we’re seeing have eliminated some of the steps and are able to get products to consumers either at a cheaper price or a higher margin. Now we’re on the third model which is COVID driving us towards, directly getting from the factories.

So forget about all the warehouses and brand taxes and all of them. Let’s just go direct to farm, factories and get our eggs and milk direct from the farm. It doesn’t matter what brand this is. Probably people probably even like organic products even more, but in the case of PPE supply, I just go directly from the factory and donate these sources to people in need.

So COVID’s driving us towards the third option, which ultimately can be a cheaper option, can be a much cheaper option if the seller is willing to reduce the margin. Now, obviously some sellers will choose to have a higher margin, which is better business, but ultimately this is approach where will allow the consumer to have cheaper supply, better quality and also faster, which will be also more robust in the age of COVID.

So that’s one example of how COVID’s transforming the way supply chain works, which is a very fundamental kind of pillar of our economy. So those are three examples I want to throw out. Hopefully this kind of sparked some discussion, good discussions among us. I think COVID’s going to drive us towards a complete reset in many different areas. It depends on who you are, how you work and how this is transforming your support system and our infrastructure. The implication for each person is going to be a little different.

So I encourage you to think about, if you’re a founder, think about how does it impact your business? What do you have to do in this situation? What is your unique advantage to not only survive but thrive in this situation given everyone’s getting hit pretty hard. So with that, I’m going to take a look at some of the questions.

The first question, if you have questions, feel to type it here. Now I’m going to open up the Q&A with the last 10 minutes. So the first question is, what do you define as scrappy or agile thinkers, or what are the characteristics you used?

So the way we did our calculations is we did a cluster analysis with our data and the data tells us which attributes tend to group with each other. So with humble operators, the attributes that matter more for this segment are whether you’re humble, whether you’re resilient, whether you’re scrappy, whether you are resourceful and gritty.

So these are attributes that define humble operator. The key thing here, I think a lot of operators are very strong in execution, but not necessarily humble. And this type of founders are particularly humble in the sense that they can place themselves out of the equation and be very empathetic with customers and have conversations with them and find product-market fit that way. So that’s a humble operator. In terms of agile visionary, agile in the sense like quick to respond, pivot if needed, super-strong in execution in the sense that you execute and see what works, and if it doesn’t work, let’s go back and do something else. So these founders tend to be younger and first-time founders, so they have to try different things to really figure out product-market fit. So hopefully that answers your question.

The second question is, what surprised you most about the findings about the three types of successful founders, and can you please refer to the slide while answering?

So the second question, what surprised me the most, I guess the one thing that really surprised me is the percentage of each type of founders. So as you see here, humble operator is 18%, an agile visionary is about 10% and the seasoned executive is 27%.

This surprised me because typically I would think humble operators are actually undervalued and not the obvious type of founders, because if you’re humble.=, if you are not out there talking about yourself constantly, investors have a tendency to not take you as seriously. So I would have imagined this type of founder probably account for an actual higher percentage in the database, but from an investor point of view, maybe a lower percentage, just given they’re not obvious.

I was a little bit surprised by the percentages. I think the reason for that is probably because our sample is frankly a little bit biased. We tend to like founders who are humble operators, and maybe the investors we like tend to like these types of founders and maybe our sample just had more of them in the database. That’s my explanation. Hopefully, that answers your question.

Do you ever think about the supply chain logistic of things, like service delivery in the public sector, how government delivers it’s critical social services to the public? This is something that is more critical than ever now. Ordinary people face challenges they have never faced before.

Great question. I think about that all the time. I’m unfortunately very disappointed by how the government is reacting to everything that COVID brings us. Simple example as testing, testing should be widely available from day one. Had testing been available right away, we probably wouldn’t be in the situation that we’re in now.

I understand why the government wasn’t responding as fast to provide us all the testing kits that we need in the first place. I’m afraid of going to details, but I’ve been thoroughly disappointed, and frankly, I’ve lost confidence in at least the federal government.

I think the private sector, I’m more encouraged by the private sector and how fast people are willing to step up and like the Gates Foundation, for example, do some of the things that the public sector is not able to do, and hopefully that will be somewhat of a solution. I think one thing that maybe I want to mention here regarding the public sector’s response is I think regulation training.

The FDA has stepped up and drafted a lot of regulations because of 911 which has been extremely helpful because of that, which actually turned out to be not so helpful during this time when we have to respond. Testing kits, for example, we know the testing kits have been available by WHO, by a lot of other countries.

Our country has been using that for months but because of FDA process, we’re unable to use all the testing kit that other countries have developed because the law says we have to do in the United States, therefore there’s a huge delay in terms of, that’s one factor, there are other factors as well. There’s a delay in terms of how we’re developing our own testing kit and using them.

Had we used the testing kits that’s been given to us by WHO, we probably would discover this much faster. It’s one of the reasons I think it’s a little bit harder to mitigate. Hopefully in the future, we’ll learn from this and then become better at managing a global pandemic, and Asian countries like China and Singapore and Hong Kong, Taiwan, they’re better equipped in responding to this because they all went through SARS.

They know how these things work, but this is our first time responding to this. So hope that answers your question.

Do you think that the trend towards fully distributed teams is, or will, lead to investors becoming more geographically agnostic?

100%. 100%, I think the bottleneck for investors become more waiting to make investments in founders who are further away or have not met in person, is this psychological barrier of trust, right?

If I have not met you in person, technically, investing is a people business. It’s driven by emotion. Developing trust with someone over Zoom or building trust with someone who’s further away from you, it’s harder to do reference checks because I don’t know that ecosystem. That’s the barrier that causes investors to become less active and less likely to invest in founders in other geographies or founders who really don’t meet in person.

But I think COVID’s driving towards investors being forced to make decisions over Zoom. Because of this forcing mechanism, I think investors will become more .. So investors will become more okay as a result and realize that it’s actually okay. We can write a check without meeting founders.

It’s actually maybe better because we’re more objective, we’re less likely to be influenced by one’s charisma, or body gesture. Because we’re meeting on Zoom, maybe that pushes us to do more work, reference calls versus trusting our friends, trusting our instinct. So absolutely. I do think that forces us to be focusing more on different geos and better investors, to be honest.

When you talk about supply chain changes, do you mean this in the context of future work within supply changes versus example different in staffing?

I think, yes. I mean this in terms of how the supply chain will work in the future, which is a complete revamp. Obviously it will impact the way people work and impact staffing for sure. If we’re cutting supply chain in the middle, we’re cutting the brokers and cutting middlemen. Just hopefully people will shift towards more on either end, maybe on the supply side, work more in manufacturing or find other roles and cutting more of the middlemen. So for sure, it’s going to be impacted.

Now virtual events space is getting hot through the world, what do you think about this area? Are they already a winner or any different angle?

Virtual event space. I don’t know. I have a complex feeling about virtual events. On one hand, I know we’re forced to do virtual events and that’s what the direction is going to. On the other hand, I’m just really sick of doing Zoom meetings and Zoom calls and everything on Zoom. So I think that probably reflects how people feel.

On one hand, we’re forced to do this and you’ll see increased usage, but on the other hand, I think the moment we’re allowed to go out, we’re probably just going to do real events and in-person events. I think this will get more people online from those who were previously offline, and as a sector, I believe they will do well, but I think maybe the portion of people who actually want to do less virtual events and more in-person events as a result of this, probably is, in some, maybe a little bit increased, but not the drastic increase we’re seeing today.

How are founders, owners, managers making sure that corporate goals can still be achieved while employees work from home? Any good tools for this? Is it easy to shrink from work?

Yes. So there are lots of tools on the market, we’re looking at some of them, that try to help managers to work better and more efficiently. Actually on these slides, I went through, some of these tools are remote to just help people work better and more effectively.

They’re not meant to be KPI management, but there are some, for example Range, Range.co, this is a tool that helps you do daily stand up. It helps you to talk about what your, right on the tool, what’s your goal and how you’re achieving these goals. So these are the tools that help people get alignment.

Another example is Notion, we’re not investing in any of these tools. I have no stake in any way but I like these tools. Notion basically allows you to interact with your coworker as if they’re in person. So there are a lot other tools that help people to work better.

I think this makes us better workers and more efficient. I don’t actually believe our efficiency will decrease as a result of remote work. I actually think a lot of us will work better and more efficiently. So I think, as a trend, I believe these tools, I believe in the pattern we’re investing in some of, not the ones I mentioned, but in some of these tools.

Will remote working also affect supply chains over the long term?

Absolutely. 100%. Once supply chain go direct it’s very hard to go indirect. I think the impact is permanent.

Slack and Microsoft Teams have been growing well in synchronous collaboration space, but are you seeing opportunities in asynchronous collaboration space there?

For sure. I think both are happening in some cases where people need real-time collaboration, Microsoft, or some of the smaller players, in other cases where it fits the workflow. One person does this, another person does something else. It doesn’t need to be happening at the same time but could be asynchronous. I’m also seeing this happen more in the workflow automation setting. So, yeah, for sure.

How will the travel and leisure industry change post-COVID, specifically local and international air travel, and also tourism?

That’s an interesting question. I think travel will no longer be the same as before. People will be more conscious in terms of what they take, where they stay, how clean these spaces are. So it will change some of the behaviors in travel, but I think travel will come back at some point. People will still want to travel, it’s just, why are they going, how they’re traveling, how frequent they are traveling, these things will be different.

Specifically how exactly this would change, we’ll see. And there are a portion of people probably just are okay with virtual events. I think VR is getting better. I personally don’t use much of VR, but I’ve heard great things about Oculus. So maybe a portion of what people will travel virtually. I really hope people still travel in-person. But I think some people’s behavior will change and travel will bounce back in some shape or form and may be different from how we traveled in the past.

How do you feel about the assessment? Times typically value the assessment testing in the realm of human capital due diligence, for example, investing founders or hiring of employees. Those types of products are getting funded and increasing in post-COVID, but it seems that not many investors are experts in this area. Do you think it will open up?

I think the fundamental challenge of investing in science, healthcare, it’s that the timeline and risk profiles are different and it is harder to get these projects funded because the risk is a scientific risk.

A lot of investors are okay with market risk, with technology risk maybe to some extent, but science risk is a whole different level of risk profile. Investors are less likely to be okay underwriting such risks. That’s why you’re seeing some are just harder to get funded.

That said, a lot of investors have that specific focus on this type of risk. You have to have a balanced portfolio to make a calculated bet. And I’d really like investors who are thinking really big, like Gates Foundation, some of the other investors with a goal of funding projects like this. Hopefully, projects will get funded, but I agree with COVID it’s is harder.

What work-from-home issues have not been yet solved by existing software solutions?

A lot. I think the bigger one is, what do I do with my kids? We have all these tools that will help us work better, but I have two little kids, two and four-year-olds, they can’t use any tools. They just need to be taken care of by someone. They have their Zoom meetings, but I’m their IT support and admin to help them even set things up. So that’s been extremely painful.

If you’re a parent, I’m sure you’re feeling the pain of complete work and life integration. My kids can come up anytime actually. So I think that’s really hard to solve like relationships, empathy, taking care of elderly and kids, and a lot of the fundamental human, at basic life and work issues are not getting solved by software solutions. Education, healthcare, so many. The number one thing I hope we can all solve at some point is childcare.

I think we’re completely out of time. I’m not sure if I should stop or keep going. I’m going to just like, still have a few questions, I’m just going to finish answering them quickly.

How will COVID change employee onboarding or software training, or is it too soon to tell?

I think onboarding is getting online, getting faster and easier, and founders are trying to make onboarding easier, which in fact should be online. I think it’s a trend that’s going to happen.

Which two different kind of founders out of the six do you feel form the most strong founding team?

I think the three types are the three, agile visionary, humble operators, and seasoned executive. They’re all strong for different reasons. I think they might be fit for different types of startups. For example, if working a supply chain or logistics business, if you have been in the business for five years or 10 years, it’d probably give you the advantage of being strong in that business. So I think it’s a matter of fit with a business problem. They’re all strong founders for different reasons.

How drastic do you think the changes will be with middlemen type of business?

I think it’s going to be severe in some cases, like supply chain, but also lucrative. If you’re the middleman, who’s able to figure this out and other people can’t, and you’re probably going to be dominant in the market. But overall I think the trend, I think it will get hurt, but if you figure out something unique in the sector that you you’re in and nobody is, I think that’s also opportunities in the silver lining.

What do you mean by scientific risk?

Drugs that’s for recovery, for example, vaccine risks, there’s a chance that we might not be able to figure out how science work in this case. There’s a chance we might not have any vaccine. So that’s a scientific risk. Science, it either works or it doesn’t work. We just need to figure out how it works. I used to do a PhD, I used to do science. It’s not something like, you can figure out product-market fit, you can’t figure out … if science doesn’t work, it doesn’t work. There’s no figuring it out, I guess.

Thank you, I have a two and four-year-old also, it’s very good. One thing I really appreciate out of the COVID is teachers, oh my gosh. We should pay teachers so much more. They deserve a medal. They deserve to be compensated as much as possible. I am very happy to be paying the full tuition of my kid’s school even though we’re having two Zoom meetings every day. I’m very happy to support the school. I think they need to be paid.

Last question, how will connectivity infrastructure change in light of this crisis, with internet usage surging much faster than expected?

Internet has not been very reliable because of the surge in usage. The trend is that we’re shifting to 5G, we’re shifting to fiber, we’re shifting to those higher, better technology. I think that’s a trend. I think this probably drives us towards faster implementation of a better internet, and for sure it’s happening. Hopefully it happens sooner than we expect. It’s probably not the most reliable. Google Fiber, some of this stuff is already happening.

Cool, it’s been great chatting with all of you. If you have more questions or would love to discuss anything, you can find me on LinkedIn or Twitter. I think this is my Twitter handle right here, @xuezhao. You can also find my LinkedIn with my name. Thank you so much again. This has been fun and hopefully, this is interesting.