Accountants

Three emerging technologies poised to reshape accounting and financial management

Businesses that can effectively harness data to identify trends, streamline operations, and make better business decisions have always had an edge over competitors. Today, as technology advances make it easier to digitize data at a seemingly exponential rate, this gap is widening. As the Economist put it in 2017, data is the new oil. Businesses that can use data to create business value and opportunity have a growing competitive advantage over those that can’t.

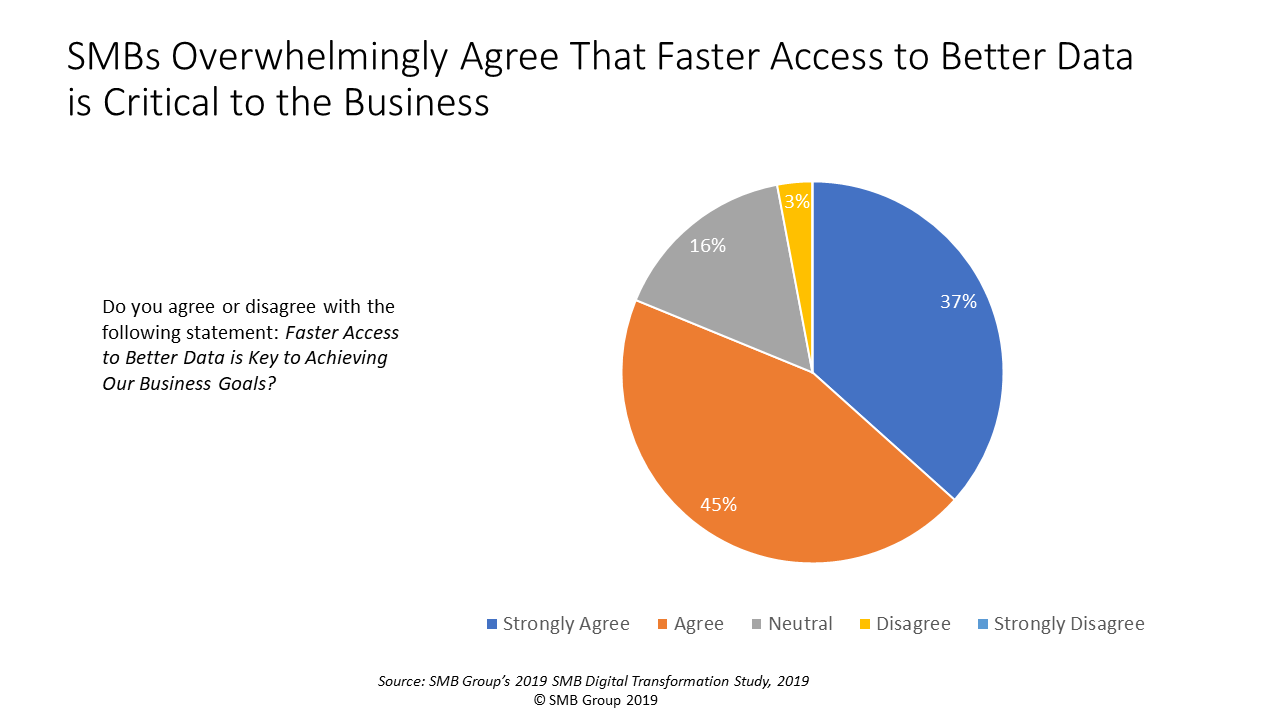

Small and medium business (SMB) decision-makers understand this: 82% strongly agree/agree that faster access to better data is key to achieving their business goals.

Perhaps nowhere is this reality more important than in the financial management and accounting space. From the CFO level down, finance professionals are responsible for measuring, communicating, and analyzing key financial information to help guide the business and improve outcomes. In this post, I discuss three emerging technology areas that are poised to change how companies gather, manage, and use data.

Perhaps nowhere is this reality more important than in the financial management and accounting space. From the CFO level down, finance professionals are responsible for measuring, communicating, and analyzing key financial information to help guide the business and improve outcomes. In this post, I discuss three emerging technology areas that are poised to change how companies gather, manage, and use data.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML solutions make computer programs and machines “smart” by enabling them to learn, change, and predict patterns as they are exposed to new data. These technologies promise to remove friction from operational processes and to speed access to the information that decision-makers need to improve business outcomes.

AI and ML are already in broad use in the financial services sector—from loan applications to the stock market. Banks and financial organizations are using these technologies to help streamline data analysis and processes for credit scoring, risk assessment, trading, and more.

Use cases for AI and ML in the corporate finance world are also becoming evident, as cloud-based accounting and financial management application vendors begin to embed AI and ML technologies into their solutions. When integrated into accounting and financial systems, these technologies can assist with many tasks, such as automatically categorizing expenses, flagging policy violations, spotting trends and anomalies, and making recommendations.

For example, AI and ML-powered applications can learn how to tag and assign transactions to the right ledger account based on prior tagging decisions and rules—learning and improving accuracy every time they process new information. This helps with tasks such as budgeting and credit scoring. Vendors are also bringing AI and ML capabilities to bear to quickly scan large amounts of data to uncover anomalies, such as during an audit process.

By layering chatbot and natural language processing (NLP) interfaces on top of these applications, vendors can also give users a more intuitive, conversational interface to query the data in their systems and get the answer they need.

Internet of Things (IoT)

The Internet of Things (IoT) connects everyday things in the physical world—such as objects, people, plants and animals—to the internet with sensors. Once equipped with sensors, these things can send real-time information about what’s happening in the physical world—such as from farms, retail shelves, or the factory floor—to IoT-powered applications. This enables businesses to replace manual data entry and subjective judgements with automated data collection that provides updated, precise monitoring and metrics.

Since IoT-generated data is generated directly from the data source, it lessens the potential for human error. With access to data that’s continually updated data in real time, finance can quickly and easily access current data whenever they need it to streamline audits and reporting.

IoT can also provide finance and accounting managers with better insights and control of where money is being spent. For instance, smart retail shelves can automatically keep tabs on inventory levels to maximize product availability while minimizing overstocks. In addition, IoT can be used for predictive maintenance, flagging potential equipment failures before they happen, helping to increase efficiency and reduce unexpected costs.

For example, Sage Intacct sees IoT playing a pivotal role providing statistical account data, e.g. non-monetary data such as number of items shipped or the amount of data that is used. In turn, businesses will be able to use this information to inform business metrics, such as revenue per shipped item, and to drive business processes such as automated billing based on data usage.

Blockchain

When people think about blockchain, cryptocurrencies—such as Bitcoin—often come to mind. But authenticating new currencies is just one of the many use cases for blockchain technology.

Blockchain can be used to exchange money, property, goods, services, or any value-based transactions requiring an enforceable contract. Blockchain records, links, and secures transactions on participants’ individual ledgers; verifies that transactions are valid; secures the transaction with encryption and permissions; and enforces terms associated with the transaction, such as net payment terms.

Although still nascent, blockchain could reinvent the accounting ledger with its continuous, secure update and verification capabilities.

For instance, since blockchain entries are encrypted, the chances of falsifying them is dramatically reduced—affording a faster, loss costly audit process. Another possibility is that businesses could enter transactions into a shared ledger. This would help to reduce the costs to manage and reconcile ledgers, and streamline contract and audit processes.

Perspective

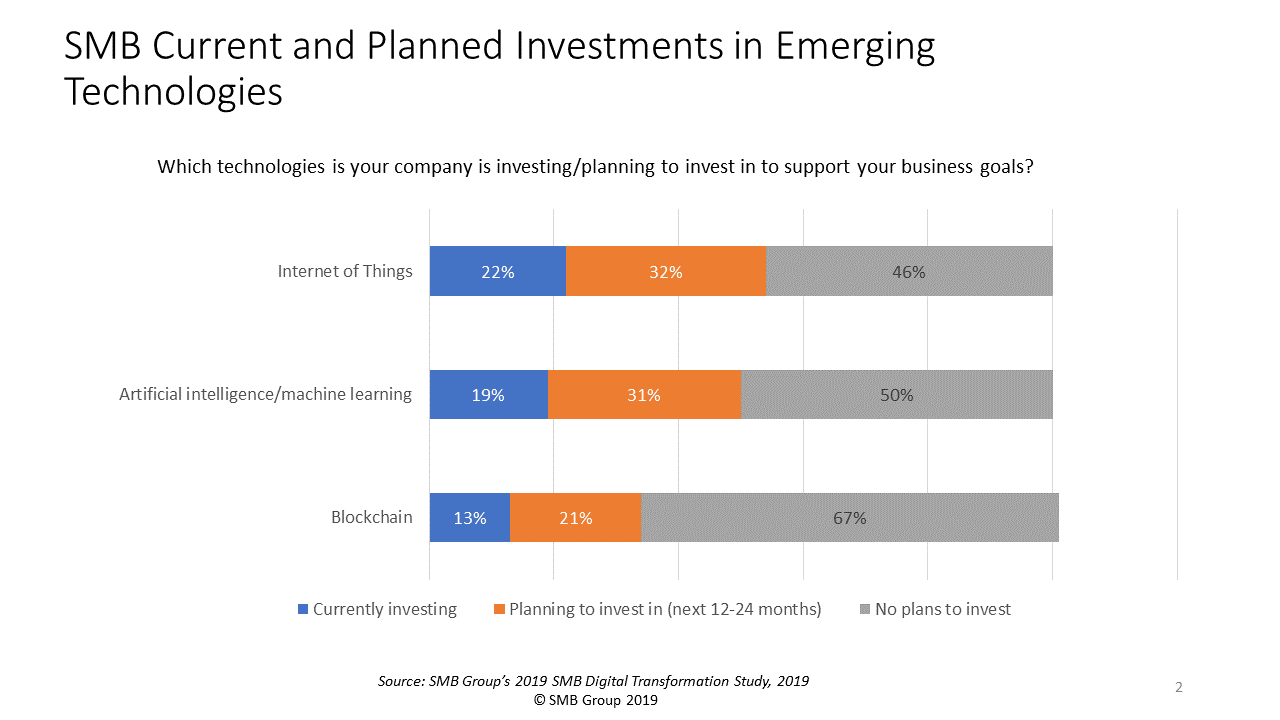

We’re still in the early days for these technologies. However, more SMBs are starting to realize that their businesses will need to take advantage of them in future.

But even as they become more mainstream, few SMBs will have the resources or expertise to figure out how to integrate them with their existing financials systems. And accountants aren’t likely to become computer scientists or engineers.

But even as they become more mainstream, few SMBs will have the resources or expertise to figure out how to integrate them with their existing financials systems. And accountants aren’t likely to become computer scientists or engineers.

However, financial professionals do need to understand these technologies and the opportunities—and risks they pose for their business. They also need to work with technology decision-makers to make sure that the business can take advantage of new technologies as they become relevant.

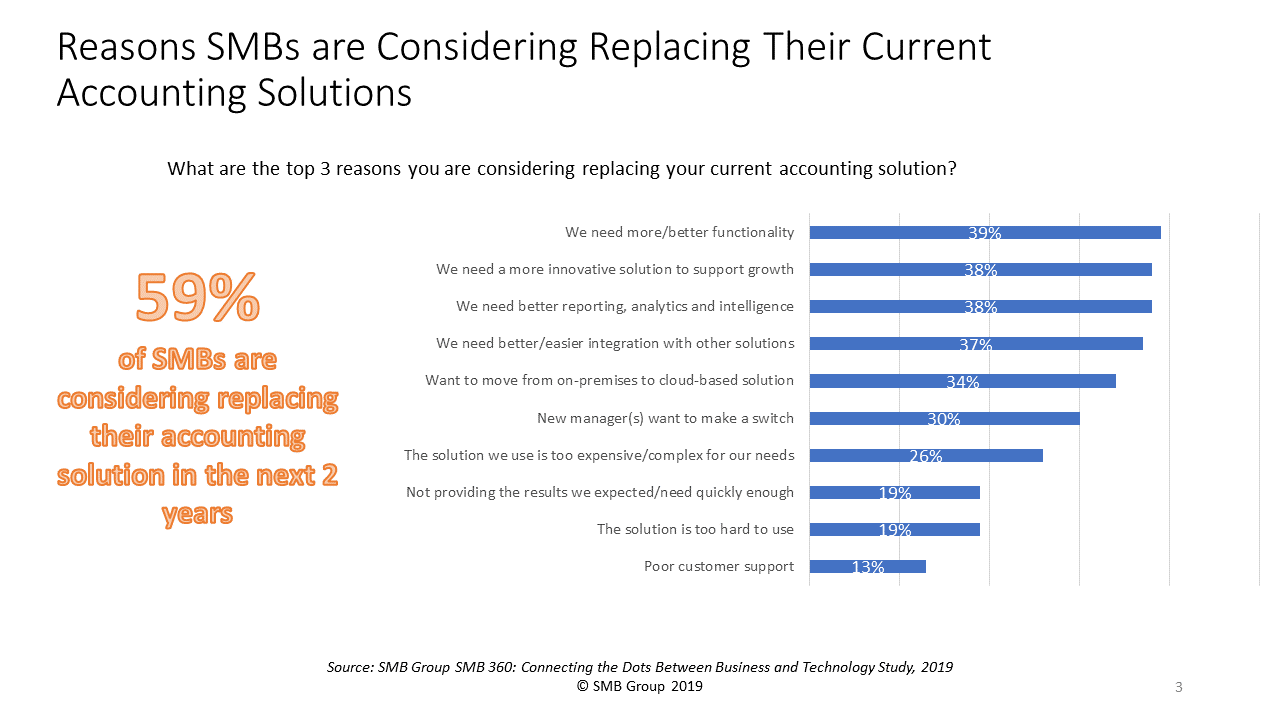

In fact, SMB Group data shows that 59% of SMBs are considering replacing their current accounting solution because they need better functionality, more access to innovation, and better reporting and analytics—benefits that these new technologies will provide.

Businesses running legacy, on-premises solutions will need to evaluate whether they can retrofit fit older systems to capitalize on new capabilities. For most SMBs, this is likely to be an uphill battle that will be difficult to win.

Businesses running legacy, on-premises solutions will need to evaluate whether they can retrofit fit older systems to capitalize on new capabilities. For most SMBs, this is likely to be an uphill battle that will be difficult to win.

In contrast, modern, cloud-based accounting and financial solutions are continually refreshed with real-time data, ensuring that you always have the most current information at your fingertips for reports and analysis. As important, modern cloud financials solutions need to be built on open, flexible platforms, enabling providers to integrate these new technologies into their solutions more easily than would be possible with older, more brittle software.

Cloud-based financials solutions can give you direct access to new capabilities from within their solutions. They focus on new functionality to solve for key financial use cases, providing you with a clear on ramp to value.

Business performance will continue to become increasingly dependent on a company’s ability to effectively use technology. Financial professionals must understand the potential opportunities that new technologies offer and provide guidance to their organizations on how to prepare and adapt for the future.

© SMB Group

Ask the author a question or share your advice