Table of Contents

Data science is beginning to replace spreadsheets for entrepreneurs wrestling with uncertainty in their business models. How did we get here? What’s really new? And how can founders at any stage get better at predicting their future?

Staring into the Void

If you’re like most SaaS founders, you’ve googled for a saas financial template you can use to forecast your subscription business. As of the writing of this post, a query for “SaaS forecasting” returns 2.8 million results, many of them providing financial lessons and file downloads offering to help you see into the future.

Maybe you took advantage of one of these, at first; perhaps, eventually, you retreated to a blank spreadsheet — preferring an empty canvas of your own design over the learning curve of someone else’s formulas, or worse — macros.

If you began filling out one of these templates, did you finish? If so, did you use it to make key decisions? How soon did you come back to it?

Good founders begin this exercise with good intentions. But often, the result falls short of expectations.

Is that because we’re searching for a crystal ball, or something else?

Divining the Future: Past and Present

As the practice of predicting the future, forecasting has lured, plagued, charmed, blessed, and doomed the plans of humans for eons. High-stakes operatives, from mariners to soldiers to astronauts, have drawn whatever advantages they can from tea leaves, constellations, and weather vanes. To stare at a blank Google Sheet, ready to populate columns B-ZZ with monthly timestamps, is to gaze from the edge of a remarkable wave of advances in philosophy — the shift from fatalism to humanism, as well as science — the discoveries of chance, curves, and chaos.

Yet, while forecasting subscription businesses is a new frontier, it’s far from the state of the art. Because of its immense impact on warfare and commerce, weather forecasting has commanded significant research and development focus since the 1980’s, second only to cryptography in global consumption of compute cycles. What could the evolution of weather forecasting teach us about our field of forecasting our SaaS performance?

The weather forecasts we take for granted today would have made us gods among the ancients. Though they obsessed over cloud formations, the Sun and the Moon, without sufficient technological advances, their practice was reduced to guesswork. At last, shortly after the invention of the electric telegraph in 1835, the modern era of weather forecasting began. With it, the manual recording of observations on the shores of the United Kingdom could travel fast enough to deliver value to those downwind. Later, linear trend lines would evolve into systems of governing equations and eventually, deterministic models and statistical ensembles powered by supercomputers, fed by the latest observations from geostationary satellites and mesh networks.

Measuring Up: A Forecasting Maturity Scale

Where are we in our progress, brave SaaS financial template searchers, in comparison? Consider the parallels between observing and predicting two complex systems along a sophistication (maturity) scale:

- Level 1. Anecdotal Observation. “It feels hotter outside than yesterday” : “Our sales team has more momentum than last month.”

- Level 2. Quantitative Records. “I’ve journaled that it’s 88 F” : “I looked through my email: we got 16 leads this month.”

- Level 3. Consistent Instrumentation. “The thermometer reads 88 F, according to my logs, yesterday it read 91 F.” : “This HubSpot chart shows that we have 4 fewer leads than last month.”

- Level 4. Derived Measurements. “At 88 F with a relative humidity of 75%, the heat index is 103 F! Yesterday’s heat index was 87 F.” : “We had fewer leads this month, but 12 were qualified, which is 3 more qualified leads than last month. Our lead velocity rate is 33%, up from 20% last month.”

- Level 5. Linear and Exponential Trends. “At this rate, it will feel hotter every day; by October we’ll be scorching!” : “At this rate, we’ll hit $73k MRR next month, and $284k MRR by October!”

- Level 6. Governing Equations. “To be that hot in October, weather patterns would need to shift dramatically to overcome the fact that we’ve begun tilting away from the Sun.” : “Our sales team would need to double in size to attack the number of leads required to hit $284k MRR by October.”

- Stage 7. Compounding Factors. “Sea surface temperatures are hotter than last year, but the stratosphere is unstable, increasing the chance of early arctic air masses arriving in North America.” : “We do have cash to invest — if we double our PPC marketing budget and drive leads towards self-service, maybe we have a chance? But our lead velocity rate is likely to decrease as we saturate this channel.”

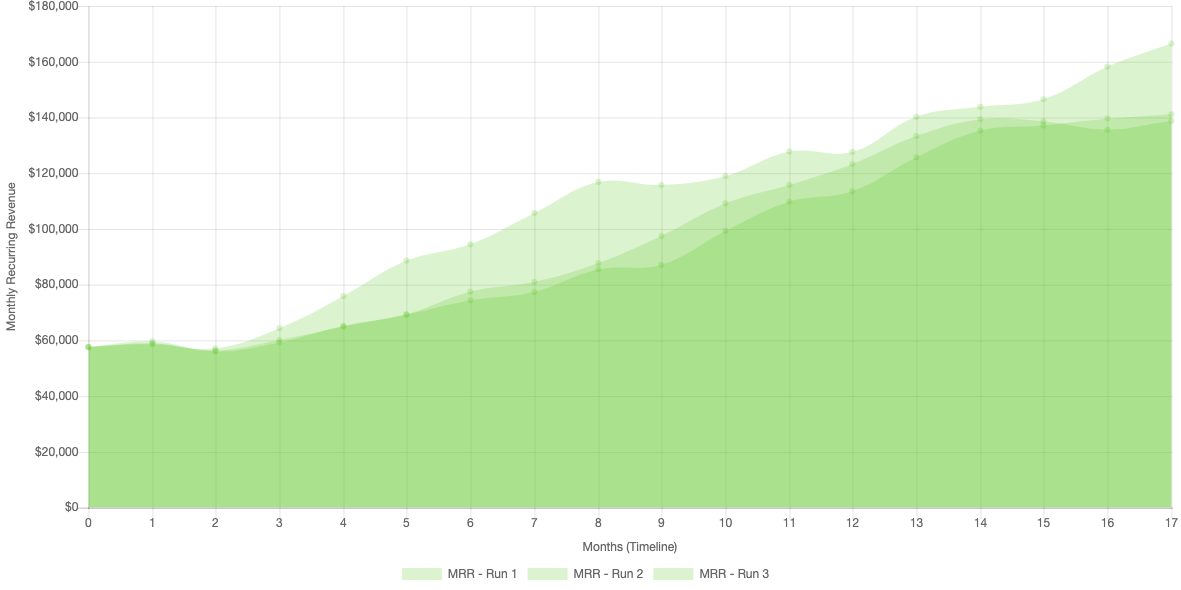

- Level 8. Managing Uncertainty. “The atmosphere is a chaotic system where small changes in initial conditions can have a large effect on medium- and long-range conditions, so let’s combine all observations, equations, and factors into the global forecasting system and run it 50 times to see a wide range of possibilities.” : “I don’t feel certain about this, let’s have an exec retreat to look at these trends, budget limitations, and market factors, and then just make the best decision we can.”

Where is your business on this maturity scale? If you’re consistently using data from a CRM and metrics provider to make decisions, you’re at least to Level 3. If you’ve taken the time to know your funnel and used historical growth rates to create forecasts — congrats, you’ve made it to Level 5.

And if you’ve made it to Level 5, the act of searching for a financial template is a natural next step. Armed with a constant or compounding growth rate, it’s easy to drag a =SUM(B2+1500) from cell C2 to M2, title it a 12-month forecast, and start sharing the news.

Yet, while these arithmetic forecasts are directionally interesting, their lack of enforcing constraints — unpleasant reality checks, harm their accuracy beyond a few months. Even after the earliest stages of starting up, resources remain limited, guaranteeing that a straight line from now to then is almost certainly not the path you’ll be taking. To acknowledge and account for these scarcities — like cash, hiring bottlenecks, and ramp-up periods for sales, is to enter the real world of Levels 6–7.

Constrained Reality

In the real world, it’s not straight lines or hockey sticks, but S-curves that dominate. These sigmoid functions draw our slow genesis, rapid growth, saturation, and then decay; they are the storytellers of the inescapable laws we face in complex systems. They explain why no hurricane intensifies indefinitely, and why no company grows forever. Regardless of LTV’s or CAC’s, friction catches up.

And these stories don’t just play out on the macro scale. The lifecycle of a sales channel’s cost-effectiveness, of an engineer’s efficiency, of managerial spans of responsibility — all contain these tales of zero to 1 and then diminishing returns.

How can we incorporate these laws into our forecasting? Most of our direct experiences with Level 7, to the extent we’ve dabbled with it in Excel, are short-lived; this is typically the Land of Someone Else’s Macros. But what about your own? Skills aside, while inspiration abounds at the outset, it’s hard to know where to stop. While I’ve seen a few founders bring GSheets to its knees creating a veritable simulation, most would not call it fun, let alone sustainable. Our creativity yields unmaintainable complexity.

Instead of this, most founders skip Level 7 and move straight to Level 8. Bringing all of their KPI’s, charts, and trends to meetings where they lean on the algorithms baked into their biology — i.e. gut. This is often the role of boardrooms and the C-suite. Properly run, this is the state of the art for 99% of us. We enter with a dilemma and exit with the best decision we can.

Some have argued that perhaps it is for this very reason — that we can’t enter these meetings without them, that the exercise of building these forecasts persists. This is amplified in the contexts of fundraising pitches and investor updates. Cynically: “founders show investors what they want to see.”

Does this mean our gut instinct is bad? Yes and no. In actual fact, our gut feelings are the output of biological formulas millions of years in the making. These formulas can’t be written into Excel and contain wisdom. Nonetheless, feelings can also mislead us into fantasyland where anything is possible, or doom is imminent.

Hope for Tomorrow

So is this data-to-gut pipeline the future of SaaS forecasting? Far from, if meteorology provides a clue. While we SaaS founders were grappling in our minds with the compounding factors of Level 6, the meteorologists were turning to software systems, global in scope, incorporating constraints, and capable of considering the fact that their measurements and assumptions could themselves be wrong; wrong enough to tempt fate into producing a swan of a different color. From this, not one, but fifty forecasts emerge, along with analysis of consensus and deviations.

For modern weather forecasters, the boardroom discussion remains, but its purpose isn’t to re-discover or litigate the laws of thermodynamics; instead, it’s to review and discuss those fifty outcomes in order to do what humans do best — notice familiar patterns, and ultimately, to interpret. The focus shifts to translating future states into scenarios, and developing strategies for dealing with those scenarios. Risk is further reduced by evaluating which constraints matter most, and which factors are the least understood. And because it’s system-generated, this practice doesn’t take place monthly or quarterly, but rather four to six times per day.

The breakthrough in weather forecasting was the creation of systems that shrank the time required to make predictions while also improving accuracy. These forecasting advances coincided with the dawn of the computing age, and are now as mission-critical to the world’s economy as they are pervasive.

Forty years later, and twenty years into SaaS, the same breakthroughs are beginning to define the modern era of subscription business forecasting. Internal systems at lenders like Lighter Capital and other startup funding options, and investors including CircleUp and Funders Club are pushing the boundaries on complex systems designed to challenge or bolster their confidence in allocating growth capital. A Hong Kong VC and a Finnish software company have granted voting rights to algorithms. Meanwhile, startups like SimSaaS aim to make these systems available to founders for operational planning.

These systems belong to an emerging, modern era of SaaS forecasting, in which software will carry us from observation all the way to exploring uncertainty, releasing us to focus on interpretation and application. Can software really predict the performance of your SaaS business? Such an exercise may sound reductionist. In many ways, businesses are unlike machines — they are organic, social, biological. They evolve. Because of this, whether your business will succeed is much less predictable than the theories and laws that govern the weather. Nevertheless, as SaaS founders, we quest for repeatable, predictable revenue.

Given this search for predictability, we must move towards systems that acknowledge that the future is not like the present. Discontinuities abound: competition, new channels, pivots, price increases, new product tiers. Not to mention our desire to think through scenarios: “what if we raise prices? Hire two more sales reps?” etc.

These systems will also help us avoid fantasy. Impossible projections that surface when founders still know very little about their target market, their business model, or SaaS at large. In these cases, the founder has a blank spreadsheet, and without constraints, can feel pressured into presenting whatever’s most exciting, rather than what’s realistic. This often becomes a very expensive or fatal game of trial-and-error.

Instead, by dropping the cost of testing a growth plan to almost zero, new tools will enable founders to exponentially increase their rate of learning about their particular business designs, and SaaS in general. These systems will act as private laboratories to experiment, fail, and try again, before deploying new product, sales or marketing strategies in production. Once deployed, these systems will watch how your designs perform when reality begins to hit, alerting you to deviations and recommending next steps.

Back at Your Drawing Board

“Risk comes from not knowing what you’re doing.” – Warren Buffett

If we accept that we are entering a new era, what about today? What should you do when you find yourself staring at that financial template? While achieving parity with the world’s most advanced forecasters may be out of reach, I would encourage all founders, regardless of stage, to adopt a modern mindset:

- The forecasting process is more important than the output. Why? Because a steady stream of consistently-formatted, and therefore comparable, forecasts is more valuable than a single, glorious gaze into a crystal ball. The former enables a demonstration of progress that allows you to answer “well, how accurate are your projections anyway?”

- At medium- and long-ranges, you are going to be off. Accept it, and use new data or changes in your environment to re-forecast and adjust. While it’s disheartening to realize these time horizons are uncertain, you can only improve through repetition. And take heart — even in a chaotic regime, there are going to be short stretches of predictability. Having these flashlights on your dark path can spare you tragedy.

- Include your expenses. And have a realism-accountability partner. It’s easy to fall into the trap of forgetting you will need to hire new staff to support new growth. Hiring sales reps is sexy but what about your growing hosting costs, operations, SaaS vendors per headcount, and travel? Underestimating expenses is a fatal mistake; how many bankrupt startups leaned into a revenue-centric forecast?

- Don’t start with your revenue. Revenue isn’t input; revenue is the last output of a model that begins with assumptions as far upstream (top of funnel) as possible, then uses qualified lead and conversion rates to estimate your top-line MRR. For a simple hack, try making these estimates fuzzy by rounding down to significant digits. $40,000, not $44,418.

- To enforce realism, mind your cash flow. The ratio between your annual billing subscribers and monthly billing subscribers can be the life or death of your business. More annual means more cash to work with today, but it also means less of it tomorrow in the event that you spend it and growth doesn’t follow. This is where randomness can really help; and remember, true randomness contains more streaks of ‘bad luck’ than most want to imagine. What if your first 30 customers choose monthly billing? The world can be (very) lumpy.

Most importantly, take stock of your expectations and motives. The best forecasters in the modern era don’t make predictions in an ad hoc fashion or only when compelled to do so by shareholders.

Instead, they forecast in order to detect certainty as soon as possible. They support this goal by forecasting well in advance of decisions. They also forecast to measure uncertainty, and watch how that uncertainty changes over time. They support this goal by forecasting often, and admitting their uncertainty in their assumptions. It’s no coincidence that both of these behaviors are habitual: they know that forecasting — like all processes that improve by doing, is as much a practice as it is a skill.