Accountants

Preparing your company for recovery: six steps for SaaS finance leaders

While the COVID-19 crisis continues to evolve, many SaaS and subscription finance leaders are looking ahead to the recovery phase and wondering what their peers are doing. During the virtual Modern SaaS Finance Summit, CFOs and investors shared six steps you can take to put yourself and your company in a position to know where you stand, anticipate and plan for volatility, and communicate your plan to your Board. Here are those key takeaways from the Summit:

Step 1. Know Where You Stand on Cash and Tackle Churn

Going forward, companies will continue to stay on top of their churn, cost structure, and capital consumption. Boards will be focused on cash flow management as well, so make sure you can answer these key questions:

- How much runway of cash do you have?

- What revenues can you depend upon, either customer by customer, or product by product, or cohort by cohort, depending on your billing model?

- How are you working with customers to reduce churn?

When you evaluate your revenues and customers’ ability to pay, you need the right tools to accurately model the direct impacts on your cash positions. You also need the ability to quickly change your assumptions to adjust to the market. With multiple models at hand, you can be proactive with customers to reduce churn.

The best-positioned companies have visibility into their customers in a way that they can aggressively tackle churn by adjusting their initiatives from “logo chasing” to world-class customer success and retention. During the virtual Modern SaaS Finance Summit (MSFS) in April, we spoke with Peter Perrone, the CFO of AtScale, about reducing churn:

“We model [customers] individually in terms of their renewal rates and other characteristics. Then we can quickly make very customer-specific changes or macro changes and see the sensitivity flow through to the cash flow statement.”

Step 2. Leverage Tools that Automate Billing and Revenue Recognition

For many companies, it will be a challenge to manage multiple one-off SaaS contracts and scale as the economy moves into the recovery phase. Automating forecasting removes manual processes and inaccuracies. Rethinking the order-to-cash process and adjusting to today’s business reality is critical. Ashmi Shah, Head of Finance at Talix, shared her expert perspective with us at the MSFS. For her, it’s a game-changer:

“I can report on all of the different product lines with multiple different dimensions. I think that’s been extremely important–building a forecast model to be able to understand the different levers of the company and coming up with a bottoms-up model.”

This is also a time to find ways to make your company more efficient. Automation can help you be fluid and flexible. When you put the right platform in place, you can move before your competitors do. Ashmi described the value of automation:

“Without an automated system, it can completely throw off your forecast and create a manual mess. We invested in and rely a lot on our automated billing because we have so many different components and variable billing terms. If we had delayed billing, that results in delayed cash. And right now, when cash is top of mind, getting really agile supports [the business].”

Step 3. Build Revenue Operations to Guide Your Growth

- How do you measurerevenue operations?

- How are you going to use it to guide your business into the recovery phase?

While it is relatively new, many SaaS companies are implementing revenue operations (RevOps) to determine their predictable revenue. They are breaking down silos across finance, sales, marketing, and customer success. These teams need to be working from the same data to get a holistic view of their recurring revenue. RiskIQ Controller Masha Murphy uses RevOps to reveal process bottlenecks. She targets small improvements in their day-to-day processes:

“We’re going to be much more successful in bringing in revenue and creating opportunities for ourselves.”

Patrick Campbell, CEO of ProfitWell, explained how to measure revenue operations:

“It’s not just acquiring customers. It’s monetizing them and really taking advantage of the monetization lever as opposed to acquisition numbers.”

Profitwell recently looked at businesses that already have a revenue operations organization and found that they tend to have better unit economics on the monetization and retention side than those who don’t. So, SaaS businesses looking for a competitive edge can justify building out this function as part of their recovery strategy.

Step 4. Leverage Your Finance Community – Build Your Personal Resiliency

Now more than ever, it is valuable to have a group of peers you can connect with and share resources with regardless of where you are in your finance career. Finance and operations leaders face a wide range of different challenges, many of which, they may be facing for the first time in the era of COVID-19. Being able to come together and leverage each other’s strategies and knowledge can be invaluable as we’re all pushing forward towards our economic recovery.

One of our MSFS sessions covered the value of finance peer groups and Amanda Kattan, Finance and Strategy Leader at 4th & King, shared her perspective: “In the startup community, one day feels like a year in a larger business, so you need to find extra resources creatively. Being part of a group where there’s a significant level of trust, and people are willing to be very open and honest about their experiences becomes an extension of your team. One challenge I brought to the community involved opening an office in India. The community shared their lessons learned, recommended contacts, and key steps for success. I leveraged the combined wisdom of 300 people to make an informed decision and didn’t need to become an expert.”

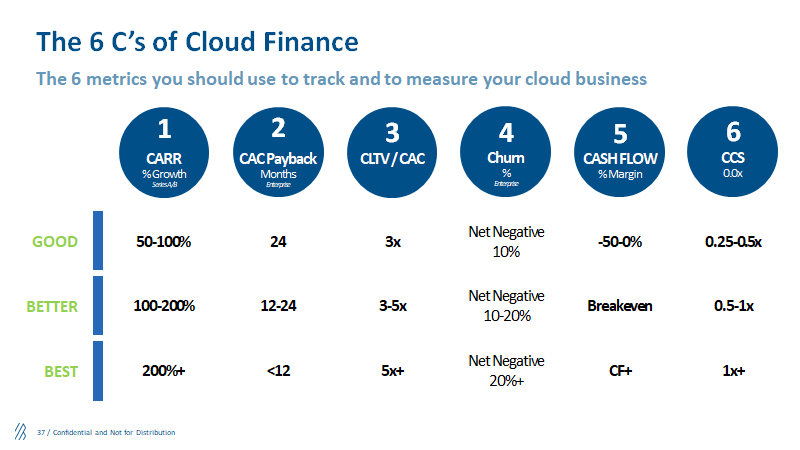

Step 5. Develop Your What-if Scenarios with the Six C’s of Cloud Finance

Right now, finance leaders are modeling multiple what-if scenarios to evaluate their business plans and prepare for recovery. Bob Pinkerton, CFO of Conga, a contract lifecycle management company, shared how he’s doing his scenario planning now:

“Understanding each client’s terms is really critical when you’re thinking about renewals and how they’re coming up. So, as we think about this time of uncertainty, clearly the FP&A role is to come up with scenario planning, contingency planning, etc. How can we make sure that we’ve got the right kind of plans for different volatility levels and [adjust] assumptions around churn, new bookings, and collections?”

Let the Six C’s of Cloud Finance guide you in creating a comprehensive scorecard for your business and build what-if scenarios. Byron Deeter of Bessemer Venture Partners joined us for MSFS and walked through their market-validated “Good, Better, Best” ratios, which give you the benchmarks to strive for as CFOs and position your business for recovery.

Step 6. Update Your Board

Great operators and investors work together through the unknowns, making experiments and taking risks to build successful cultures, products, and outcomes. It’s no different as you develop your strategies to recover faster than your competitors. And, according to our MSFS VC and PE panelists, you can still raise money to bolster your business and emerge stronger.

Make sure to communicate how your company and products are mission-critical. Any “nice to have” solutions are unlikely to get funding in this environment, according to Mark Terbeek, Partner at Greycroft. Second, you need to tell the story of the expense levers you’re pulling and show potential investors you can navigate through these turbulent times. Many private equity firms are preparing to ramp up acquisitions during this time, according to Dan Fletcher from Vector Capital.

Regardless of what’s happening in the market, Mark advises you to answer these questions:

- Why is what you’re doing so much better than what exists today?

- Why is that pain so acute?

- How do you go beyond what is available in the marketplace today?

“That’s the single noble purpose of the company and . . . be very crisp and very clear . . . . If you nail that, the whole thing flows from there.”

While there’s a lot of disruption happening right now, the trends in the cloud industry show a much broader growth trajectory over time. Along with the Six C’s, Byron shared the Bessemer Ventures State of the Cloud 2020 report, explaining the cloud industry’s exponential growth over the last twenty years. Bessemer’s research shows there’s great momentum you can build on as you transition into recovery mode. Couple that with the fact that ninety-four percent of enterprises use a cloud service today, and you’ve got a total addressable market that will remain sizable throughout the recovery.

We all hope for a fast, safe transition to a new normal as soon as possible. Preparing for that is the focus of great SaaS finance leaders. Whatever that eventual scenario looks like, you need to recover even faster than the companies you’re battling in the marketplace. Your peers and great investors shared their leading practices to layout your framework for being ready to do just that.

Ask the author a question or share your advice