It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

Mark Suster | Managing Partner @ Upfront Ventures

FULL TRANSCRIPT BELOW

We woke up February 2020 with a shock to the system and no idea what it would mean for our business. I just plotted a graph of the Dow Jones industrial average. If you look on the left hand side of the slide, by December 12th, we started to seek cases in Wuhan China. In January 13th, the first cases were detected outside of China. And as you’ll notice, all the way from middle of January to middle of February, the markets didn’t seem to notice. February 22nd, all of that changed and the markets plummeted. So we had a shock to the system with no idea what it actually meant. On March 27th, so about a month later, the US government passed the CARES Act, which probably you know, stands for the Coronavirus Aid Relief and Economic Security Act, which is now at three trillion dollars.

That has created a market bottom for now. So I plotted out for you. If you look at March the 23rd, the Dow Jones bottomed. At least for now at about 18,600. That’s the week that the CARES Act was signed into law and created some market stability that drove the Dow Jones back up. I thought it was worth putting three trillion into perspective for you so you could get some sense of scale. The starting point is how big was the last economic collapse and how big was our response to that? Well, the 2008 economic insecurity, we passed the $700 billion stimulus called TARP. Compared to what we just did in 30 days from the onset of a crisis, we’ve passed 4.3 times the total amount in three trillion dollars. And of course, we’re not done with this stimulus. I thought it’s also worth giving you some sense of scale for how much the US government takes in in revenue every year.

In revenue, the US government takes in 3.5 trillion. So the amount that we’ve handed out just in money going out of the US government is equal to 86% of the total revenue we take in in a year. What we see is the amount that’s actually being handed out by the government, but there’s actually a greater amount that’s injected into the economy. The Fed stimulus into the economy is projected by Morgan Stanley. It’s hard to calculate, but projected at eight trillion dollars. So several orders of magnitude bigger than you’re probably even aware. That’s 15 times larger than during the Great Recession. And we’re just, as I said, 30 to 60 days into this program, so there’s 11 trillion of stimulus.

Trying to put the impact on the economy, I think most of you know this, but in four weeks, in four weeks, 22 million people have filed for unemployment. If you look at this graph, it simply plots out how many people filed in the weeks before 2016, 2017, 2018, 2019, 2020. You can see very few unemployment filings and in four weeks, 22 million. So let’s put 22 million into perspective. First of all, in the last four weeks, more jobs have been lost in our country than exists in total in California or Texas. California employees about 17 million people, Texas about 15 million. If you take the 20 smallest States combined, the entire workforce of the 20 smallest States is about 12 million in 20 States. And if you look at the peak of unemployment during the last economic recession, you will notice there were 8.7 million people, total unemployed. We’re at 22 and counting, the figures come out every Thursday. So we’ll know tomorrow, the extent to which that goes up.

The thing that is, I think, less understood by people is the extent to which demand has completely evaporated and supply, global supply of products that are being produced now greatly exceeds demand. Anyone who studied economics will know when supply greatly exceeds demand, prices drop. This is an example just of the oil market compared just from April 2019 to April 2020. S&P over that period of time is down 3% the standard [inaudible 00:05:12] stock index. Whereas the oil markets are down 66%. That’s what happens when demand goes down so precipitously. And don’t think this is a constraint of oil. This is going to happen for many assets that are over produced now in markets where demand isn’t as strong. Many of you may have noticed this past week, actually oil future prices went negative. That means that people were actually paying you to take oil. If you want to know what happened there, the actual storage facilities are now completely full in the United States. So the ability for people to store oil doesn’t exist. So people were paying people to take their futures contracts.

So what outlook for VC funding and the backdrop of that economic news? Why is financing hard right now? I think you probably know, you read the headlines. It’s very difficult to get financed. So the market hates uncertainty. They hate when they don’t know what the future looks like. When the future is predictable, people like to invest. When it’s not predictable, they like to wait and see what happens. The second thing is the markets generally hate deflation. Deflation is when prices are dropping, that could be prices of real estate. I’ll give you an example in your personal life. If you think about buying a house and let’s say your price is $500,000 or a million dollars, let’s say it’s a million dollars. Then three months later, prices in your neighborhood dropped to 800,000 and you think, wow, that’s a great deal. Maybe we should buy.

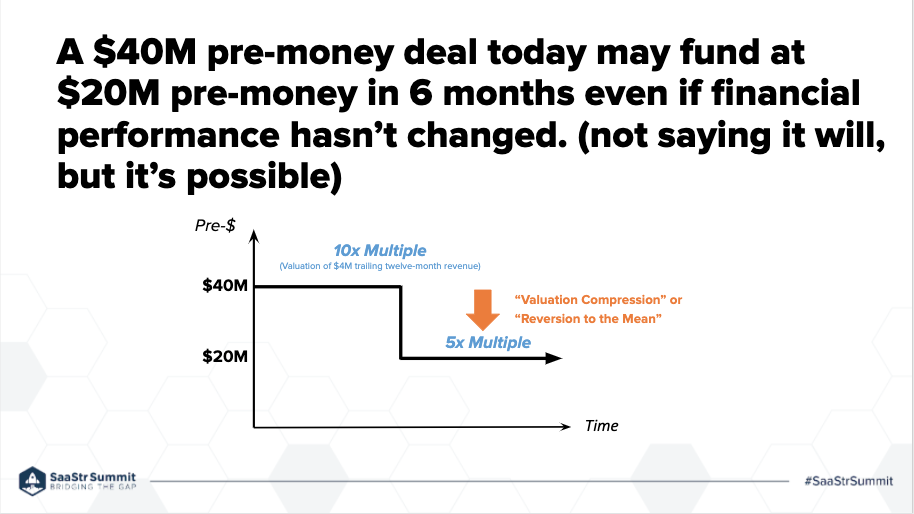

But you wait 30 days and you notice that prices dropped to 720,000 and you think, wow, what a great deal? Let’s wait 30 days. The more they continue to drop, the more buyers actually pull out of the market because they see deflation. They see asset prices going down and people don’t like to buy in a period where asset prices are going down. Obviously, eventually you find market equilibrium and prices stabilize, but investors generally, don’t like deflation. To give it to you as a startup for example, let’s say that the markets were paying 10 times trailing multiples for revenues. So a company doing four million in trailing ARR, let’s say could get a 10X multiple and people would pay $40 million for that. Well, if the market changes how it values companies, the exact same company doing four million in revenue, the market may start paying five times trailing.

This happens like this in public markets. So public market investors are very used to what’s called valuation and compression. They see it where SaaS companies might trade at 13 times, 15 times, 17 times trailing. And then one day the whole market resets to the seven times. The problem in private markets is private markets don’t adjust their pricing because it takes time until financing’s actually happen. So that kind of price discovery makes financing very difficult. The other term you may hear for this is called reversion to the mean, which is where values go up and then values come back down in terms of other values. Nobody actually knows what’s going to happen with COVID-19. I should tell you, this week the CDC warmed this week that winter could be worse than today. I don’t think by now that’ll surprise any of you. I put this chart together in February, where people weren’t talking about this quite as much, but this is the Spanish flu mortality rates in the UK.

Several markets saw this, where they saw an initial wave of mortality. They thought they were through things as things heated up. Then you had a wave that was bigger. What the CDC and the US is worried about is that the flu, the normal flu, comes out at the same time as COVID-19 makes the resurgence in the winter and that overwhelms our healthcare system. Social distancing, it’s now a term that everybody talks about and is widely understood. Again, I put this together in February saying that I thought like chain restaurants, domestic air hotels were going to be impacted. I think this impacted is too light a word. These industries have been devastated, but there’s other factors at work. We were warning startups to expect a degree of uncertainty in the year ahead anyway.

We have the elections coming up this year. In election years, there’s always more investor uncertainty about not only who’s going to win, but the degree to which the [inaudible 00:09:50] will happen in the country. In an election year, other than in a crisis, it’s very hard to get bipartisan support for anything. De-globalization, I think is real. The challenges of global supply chains and the global competition for resources, particularly the US, China, but this is really a trend happening everywhere. Brexit being another example. I think the other thing on uncertainty that we shouldn’t downplay is worldwide populism from the right and left. Now, I usually give people a good book to read, which is Genghis Kahn and the Making of the Modern World. It talks about how the global economic system was set up under the Genghis Kahn regime globally, and the building of the Silk Road and why the bubonic plague actually led to a decline of global trade. That led to a decline of global order that led to the dark ages, which lasted hundreds of years.

And really it came from the same forces at work from what we see on populism on the left and the right, and I’m not trying to be alarmist, but it is something to be aware of in terms of planning for uncertainty. When I put my slides together, I said, VCs are possibly going to start focusing on triage. They’re definitely focusing on triage. Triage means it’s a term that comes from [inaudible 00:11:15] where you have an acute thing that happens all at once and you have to decide which patients are going to die and therefore don’t warrant the limited resources we have. Which patients are fine, and we’ll get to them later, and which patients, if we step in and make a difference right now, we can save.

That happens in venture capital, and that’s happening right now. Every venture capitalist is stress testing his or her own portfolio. That means they spend less time looking at new stuff and they’re trying to shore up and protect their existing investments. When you get through that period, then people start looking at new stuff. It’s much easier to look at bright eyed and bushy tailed new investments. It’s much harder to look at companies maybe that were overvalued six, nine, 12 months ago, and are trying to raise at lower prices today because investors generally don’t like to invest at cheaper prices. They don’t want to piss off the existing investors who don’t generally like taking markdowns. They don’t want to piss off management teams that face dilution from down rounds. So it becomes easier to fund newer companies. I’m not saying it doesn’t happen, but it becomes easier.

For people asking questions, I see the Q&A coming in. I promise I will bring this home with enough time to answer some questions. But I’m going to keep with my flow for a bit. In a tougher funding environment, I like to say it becomes a bit like constipation, nothing gets through. That’s just what happens. Like it’s funding, funding, funding everything’s going on and then all of a sudden everything shuts down and it shuts down immediately and almost entirely. So financings are happening, but the pace of financing happening is so low. I think you could say we’re generally on pause. When uncertainty passes, VC funds have plenty of dry capital to put to work. This is the US Venture Capital Market. This is how much money has been raised year by year by US venture capitalists. And you can see they’ve been raising, we’ve been raising billions of dollars over the last decade.

So your job really is just to stay funded past this period of uncertainty. It could be, when I call uncertainty, it could be three months of uncertainty, it could be 18 months of uncertainty. I don’t think we really know how bad things can be. I don’t think we know if we’re through the worst. I suggest we probably aren’t. I teed up this slide where revenue in the future might continue on some trajectory where you’re up into the right. But honestly, there might be a quantum where everybody’s revenue is brought down. So far in the Q1 reporting in the public markets, public companies are forecasting that Q2 is going to be down pretty dramatically. And estimates are that full year earnings will be down 15% year over year. That should give you some indication of what may happen in private markets.

I think the VC backed tech market will likely see its worst moments next year. I think this is something a lot of people aren’t talking about. So I want to make sure you’re aware of it before other people are. If you think about what’s going on today, you take when people first found out about the news and tried to react in March. We’re in April now, but in March they had nine to 18 months’ cash because that’s how much most venture back startup companies have. So in Q1 and Q2, this is the period with which this cash is going to be depleted. It doesn’t mean these companies are yet out of cash, but they’re getting pretty close. So I suspect you’re going to see increased bankruptcies and where maybe five years ago, or three years ago, or three months ago, maybe investors would have stepped in and helped bridge some of these companies. I think there’s going to be a lot more ruthless focus on who makes sense to finance and who doesn’t make sense.

You’re going to see a lot more recaps, which are recapitalization, which is refinancing a company and pay to plays. The reason is, if you have four or five large investors and two of them are willing to step up and write a big check in your company, they’re not going to do it if three of them aren’t. So either that forces the company into bankruptcy, which sometimes happens if two people step up and three people don’t, or those investors say fine, we’ll step up. But we want to wipe out investors who aren’t stepping up to save a company that otherwise would be bankrupt. This is the reality of tough markets. I don’t know if we’ll get there. I mean, sorry, we’re already there, but I don’t know if it’ll be there on mass or if this is just a small trend, it’ll depend on how bad the market gets.

You’ll see a lot more asset purchases. And what I mean is, healthy, mid sized, private companies buying for nearly nothing, let’s say in the past we’d call them acqui-hires. In some cases they don’t even want to acqui-hire. They just want to asset-hire. I think you’ll see a lot more of these in early next year. So what can you expect for SaaS businesses next year? Well, in a booming market, executives are paid to innovate. Executives at companies are told, engage with startups, launch new initiatives, be first to market. Why aren’t you using RFID? Why aren’t you launching collaborative this or that? You are almost under pressure as a corporate executive to show that you can innovate, but [inaudible 00:17:03] markets, people are not paid to innovate. They’re paid to consolidate and cut costs. So they’re going to take nine vendors who all roughly do similar things and say, let’s get that down to two. That means specifically they’re going to cancel contracts. And that means they’re going to renegotiate prices for tools that they deem essential.

I think most SaaS startups haven’t seen the full effects of what you’re going to see. The reason for that is most people have annual contracts and they haven’t come up for renewal yet. So you might have some companies that are in travel or transportation or hospitality that have literally called you and say, I can’t pay my bills. I know that’s happened to you. But for the most part, people haven’t seen it across their entire customer base. When renewals come up the next 12 months, I think you will see pretty big increases in churn even for good software companies. But the thing that I would really focus on is price reduction and harder term negotiations. Because it’s coming and you need to have a plan for it now.

Intransigent is not a strategy. You’re saying, well, we’re just going to hold the line. That’s no strategy. So if you can hold the line because you’re essential, obviously be my guest. But if holding the line increases your churn, I wonder if you’re winning or you’re losing. I’ve been advising some of our companies, when your bigger accounts are asking you for lower prices. Can we go in and say, listen, we’re willing to lower price in exchange for a longer contract? Can you lock in some degree of more security over the long haul? If you’re going to lower your revenue forecast, perhaps you need to be cutting your OPEX aggressively now in anticipation of some of this lost revenue. I think you should have conversations with your investors early.

What businesses will resonate with buyers and with investors? What I’ve been encouraging people to think about is, can you take your existing businesses and slightly alter your value prop or at least change your positioning to the market? On the one hand you have cost takeout. So can your product be used to reduce other software expenditure or help clients reduce OPEX costs? In the past, you may talk about productivity gains, but honestly, productivity gains are so last year. It’s, how do I help drive my bottom line by cutting out costs? And are there any COVID or post COVID use cases that are relevant for you? So can your product improve operations given the changes in how businesses will operate? That’s things like monitoring people or assets remotely, improving how we work in a distributed operation, ensuring compliance with government or with internal policy, you name whatever how the world is changing. I think it’s time to start thinking about how you talk about that with clients, even if it’s soft marketing, this is something that’s really going to resonate with people.

Some sectors are obviously well positioned for the future and they will attract capital and customers even in this market. One example is food production and distribution. We’ve realized how difficult our food supply chains are and how vital they are. So anyone involved in that sector right now is experiencing more demand than they can handle and probably a lot of inbound investor requests. Obviously remote training and distance learning will get a lot of heat going forward, distributed collaboration, anyone who’s doing tools that will get teams working in different ways. The opposite to this is I think a lot of people are looking at canceling their real estate. They’ve realized, Hey, we can work effectively as a distributed team. So you may see teams of 25 or 30 decide they don’t want or need offices going forward. You may see bigger companies decide that they’re willing to allow more work from home.

Biotech and diagnostics is an area that you’re seeing a lot of focus on right now, remote medicine, telemedicine. Right now, if you have a three month old, you’re not dying to take your baby into a pediatrician. And frankly, the pediatrician is not dying to come into his or her office to treat your three month old. So remote medicine is getting a lot more heat. And any application that, as I said, senses things with people, not just temperature, but just the movement of people around spaces is an area that’s become vital because we need to ensure social distancing norms are maintained. There are some silver linings, I’m going to cover this quickly so that I can save time for Q&A.

I like to remind people that good businesses are built in good markets and bad markets. Google and Salesforce were built in the Dot-Com crash. Uber and Instagram were built in the last economic crisis. In a way, you have an advantage. If you have an amazing product that truly is differentiated IP, that solves real problems, it’s much harder for all the posers to raise their poser money and go to market and make it harder for you to charge for your product or service. As one of my mentors used to say, in a strong market, even turkeys can fly. In a downmarket, you really find out who the great companies are. Also startup funding has been up massively for the past 15 years and VC funds, as I pointed out earlier, have raised a ton of capital. That capital is not going to evaporate. It’s going to be invested.

There are more billion dollar valued private companies now than ever, which is a sign that economic value has shifted from public markets to private markets. So part of this is the over-funding of the market, but part of it is just that companies stay private longer and that capital will likely stay in the private markets. The public markets have become more reliant, not less reliant on tech successes in the past decade. These are obviously FANG the major success stories. A good deal of the economic gain in the public markets over the last decade has been these companies and maybe a handful of others. I don’t think that’s going away. I don’t think investors are going to suddenly say, let’s put all of our money in industrials. I think tech will continue to be important.

There are more billion dollar valued private companies now than ever, which is a sign that economic value has shifted from public markets to private markets. So part of this is the over-funding of the market, but part of it is just that companies stay private longer and that capital will likely stay in the private markets. The public markets have become more reliant, not less reliant on tech successes in the past decade. These are obviously FANG the major success stories. A good deal of the economic gain in the public markets over the last decade has been these companies and maybe a handful of others. I don’t think that’s going away. I don’t think investors are going to suddenly say, let’s put all of our money in industrials. I think tech will continue to be important.

If you look to the Dot-Com crash, this is no Dot.Com crash coming. Our story is much more pervasive now. In 1999, there were a hundred million internet users in the US, it’s approaching 300 million. There were 250 million in the world, we”re approaching now five billion out of whatever we’re at now, seven and a half billion in the world. Connection speeds and the Dot.com era were 50K, it’s now 96 Meg. So the ability to transform how we do business is significantly different than it was 20 years ago. Everybody of course, has a computer in their pocket now, and we’re all socially connected. So when ideas work, they spread much faster than they have in human history.

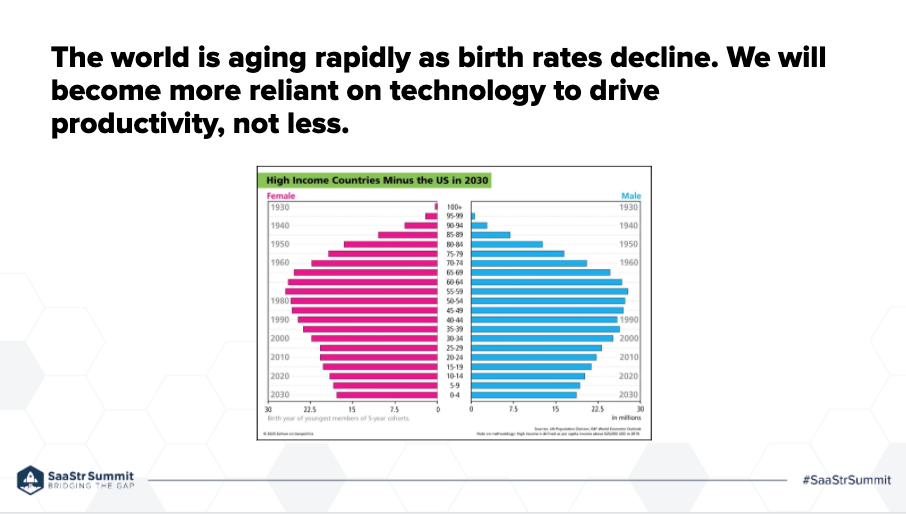

I think one of the things that’s often overlooked is that we’re all now connected financially. It’s single click to purchase just about anything. That purchase friction slowed down a lot of online commerce in the past and has accelerated it today. When we talk about connections, 5G really will be a game changer. It means on a mobile basis, you’ll have the ability to transfer data at incredibly high speeds that will change the way many businesses actually operate. And we think will lead to a lot of disruption. One thing that isn’t widely understood is that the world is aging and birth rates are declining. So if you look at this on the left are women that exists in the world, are distributed based on age group. If you look at it in the right, it’s men, and this is all high income countries, excluding the United States. The United States is an anomaly in that we have a very young population, and this is why immigration is actually a good thing, not a bad thing.

Our president has it completely backwards. But a young population isx base to pay for the things what creates the ta that we need. Within an inverted birth rate like this, as you can see, what it means is people are getting older and you’ll have fewer people paying into the tax base and fewer people productively working. But I think this is a good story for technology because it’s going to drive us to be more reliant on productivity, not less reliant. So I think the narrative of being worried about AI and robots is a bit misguided. The things we fear, drones, robots, automation, AI are actually going to be strategic imperatives to feed the world. Marc Andreessen famously wrote this week that we need to build, build more things. And he’s exactly right about that.

The way to feed the world, the way to secure the world, the way the generate wealth, the way to fight disease, they’re all driven by the things that the people on this [inaudible 00:27:24] and that’s not going to change. So we do have to get through a period of transition. You need to preserve cash during this time, but as startups, we will solve bigger problems in the world. Hopefully, we’ll see a lot more people focused on things like agriculture, biotech, remote medicine, remote training, group collaboration, remote education, and the things I’ve talked about.

I’m going to go just to the Q&A and see how I can do this in real time. Am I still actively investing as my focus shift towards follow up investments versus new investments? That is an anonymous attendee. So yes, we’re actively investing. In the last week alone, week and a half, the last 10 days we’ve approved two deals. So I should say it’s probably easier for us to fund early stage companies for reasons I already articulated earlier. Both of these are seed rounds. They’re both like four million dollar checks. We’re thrilled. What we’re looking to fund is people who want to build things for the next 10 years. So we can look beyond the instability of the next six months and say, what do we build for for 10 years?

How do I believe the VC industry will change and evolve post COVID-19 if at all? That’s from Irene Atkins. Well, one thing I think will happen is I think the number of firms will dramatically decrease. There’s a reason for that. Listen, LPs that people who invest in VC funds, they’re no different than any investor asset class, which is they’re under threat from their own asset ownership. And there’s going to be a lot more pressure for them to cut back investments. I think if you don’t have a stable LP base that you’ve had over many funds, so if you’re on fund one or fund two and you’re a smaller fund than a single GP, some of those are going to do fine, but I think it’s going to be harder. I think you’ll see a little bit of a consolidation.

Kyle Genki says, “Well, corporate VC arms differ from traditional VC and how they react. What should we expect if a deal’s in progress?” Listen, it’s much harder for corporate VCs. I’m sorry to say that, but it just is. And not all corporate VCs are the same. Someone like Salesforce has been very prolific and active and may continue to do so. But in general, corporates who this is not their traditional day job, they enter the market very late in the economic cycle and they’re usually the first people to pull out because this isn’t their core business or their core jobs. So I do think you’ll see corporate VC dry up more than you would expect.

What are my thoughts on the type of models and sectors that will likely emerge as the COVID winners? I’m not going to answer that because I answered it during the presentation. I assume you actually asked it before I answered it. How is Upfront supporting its portfolio companies in the current uncertain times? Well, I’ll tell you what we’re doing. We set up first of all, a WhatsApp group. So we were very active in trying to give real time feedback to people. Also CEO to CEO, we’re doing weekly calls on Zoom, where we’re bringing CEO to CEO around topics. We’re actually facilitating discussions between people, we’re putting out thought pieces.

If you didn’t see on my blog, Both Sides of the Table, I gave advice on the PPP program. Separate to that blog post, we wrote a very comprehensive deck that we sent out to our teams. We’re trying to help them think through cost cutting. I’m trying to help them think through on the SaaS space. Like what’s actually coming end of year? We’re actually working with them on their marketing and positioning and even product placement. Like, how do their product offerings need to change given how the world has changed? This is not a V-shaped incident. This is not like the market went down. It goes right back up when we go back to being normal. So we’re really trying hard to get our companies to take this seriously long-term.

How do I see deal up that disappeared? How do I see deals being due diligence in a remote only world? Will that speed up the investment process? No, I think it’ll slow down. Chris Calvert asked that. I think it’ll slow down the investment process. Listen, I think investors have got to change their own mentality of being willing to underwrite investments, where they perhaps haven’t met the team. Again, earlier stage, you’re running a smaller check. You perhaps can persuade yourself through Zoom. I will tell you culturally I’ve changed. Whereas before I wouldn’t have a Zoom call with CEO catching up, I’d either call him or her on my drive home and just do a voice call or I’d wait until we had in person. I’m doing a lot more one-on-one updates and I’m loving it. I’m doing a lot more pitches one-on-one that I’m doing remotely that I wouldn’t have done in the past. I feel like I can build rapport remotely, but I think the industry culture will need to change. So series seed, it might be possible later stage if someone’s writing a big check, I think it’s going to be pretty tough.

One investor said to me, “I can establish rapport one-on-one over Zoom. What I can’t get is watching the interaction between teams and how they interact with each other.” And that’s an important part of the investment decision. What sectors do I think are likely to gain more prominence doing this new normal? I already answered that. What is that one point we need to focus on while making our pitch decks post COVID? Okay. So in your pitch deck right now, you’ve got to show, first of all, that you’re solving a problem that can get through this difficult period of time. I think you need to show that you have real value for buyers because we know buyers are not going to spend money unless they’re getting real value.

If you can align your value prop with the new world and show that it’s aligned, I think you’ll have an easier time getting money, but it’s not required. I think show that you have a low burn rate and that with a little bit of money, you can achieve a lot. But my advice for fundraising is the same as it always would be, which is you have to show really differentiated intellectual property technology. You’ve got to show that you know and understand a market better than other people actually do. And you’ve got to persuade investors that you’re capable of building something incredibly large.

Monique [Metta 00:33:53] says, “So Mark, is it a good idea to connect with more VCs right now to build relationships? Most VCs will give you the advice that you should wait a month or two and come back and meet people later. I’m not most VCs. I actually think that’s wrong advice. This is the best time to reach out to VCs. Because there’s a bunch of people like me sitting at home in my hoodie all day and I got all the time in the world to do quick calls and quick pitches. My life is a little bit less chaotic in some ways than it used to be. Probably you know, but I’m both sides of the table, which is my blog.

I wrote a post that became famous over the years called Lines and Not Dots. I would suggest you go read that if you haven’t read it before, but it’s my metaphor for why you need to build relationships early. Because ultimately, investors are buying trust and they’re buying rapport and a belief that you’re going to do something big. It’s just really hard to do that in a single meeting or two. So the earlier you start building rapport, the better.

What do I think will happen in emerging VC markets like Africa, Africa peak last year at one billion? I gotta be honest with you. I’m a little bit despondent for emerging market investments. I hate to say it, but if you want to know what I actually think will happen. I think emerging markets will struggle more and they’ll struggle more for a few predictable reasons. One is, in a contraction, people focus their dollars, their money on markets that are more core in their history strategy. But there’s another reason and it’s really unfair. But when you think about it, 70% of the global trade in the world is denominated in US dollars. I think 20-ish percent is in euros.

If I talk about the US, we have the ability to print money, we have the ability to solve our problem and still be the world’s currency. That may not last forever. I’m not saying so, but we have an unfair advantage in that most people want to trade in dollars and have access to our market. So there’s a little more resiliency in both Europe and US. I think that it’s going to become harder in those markets. I wish it weren’t so, but that’s actually what I think will happen.

What metrics are we looking for pre-seed funding, B2B, AI product? That’s [inaudible 00:36:14], I’m looking for great teams pre-seed. I’m looking for people who, as I said, understand a market, understand the technology, know something that other people don’t know. And that’s what I want to fund. Both of the companies we agreed to fund in the last 10 days, neither of them have revenue. One of a monster product, but it’s an early launch of the product. We just thought they were exceptional teams that we wanted to work with that had knowledge that we hadn’t seen in other places.

Quick question around how I think the economy will bounce back from this. Do you imagine a world in which supply will actually decrease to meet a new lower demand where people go back to their consumption levels? That’s a good question. It’s going to be asset type by asset type. Let’s start with some obvious ones. Oil is not going to immediately come back because people aren’t going to go back to immediately jumping on airplanes. Even when we lift restrictions, they’re not going to go to the same level of travel and driving that they were before. And as we’re not producing products, the by-product of oil going into production is going to go down. But already there’s been signs that we’re going to cut supply. Saudi being a large producer and Russia being a large producer, have already talked about cutting supply. So I think you’ll see supply cuts.

But in other categories, I just don’t think demand is going to come back. I try to point this out to people. Consumers have not yet realized the extent to what it looks like when 20 million or 30 million or 40 million, we don’t know how big it’ll go, have not had income for six months. It’s one thing I lost my job, but I went and I bought a new computer and I bought a Netflix account because I’m at home and I’ve got to keep everyone productive and my kids have to go to school remotely so I spent the money. Six months from now, you’ve been out of the job for six months, I think consumer spending is going to take a pretty big hit for a long period of time. And I think the same is true in the corporate world.

What kind of food companies do you see doing well in a post COVID-19 world? Well, I’ll give you some examples. Think about your own consumption patterns. I now eat Daily Harvest every single day. I love the company, I love the product. It’s a really high nutrition product stored in your freezer that lasts a long period of time. I also absolutely love Ramen Hero, which is another thing that I store in the freezer. I used to live in Japan. I developed a love for Ramen and it’s the highest quality Ramen I’ve ever experienced that you can prepare at home. But also companies like Apeel Sciences that we’re a big investor in, they take the molecules from the waste product and stem of plants and they use it to allow the plant to last an additional 30 days with no refrigeration, no herbicides, no pesticides. So there’s huge demand for this product now as consumers who are hoarding grocery products and then they’re spoiling. So technologies like this, I think, will do really well.

Startups that can actually maintain revenues for the next 12 to 15 months but without any growth, why would these be valued lower? Listen, historically people have valued growth and they valued growth over any other metric, but that may change. They may value stability knowing that you have stable contracts, they may value that you’re not burning a lot of money. Obviously, if you can show that growth, that’s great, but I just wouldn’t grow at all costs. I would get through this period of time. And growth matters. It matters in every company, but for the foreseeable future, I would say stability to me matters more than growth.

What do I think of Southeast Asia from Singapore? I remain bullish on Southeast Asia. I remain incredibly bullish on Singapore. It’s an important region. Innovation will continue to be driven in that area. What am I hearing from LPs? How skittish are they? Anyone concerned with their willingness to honor capital calls? That’s from Steve Weisner. There’s a term, it’s called default where LPs just don’t meet the payment when it becomes due. I don’t think that’s going to happen because the consequences of defaults are too high and they’re secondary markets. what they’re worried about is something called unfunded liabilities, which is the future capital calls that they’re going to have to give to VC funds. So they’d rather sell in a secondary at a loss to get rid of unfunded liabilities. But if you defaulted, you’ll never get back into venture capital, you’ll be blocked out. What I think is going to happen is just cutting back. Like if you had 18 managers last year, you might cut back to 12 or 11 managers.

Jordan has asked, what are my thoughts on current SaaS companies, public market valuations, how much will start up costs and shut down? Listen, I believe SaaS valuations and public markets have gone up too much. I think people are anticipating too much future success. That’s my own personal view. And I think that once you see the price pressure on big software companies to reduce costs and once churn rates go down, I think those valuations are going to come back down to reality. I think investors are trying to shift their dollars and try to figure out what the growth areas are. That’s why Zoom is booming and Peloton is booming. Blue Apron is booming. I think SaaS is benefiting from that. But I think it’s going to come back down to earth. I think private companies that are not yet as robust and don’t have the install base, it’s going to be even tougher.

What options does the VC have when they feel one of their companies is no longer viable post COVID? Well, if the company truly doesn’t have a future, can they shut down current operations and use existing cash to launch a new business? Can they sell their assets to a company that actually does have a more productive future? These are the kinds of conversations that are happening everywhere. Give me one second, I’m just making sure I’m not running over on time, two minutes to go.

So for current productivity platforms, how do we not be considered last year on drive the bottom line for consumers? That’s from Julian. Look, if you’re focused on productivity, you can continue to focus on productivity. I would just start to alter your messages and show ways that actually are driving costs controls. You can still do productivity, but your message is not going to be, your workers are going to be 23% more productive than last year. I just don’t think that’s going to resonate. So you can talk about remote productivity and teams working more productive remotely. Because that’s at the moment. Are we still open to investing in Europe? What are key considerations? Yes. In fact, we do a lot of cross border, particularly France in the US, but we’ll invest anywhere in Europe. Probably slightly later stage than a seed round. It’s probably more like a late A or an early B. We have a gentleman named Julian based in Paris. So we actually have feet on the street. For current productivity platforms, how… That one I already answered.

I’m just going to answer one more. Is the stable LP base most from corporates? If so, then LPs will pull out [inaudible 00:43:45] pull out? No, corporates is probably the least stable LP base. I’d say, people have been investing in VC for 30 years, so public pensions, endowments, people like incredibly large family offices, a fund of funds, I think will be stable at least for the next year, year and a half. Just like corporates who invest in VCs are going to say, if this isn’t core to what we do, let’s preserve our cash for our own business.

Thank you so much to everyone who turned up. I’m super grateful that you gave me your time today. I hope I answered enough. I would stay and answer another hour of question, but maybe Jason can invite me back and come answer more of your questions. But thank you so much and good luck in all of your businesses. I’m certainly not rooting against anybody. I hope my words of caution are more challenging you to be more prudent in your businesses rather than seen as negative. Thank you.

Thanks again to Mark. We’ll send you guys the presentation and recording soon. Okay.

Wonderful. Thank you.