A few years back at the second SaaStr Annual, we put back-to-back a seemingly very different set of speakers, Jeff Lawson, CEO of Twilio, (transcript here) and Peter Gassner of Veeva (transcript here).

Both are two of the most impressive and inspiring public SaaS CEOs — but their products and companies couldn’t be more different. Veeva sells eight-figure deals to a very small number of very sophisticated customers, while Twilio has big customers yes, but also a huge long tail and starts at $0.0085 a minute. 🙂

But I wanted to pair them for several reasons. One was to get a sense of what the bar was to pull off a successful SaaS IPO these. Another was to see examples of some relatively capital-efficient companies (Veeva raised less than $10m in VC money on the way to now $30 billion in value!).

And a third key point was to learn about a subject I think about a lot, which is “When is the right time to add a new product?”

A really, really rough rule in SaaS is you need a second product firmly in place by 10,000 customers, or $100m ARR, whichever comes first

That probably means launching it by the time you have 5,000 customers

If your ACV is low, that could be as early as $10m ARR

— Jason ✨Be Kind✨ Lemkin (@jasonlk) November 21, 2022

Adding a new product line is incredibly distracting. It’s not just building the 1.0; that’s the relatively easy part. But it gets incredibly complicated after that. Do you have two sales teams? Who gets what part of the long-term development budget? Where does marketing allocate its resources? And most importantly, multiple products can be very distracting at the management team level. The new product tends to dominate the discussions, yet by definition, is only a tiny percent of the revenues in the early days. The last thing you want the team doing is chasing a shiny penny, when what really matters is hitting the plan for the quarter.

The answers from the CEOs of Twilio and Veeva were radically different. 🙂

Jeff Lawson of Twilio’s answer, as you might expect from a B2D company, is basically — just try it. Especially if there appears to be demand. If you can build it fairly easily, and the customers want it, try it. You can always kill it later. And clearly, this worked very well for them — at least up to $1B ARR or so. Then, they bought Sendgrid and Segment to add on big additional product lines faster and bigger.

Peter Gassner of Veeva’s answer was seemingly the opposite. His point was, first, don’t take the easy route. Your customers will want things that are fairly easy to build, and you’ll understand those problems well, because they are adds-on to what you are already selling. But his point was these rarely move the needle. You don’t want a new product to add 10%-20% in revenue … you want to build a new product that can do 100%+ of your existing product’s revenue. Otherwise, it is too distracting and won’t ultimately move the needle. So he challenged us to move out of our comfort zone in wanting to build the easier, but ultimately smaller add-on products, and take bolder steps.

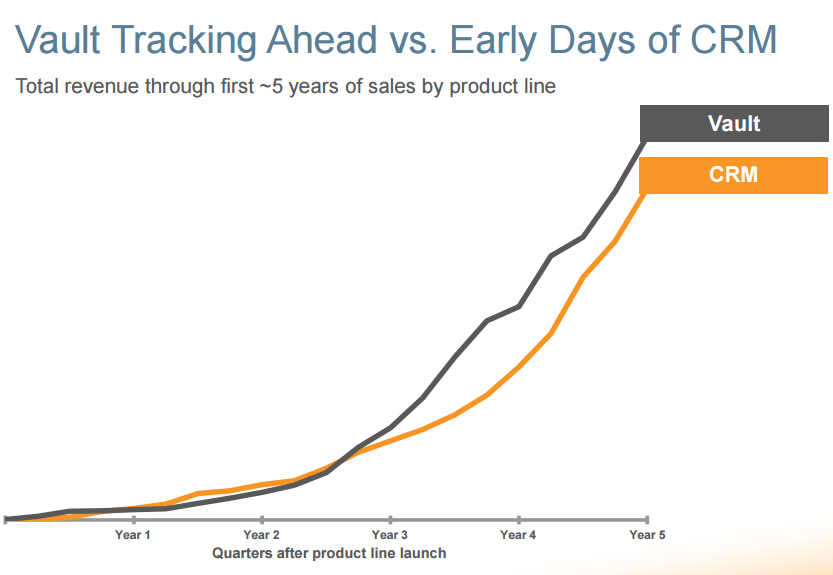

Veeva did this, adding a second core product, its Vault, to its Pharma CRM. The overlap wasn’t huge, and in fact, is diverging more over time — but the impact has been tremendous to the top line growth.

And since then, Vault has out-accelerated their initial product, CRM:

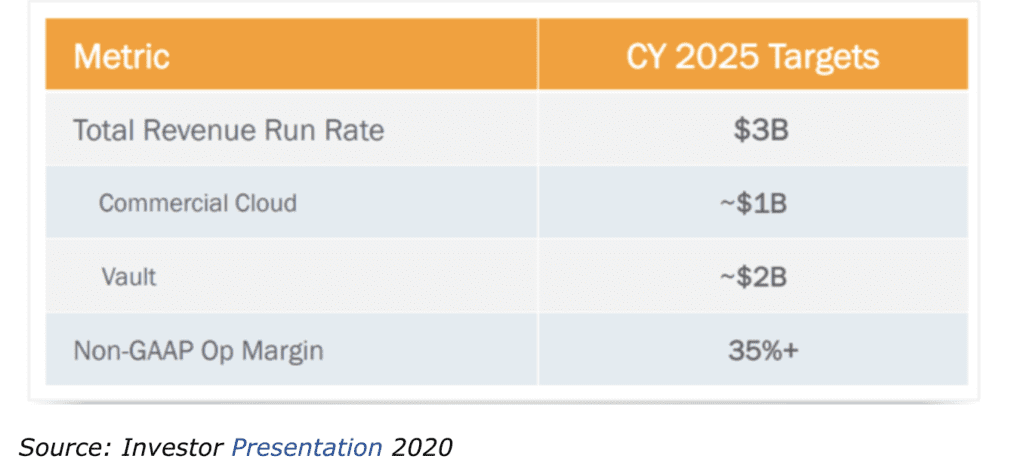

Now fast forward 4-5 years, and Vault has become not just Veeva’s largest product line … but its future:

And more recently, I did a deep dive with Dharmesh Shah, co-founder and CTO of HubSpot on how and when they went multi-product:

And Spencer Skates, CEO of Amplitude, did an incredible SaaStr session here on how critical it was to be truly multi-product by $100,000,000 in ARR … and the big mistakes that made trying to sell to different ICPs here:

And then the other day, we did a deep dive with Nick Mehta, CEO of Gainsight, as they are crossing $200,000,000 in ARR … on his Top 10 mistakes. #8? Not going multi-product early enough.

They started to hit headwinds at $50m ARR by being too slow to roll out their second act. They caught back up, but it was an unforced error. A great recent convo here:

So what should you do here?

I wish I had some magic answers. I struggled with this a lot myself. In my first startup, it was clear to me that notwithstanding closing $6m in revenues our first year, that our TAM was likely less than $100m. So we built a second product line our first year. We knew we had to. So I wanted to start as early as possible.

At Adobe Sign / EchoSign, I wanted to do this early too, but it was just too distracting. The product went from simple to very complex as we served more nuanced enterprise needs. The demands there were so heavy on the organization that there was no way, at least until $15m in ARR, at least, we could ever have launched a real second product. Although I spec’d out several.

Most Big Companies end up solving this with M&A, at least in part. Salesforce’s Marketing Cloud is a huge revenue driver, and a large percent of it and almost all the Commerce Cloud is from acquisitions:

A few learnings from companies I’ve worked with and observed:

- Someday, almost everyone adds a second product. The question is when. Not everyone does, but almost all vendors do. So maybe even as early as a few million in ARR, once you start to really understand your market, start thinking about what you might do here.

- Selling a second SaaS product is very hard. If you are B2D and/or freemium and don’t need a dedicated sales team, it can be a little easier. But maintaining distinct sales, marketing, customer success, and product teams is a huge resource conflict. The prototype is just the very beginning of a journey.

- Don’t let an additional product be an excuse. Let it be an enabler. A second product can’t bail out your sales team. It can’t solve your miss for the year in revenue. Don’t let it become like a feature gap, an excuse to miss the plan.

- It’s a good reason to raise a little extra money. If your second product starts to work, you will need to staff it. There are good and bad reasons to raise more money. This is a good one. At least after launch, you’ll need a dedicated team of at least some size.

- Understand if you can co-sell the product, for real. This is harder than it sounds, but if the products really are adjacent to each other, your sales team may be able to sell both. This makes staffing sales much easier here. But — it also makes the revenue side harder in many cases. Because the sales team will want to throw the second product in for free, or at least very cheap, to get the deal closed.

- Get on a jet. 🙂 Or least Zooms. OK, this is the most broken record SaaStr advice. But sometimes you can really only intuit when to go for it on a second product by having talked to 100 customers. You — the founder. Not just your VP of Product or your head of sales. They will bring you back tons of feedback. But it rarely will help you decide when to go for it on a second product. Your customers are one of your very best sources of learnings here. They’ll tell you all about the white space and gaps you think you are attacking with your potential second product. And you have to visit them face-to-face to really learn.

Good luck. This stuff is tough. Just plan in the back of your mind on building a second product by $100m in ARR. 🙂

(note: an updated SaaStr Classic post)