Table of Contents

Nobody wants to watch their customers walk away.

Duh, right? Lost subscriptions are an inevitable part of doing business as a SaaS company.

But keep in mind that businesses don’t typically face a flood of cancellations overnight. Instead, it’s a gradual drift of customers that snowball into a more serious problem.

That’s exactly why businesses should keep a close eye on customer churn.

In this guide, we’ll break down how to calculate your customer churn rate (and the actionable steps you can take to reduce yours).

What is Customer Churn?

Customer churn represents the rate that customers cancel their subscription to your service. In short, churn measures the percentage of people who’ve left over a period of time (typically month-to-month).

Below is a quick customer churn formula that you can use to calculate the percentage yourself:

Customer Churn Formula

Customers that churned over a period of time / Customers at the start of that time period = Customer churn rate (%)

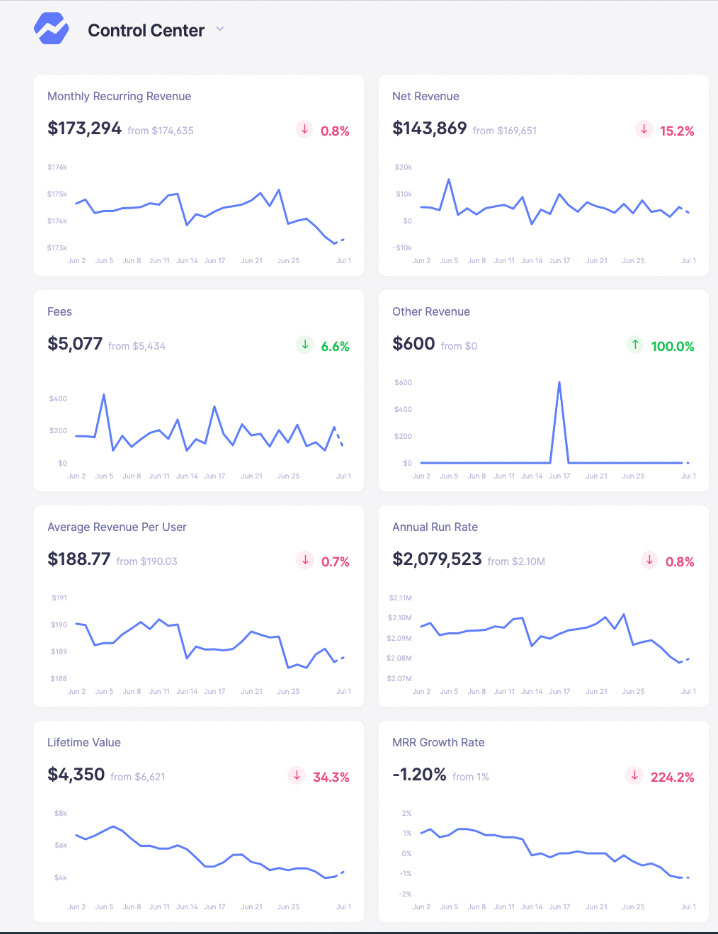

Note the distinction between customer and revenue churn (confusing, we know). The latter measures the percentage of your MRR lost over a specific period of time. Both metrics are obviously important and should be central to your SaaS dashboard for the sake of assessing your business’ health.

Why Does Customer Churn Matter?

We’ve talked time and time again about the importance of analyzing churn and rightfully so. Below are some key reasons why customer churn rate should be a priority metric for any SaaS company.

An increase in customer churn highlights bigger-picture business problems

From lapsed billing and back-end product issues to lackluster customer service, a creeping churn rate can clue you in on issues where your company can immediately intervene. Without a pulse on your customer churn, such problems can slip right under your nose.

Measuring churn makes it easier to predict and anticipate revenue

No surprises here. With a relatively consistent customer churn rate, you have a better idea of what your MRR will be and whether or not your business is growing at a consistent rate. Although some churn is inevitable, a lower churn rate obviously means more revenue and the likelihood of longer-term, loyal customers.

Lowering churn encourages more proactive customer communication

Food for thought: 80% of customers state that the experience a company provides is just as important as their product or service.

Actively reducing churn means spending more time interacting with customers. Doing so not only allows you to build meaningful relationships with your buyers, but also uncover opportunities to improve your business, such as:

- Product features that are must-have for your customers (as well as new features they might want to see in the future)

- Up-and-coming competitors in your space

- Whether your customers are pleased with the pricing and value of your product.

Taking the initiative to do all of the above starts by both measuring your churn rate and understanding whether you’re at risk for mass customer migration.

What’s Considered a “Good” Customer Churn Rate?

There is no right answer here. Your industry, price point, and other factors all play a part.

That said, we do have some firsthand insight via our own Open Benchmarks with data from actual SaaS companies. In Baremetrics, you can compare your churn rate against companies with a similar average revenue per user (ARPU).

Here’s an example of what ours looks like:

Remember that you can’t avoid churn altogether. This is especially true for newer companies still in the process of building a base.

And if you’re unhappy with your customer churn rate or still struggle with long-term retention, you don’t have to panic.

6 Ways to Reduce Customer Churn

Long-term customer retention is the end game of just about any SaaS company. To wrap things up, let’s look at the specific actions companies can take in pursuit of a lower churn rate and happier customers.

1. Ask customers why they’re churning in the first place

This is not only a no-brainer, but also an immediate intervention your company can take.

The concept here is simple: when your customers cancel, prompt them to explain why they’ve decided to walk away (via email, input form, etc). Doing so in good faith represents an opportunity to figure out how your business can improve.

Below is an example of a subscription cancellation email via Baremetrics. Our platform makes it a cinch to not only roll out such autoresponders but also turn your cancellations into data points via our Cancellation Insights feature which highlights the “why” behind your lost customers.

If nothing else, cancellation messages can create a bit of lag time. This gives you a chance to actually talk one-on-one with a would-be-churned customer and resolve the issue.

The caveat here?

Forcing customers to go through this process can be tedious for people who are committed to their decision to walk away. Either way, this is a prime example of how customer conversations can highlight bigger-picture problems that could be impacting the rest of your buyers.

2. Speed up your customer response time

Customer expectations are arguably higher than ever.

This rings true when it comes to both response time and personalizing your interactions.

That means spending actual time talking to people, not blasting one-size-fits-all service messages and “solutions.”

From email to social media and beyond, speedy responses (think: minutes and hours, not days) should be a top priority.

Because customer interactions can happen through so many different avenues, you should ideally consolidate your communication to a single platform or push customer conversations to support.

3. Check in more often (and automate the process)

The idea here is pretty straightforward: more frequent check-ins mean more opportunities to interact with customers and identify potential issues.

You can’t assume that customers will always reach out even if there’s a problem (or if they even have the bandwidth to do so.)

Check-ins don’t mean bombarding people with calls or sales messages, though. Instead, companies should try to nudge customers and frame their outreach as positive and proactive.

You can actually automate this process through winback emails which are triggered based on your customers’ inaction (see below). Your CRM can likewise highlight customers you haven’t talked to recently and might be due for a check-in.

4. Identify customers in danger of churning

Piggybacking on the previous tip, consider creating a criteria for customers who are at risk for churning. This means finding common threads between churned customers and likewise keeping a close eye on how often your customers interact with your product.

For example, a sample criteria might include the following:

- Customers who haven’t logged into your service in [X period of time]

- Customers who you haven’t opened or responded to [X outreach messages]

- Customers who’ve made a certain number of complaints

This is again where a tool such as CRM can help, allowing you to keep track of your past customer communication and likewise set reminders for follow-ups and interventions (see below for an example in Agile CRM).

5. Explore opportunities to reward loyal customers

No matter what sector of SaaS you’re in, customers are likely spoiled for choice in terms of competing products.

Consider rewards and loyalty incentives for your early adopters or people who’ve committed to your service for a certain period of time (think: a year or more).

These incentives might include premium customer service, additional features or grandfathering them into premium plans at their existing rates.

You obviously can’t do this with everyone, but these strategies can help give VIP treatment to your most valuable customers.

6. Make customer churn a staple metric for your company to watch

Making a conscious effort to monitor your churn rate is perhaps the most important tip toward improving it.

Because you can’t know where you’re going until you know where you’ve been.

This is exactly where a tool like Baremetrics can help. Our SaaS dashboard showcases your user churn rate alongside a slew of other metrics month-to-month including MRR, ARPU and LTV (to name a few).

Having all of your growth metrics in one place means that you’re never caught off guard by irregularities. Beyond that, our easy-to-read graphs and real-time reports are easy to understand at a glance. This makes sharing your data with colleagues and stakeholders a cinch.

Not only that but our platform highlights where you stand versus competing businesses in your space. We let you know loud and clear where there’s room for improvement.

Are You Happy With Your Customer Churn Rate?

Listen: your customer churn rate isn’t something you can let go under your radar.

By keeping an eye on it in Baremetrics and sticking to the retention tips above, you can set yourself up for more loyal, longer-term customers.

FAQ's

-

What is Customer Churn and how is it calculated?

Customer Churn measures the rate at which customers cancel their subscriptions over a period, typically calculated month-to-month using the formula: (Customers churned over a period / Customers at the start of that period) × 100%1. -

Why is analyzing Customer Churn important for SaaS companies?

It highlights business issues, helps predict revenue, and encourages proactive customer communication, aiding in maintaining a healthy customer base and revenue stream. -

What actions can be taken to reduce Customer Churn?

Engaging in proactive customer communication, understanding customer needs, and keeping a pulse on market dynamics are key actions to lower churn rates. -

How does Customer Churn impact Monthly Recurring Revenue (MRR)?

A lower churn rate leads to higher MRR as more customers continue their subscriptions, contributing to business growth. -

What's the distinction between Customer Churn and Revenue Churn?

While Customer Churn focuses on the number of customers lost, Revenue Churn measures the percentage of revenue lost over a specific period.