120% NRR: Your revenue doubles in 5 years even with no new customers

110% NRR: Your revenue doubles in 8 years even with no new customers

100% NRR: Your revenue stays the same with no new customers

— Jason ✨Be Kind✨ Lemkin (@jasonlk) April 20, 2021

As part of our 5 Interesting Learning series we’ve had a chance to do a deep dive on many leaders selling to SMBs in whole or in part, from Zendesk to Smartsheet, from Shopify to Zoom, from Asana to Hubspot, from Box to Dropbox, and so much more.

And there is one key takeaway: you really should aim for > 100% NRR, even from the smallest of businesses.

Yes, small businesses go under at a much higher rate than enterprises. And yes, there is far less to upsell at most tiny businesses. Traditionally, that has meant even 100% Net Revenue Retention can be tough when 20%-30% of your customers may be out of business in a given year!

Yet we’ve still seen the Best in SaaS can do it. At least 100% NRR after $10m ARR.

Some quick examples:

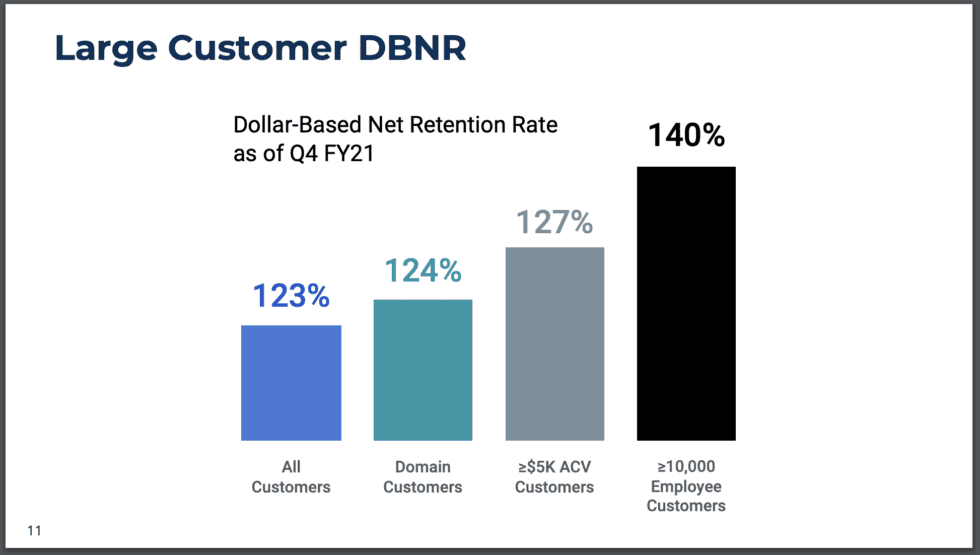

#1. Smartsheet: 131%+ NRR overall in 2022. And I love this slightly older but more specific breakdown from 2021, when it had 123%+ NRR from all customers, so probably ~110% from SMBs:

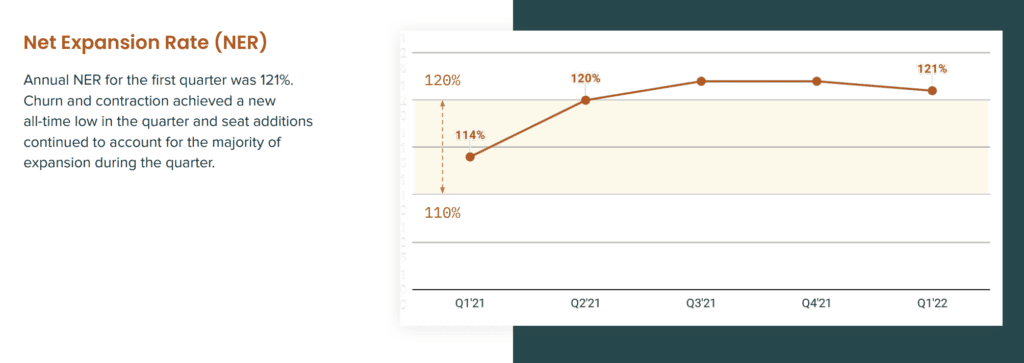

#2. Zendesk: 121% NRR overall, with 35%-40% SMB. So probably again around 100% NRR from SMBs.

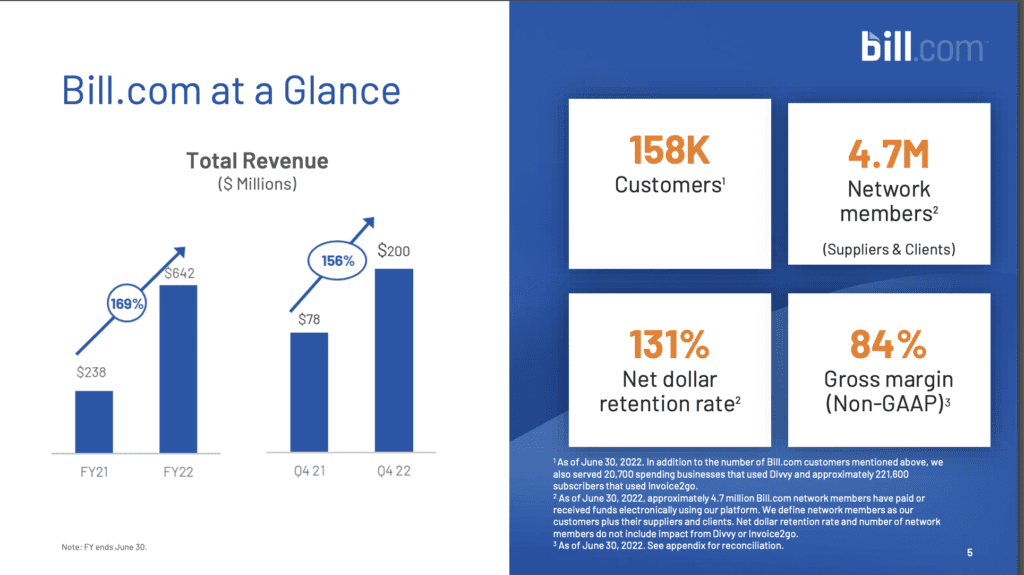

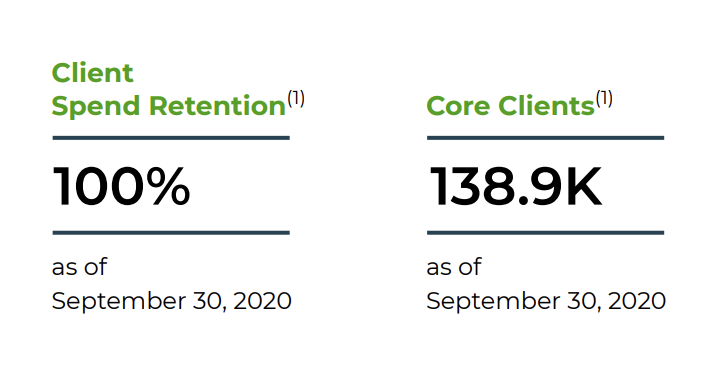

#3. Bill.com: 131% NRR from small businesses (up from 110% at IPO). And this is from, in many cases, very small businesses. It’s super helpful to also see logo retention broken out at IPO.

#4. HubSpot, over time, has driven first to 100% NRR from SMBs and now 110% from SMB+. It helps they’ve gone to bigger SMBs with higher ACVs (approaching $20k now), but it still shows it not only can be done, but then built upon to go from 100% to 110%, in large part by going multi-product.

"Even up until $20m, $30m ARR, our net revenue retention … wasn't very good. We had to push through it." @dharmesh @bhalligan @HubSpot pic.twitter.com/H5dN5P37Jd

— Jason ✨Be Kind✨ Lemkin (@jasonlk) January 30, 2023

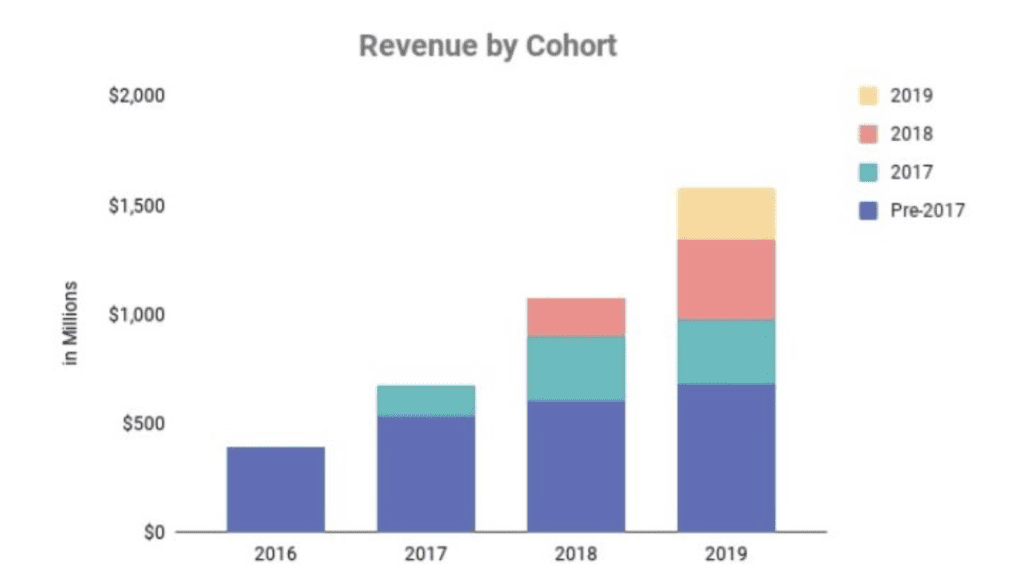

#5. Shopify at 100%+ NRR. Shopify doesn’t always break out its NRR, but since its revenue by cohort grows, it’s north of 100%:

#6. BigCommerce at 106% NRR. Shopify’s smaller rival.

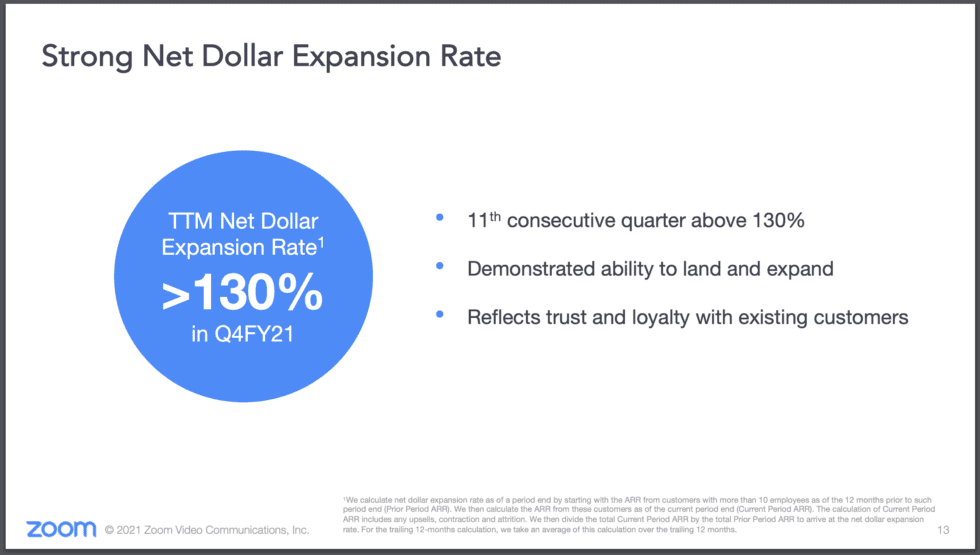

#7. Zoom at maybe 110% NRR from SMBs — at least until $4B in ARR. Zoom’s overall NRR until recently was consistently 130%, with more than half from SMBs. Zoom didn’t break out the difference, but we can impute at least 110% NRR from SMBs. Note that is even with half of Zoom’s customers paying monthly! Again, Zoom’s numbers have fallen as of late with the rocky post-Covid changes, but these were the NRR trends all the way to a stunning $4B in ARR.

#8. Upwork at 100% NRR. Even a marketplace like Upwork that can be episodic in usage hits 100% NRR overall.

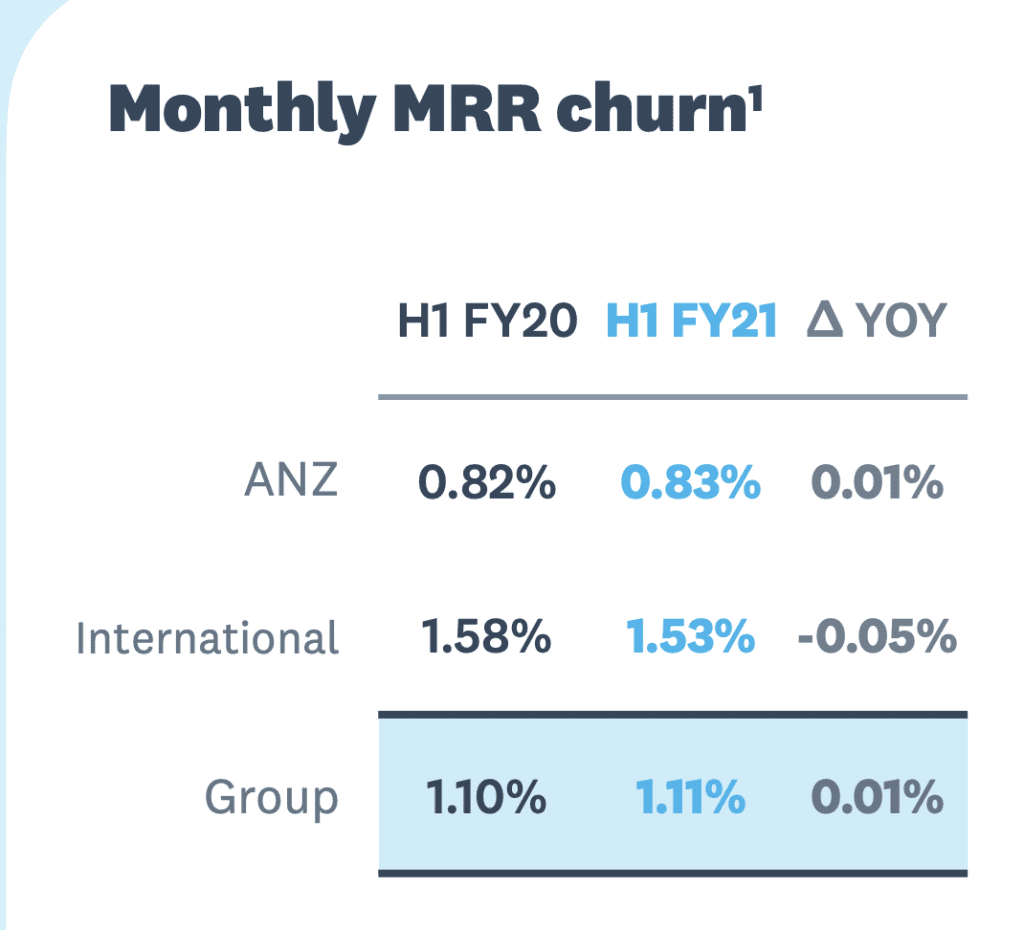

#9. Xero has 1.1% monthly churn. So it doesn’t quite hit 100% NRR.

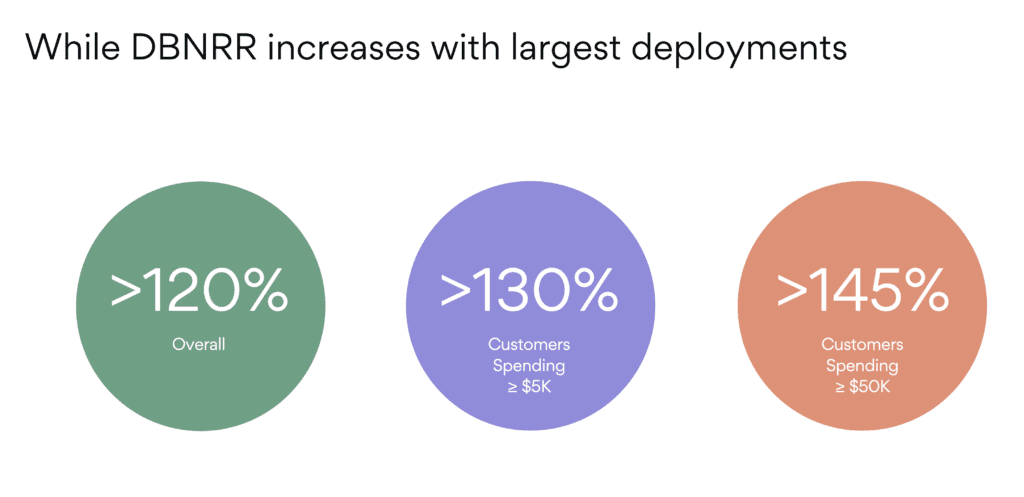

#10. Asana has 120% NRR overall (up from 115% just after its IPO), 130% for $5k customers (up from 125%) and 145% for $50k customers (up from 145% at IPO). So well north of 100% for its SMBs.

We could go on and on. A few thoughts:

- Yes, SMBs churn at a higher rate than enterprises, both gross and net. So plan on that.

- Yes, many SMBs just go out of business. So also plan on that.

- And yes, many top SaaS SMB leaders didn’t have 100% NRR in the early days.

- And the 82% logo retention that Bill.com has is probably as good as it can get with very small businesses. So you’ll need to find a way to sell them more seats, more usage, more something to get to 100% NRR.

But

- Almost all the top SaaS leaders got to 100%-110% NRR from SMBs. Although many, if not most, didn’t start there. Maybe you can’t quite get there at $1m, $2m, even $10m ARR. But keep getting closer. And try to hit that target after $10m ARR at least.

Having said that, this assumes you have a sales team or other solution. Self-service single-seat products like Squarespace have 85% NRR.

But if humans are involved in sales and success, don’t settle for less than 100% NRR.

Make it so!