So when we last checked in with Snowflake, it was at $850m ARR growing a breathtaking 110%, with 162% NRR.

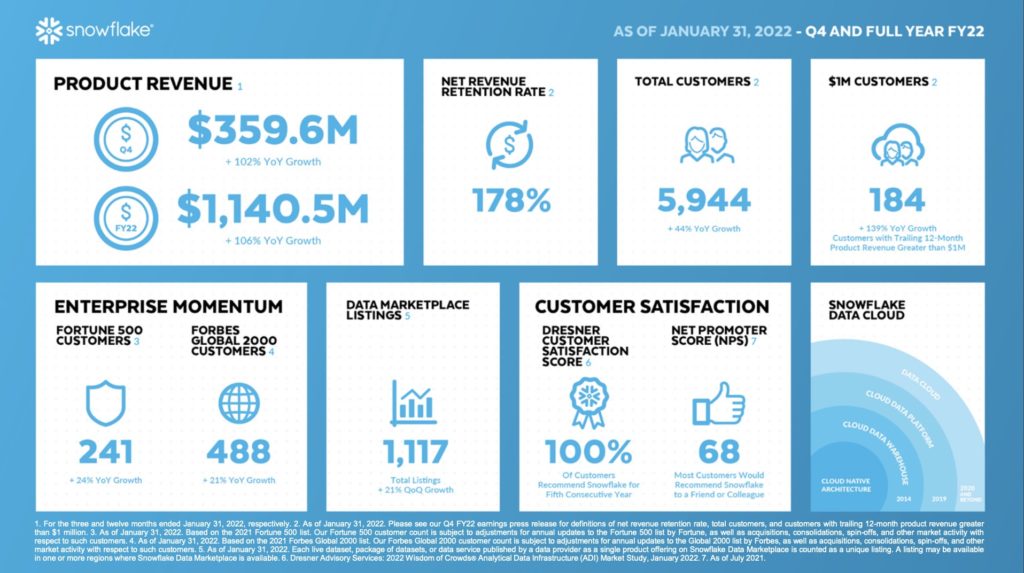

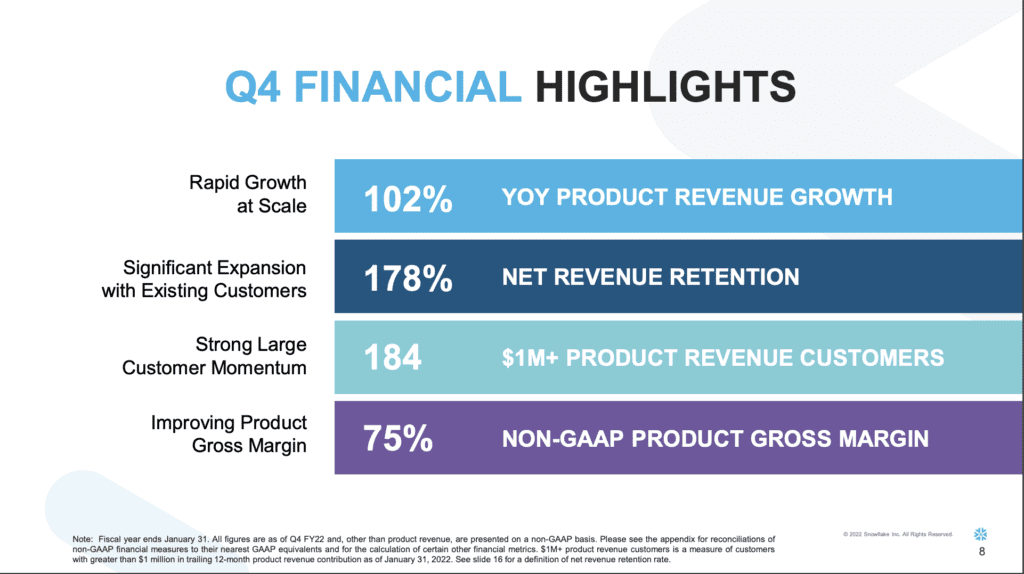

It hasn’t really slowed down! At $1.5 Billion in ARR, it’s still growing 102%. That’s triple-digit growth going into a $2 Billion run rate! Goodness.

5 Interesting Learnings:

#1. Margins Continue to Improve to an Impressive 75%. A challenge for folks like Snowflake is the high cost of managing massive amounts of data. In 2019, their gross margins were finally up to 58%, and they kept working on getting them up. In 2021, margins were up to 68%. And now, they are all the way up to 75%.

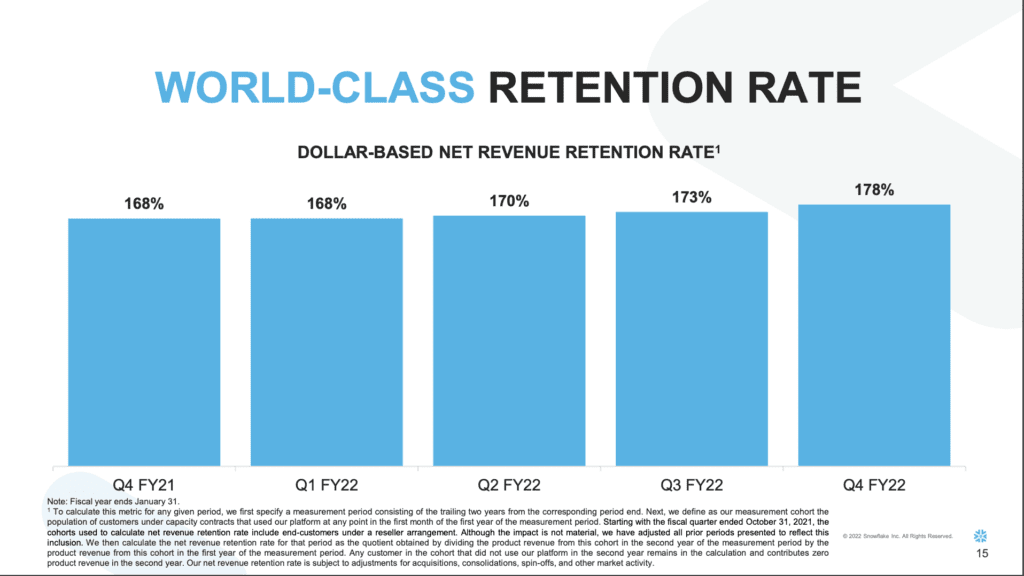

#2. NRR Continues to Go Up! All the Way to 178%. This is equally as impressive. NRR in 2021 was around 162%, and it’s since gone back up! It reached a peak of 189% in Q3’20, but nevertheless, it’s breathtaking how long Snowflake has been able to maintain this epic engine of growth.

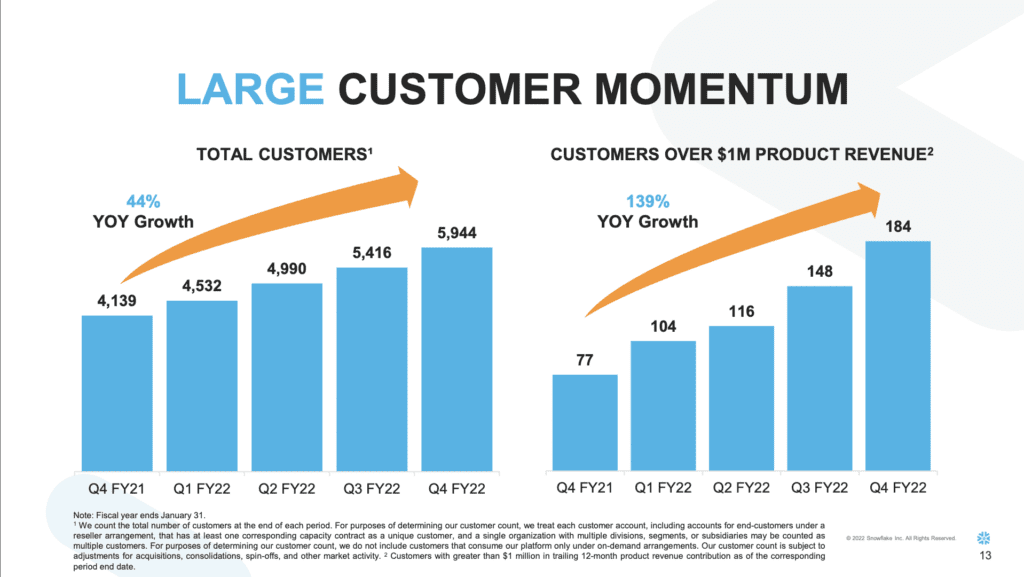

#3. $1M+ Customers Remain the Fuel for Growth. Customer count is up 44% overall to 5,944, but the 184 $1m+ customers are up 139%.

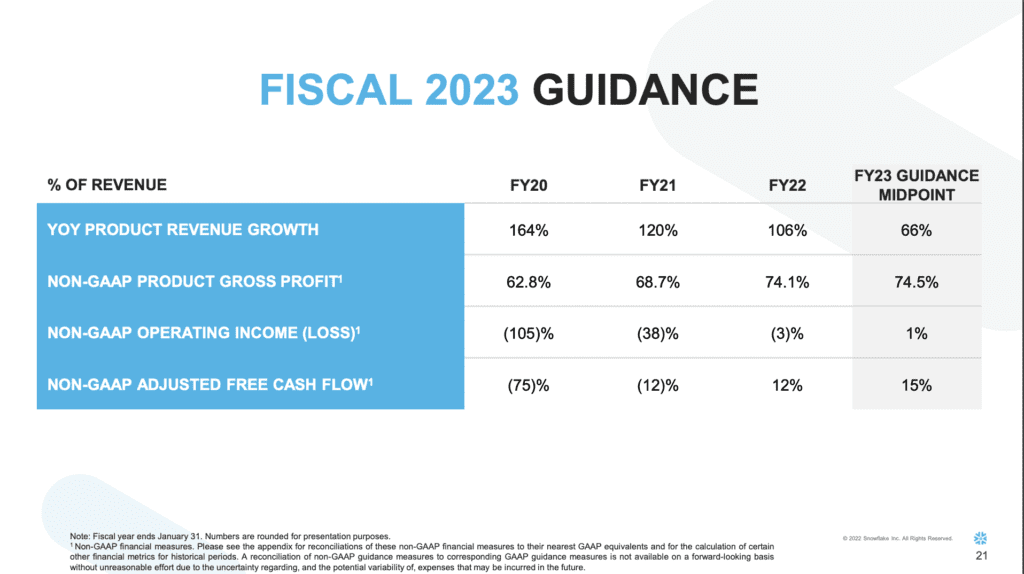

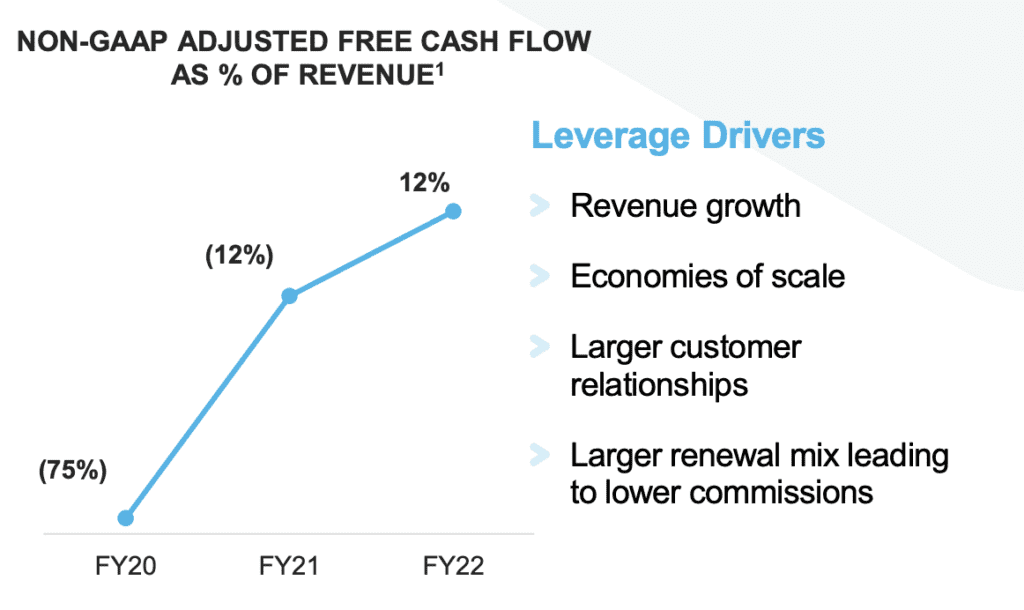

#4. Generating Real Free Cash Flow Now — But Not Until After a $1B Run Rate. This is where Snowflake has taken a bit of a knock in the public markets. It’s investing heavily in growth and hasn’t generated free cash flow until just recently, really Q4’22. Until late 2021, no one really cared, however. But now they are predicting a 15% adjusted free cash flow at a $2B run rate.

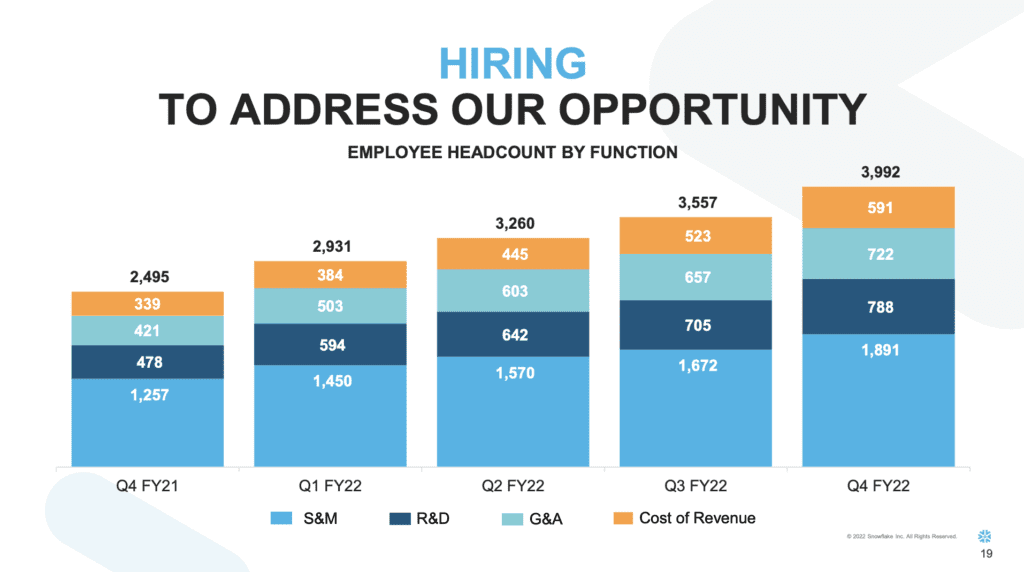

#5. 4,000 employees at $1.5B run rate, and about half in Sales & Marketing. This is pretty typical for a sales-driven model, and also one of the ultimate challenges in getting cash-flow positive. 50% of revenues going to sales and marketing is common, but makes it hard to get profitable until growth slows.

And a few bonus learnings:

#6. Being Cautious About 2023, projecting 66% growth. To be clear, this is still utterly epic growth. And triple-digit growth can’t last forever. But Snowflake is saying maybe things will be just a little bit better than The Best of Times in Cloud next year. Still, with 99% growth in RPO (signed agreements / backlog), Snowflake may just be being conservative here. I expect they’ll handily beat this 66% number, given the RPO.

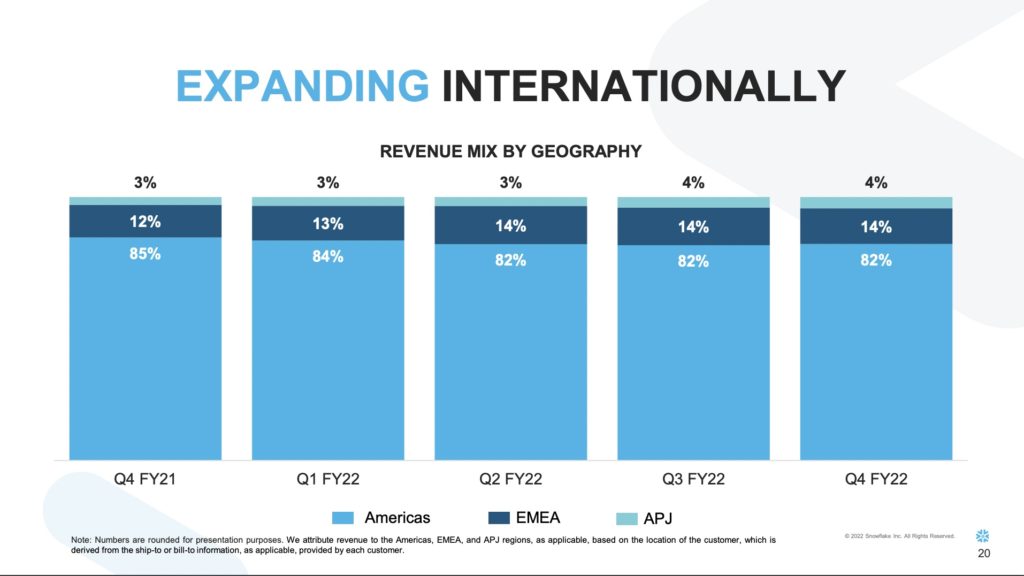

#7. International Remains a Key Area for Expansion. The percent of revenue outside North America remains small.

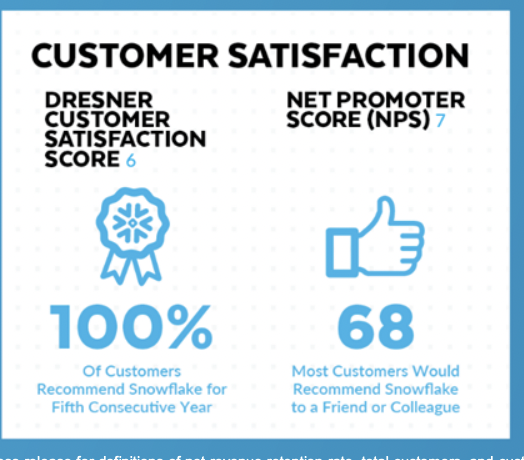

#8. NPS of 68. Look, no two NPS calculations are the same. But it’s great to still see it called out and tracked. Aim High here.

#9. No Headquarters. Snowflake announced this a while ago, but I hadn’t seen it noted as “No-Headquarters” in a quarterly release. There you go:

Wow. Just Epic.