When we last checked in on Asana, they were at $240m in ARR growing an incredible 55% a year.

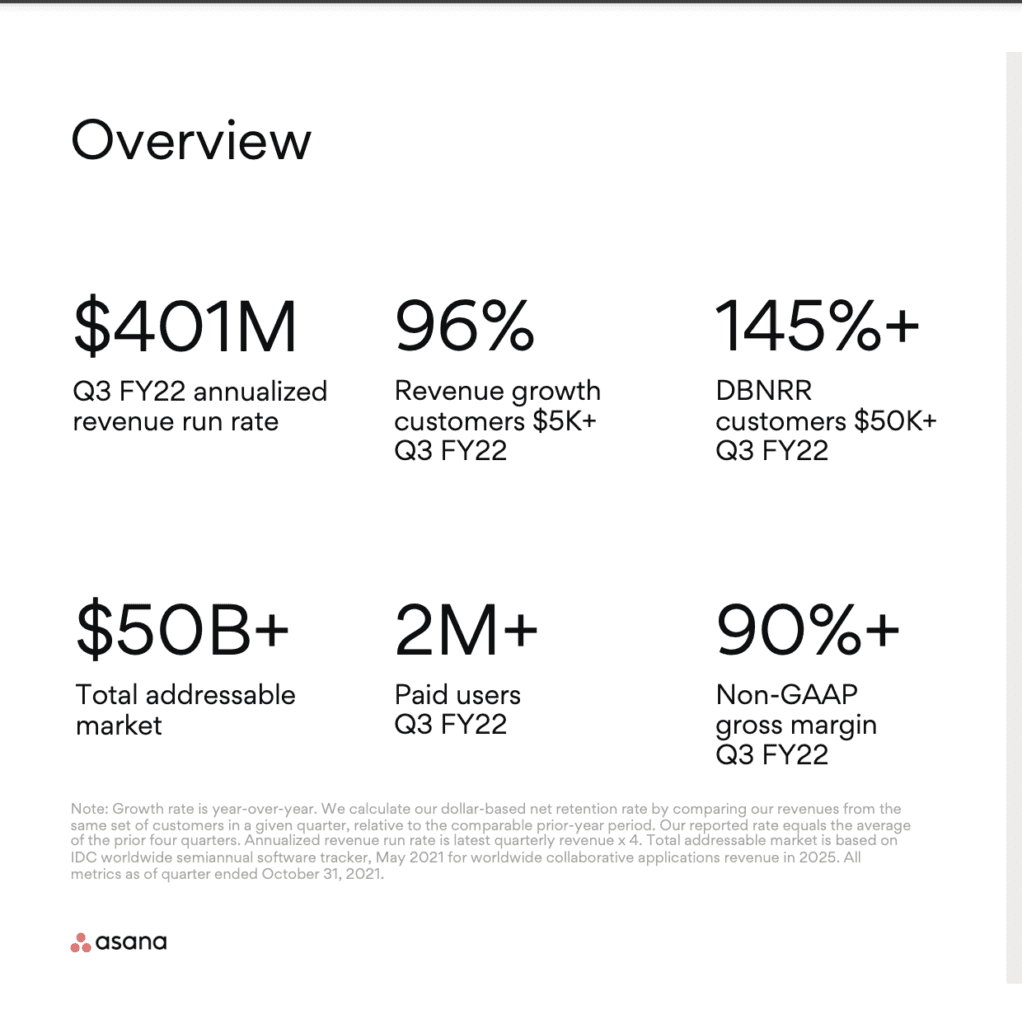

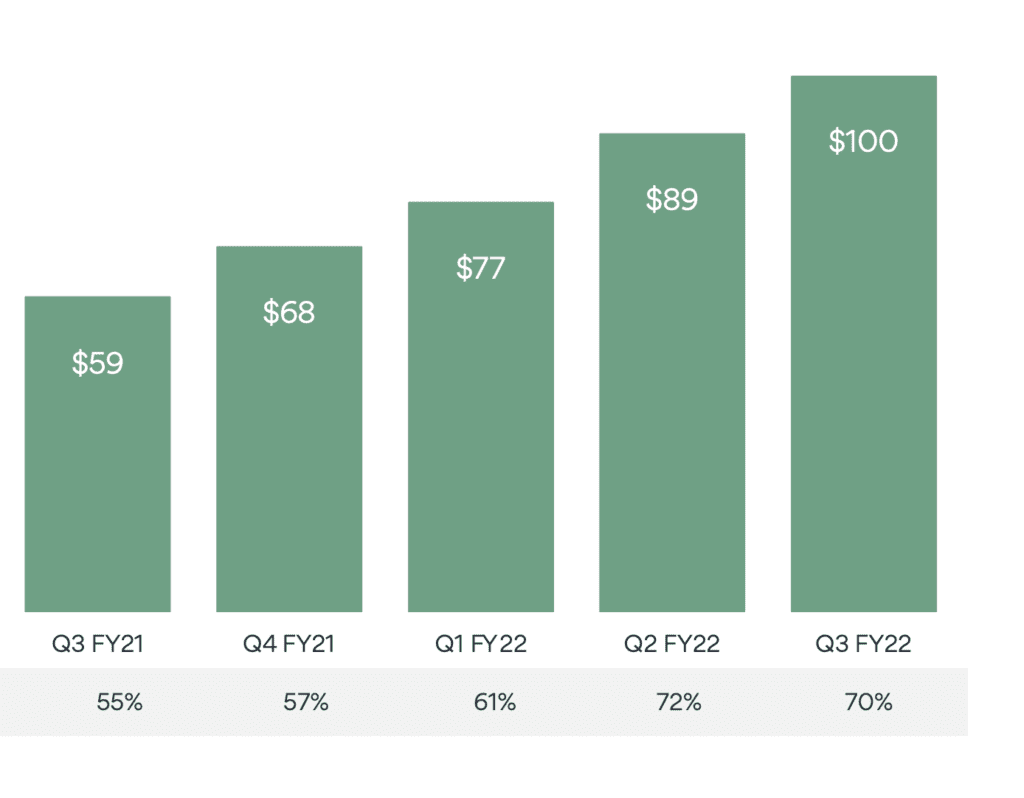

You might expect growth to slow in such a highly competitive space, but no — Asana’s growth has defied gravity. At $400m in ARR, it’s now growing a stunning 70%. That’s incredible acceleration at scale.

Ok 5 Interesting Learnings on how they accelerated growth at scale:

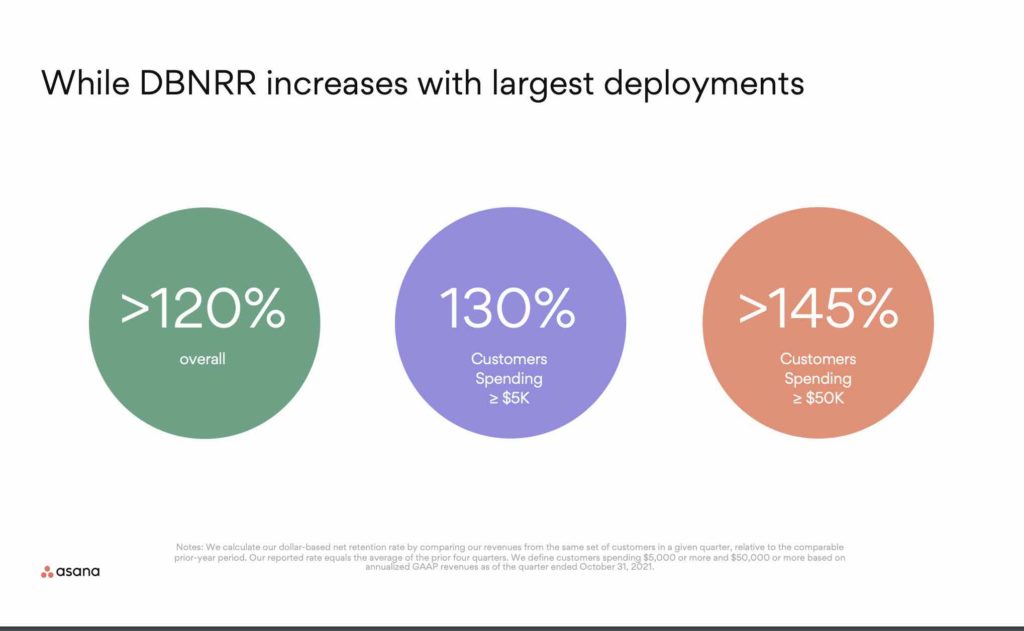

1. NRR up, from 115% to 120%. And 145% for $50k+ ACV deals. A good reminder that NRR doesn’t need to come down as you scale. Somehow, we find a way not to saturate our markets, our customers, and our total potential deal sizes. Asana’s ARR has gone up in all categories, from 140% to 145% for its $50k+ customers, 130% for $5k+ customers, and from 115% to 120% overall.

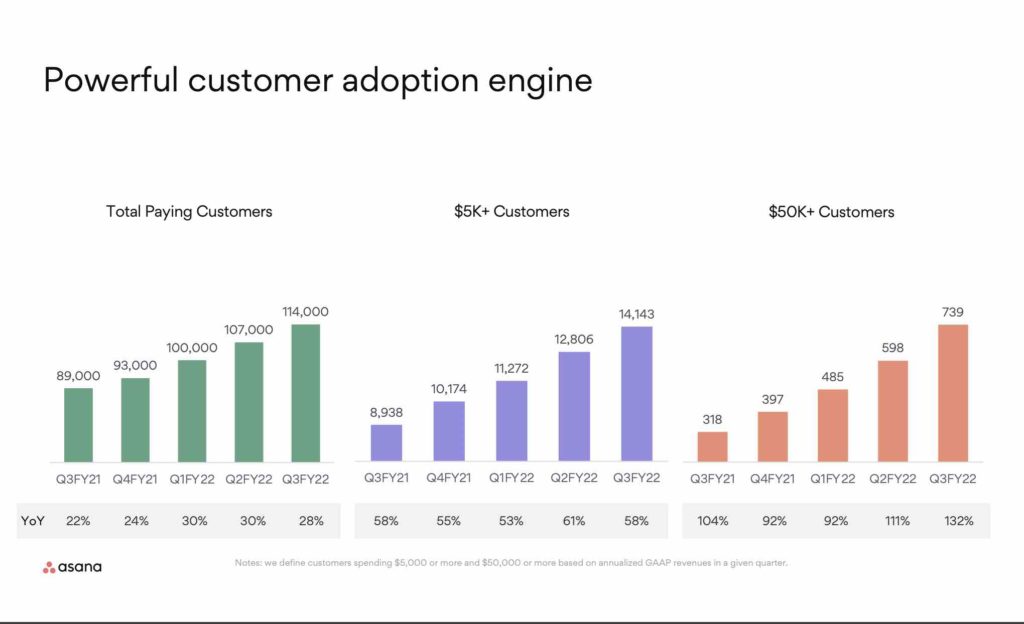

2. 114,000 total customers or about $3,500 per customer on average. The average deal size is up about 25% since $240m ARR, when the average deal was $2,800 a year, meaning a decent piece of Asana’s growth has been from growing the ACVs. We’ll see below a lot of this is due to the growth in more enterprise deals. but in any event, mathematically speaking, driving up the ACV by 25% was a material contributor to Asana’s acceleration at scale.

3. 96% Growth from $5k+ ACV customers. And 132% growth in $50k+ customers. That’s the pull at Asana, the bigger customers. Not necessarily huge. But bigger. And it’s the $50k+ segment that’s growing by far the fastest.

4. 42% of customers from outside the U.S. What we see with best-of-breed apps that can be used anywhere. Aim for 35%-40% at your SaaS company, if users anywhere can get full value from your product. And localize early!

5. Asana has accelerated each quarter since $200m ARR. Each and every quarter it has grown faster than the quarter before. Wow.

Asana — a great story on how going upmarket in a slow and steady fashion, and not leaving the small guys behind. One for many of us to emulate.

And a bit more on how Asana does it from its CCO Anne Raimondi here: