We were recently asked:

Q: Are there any examples of a unicorn startup that was bootstrapped?

Of course the answer is yes. But I didn’t have a sense of how many, and how the data might look.

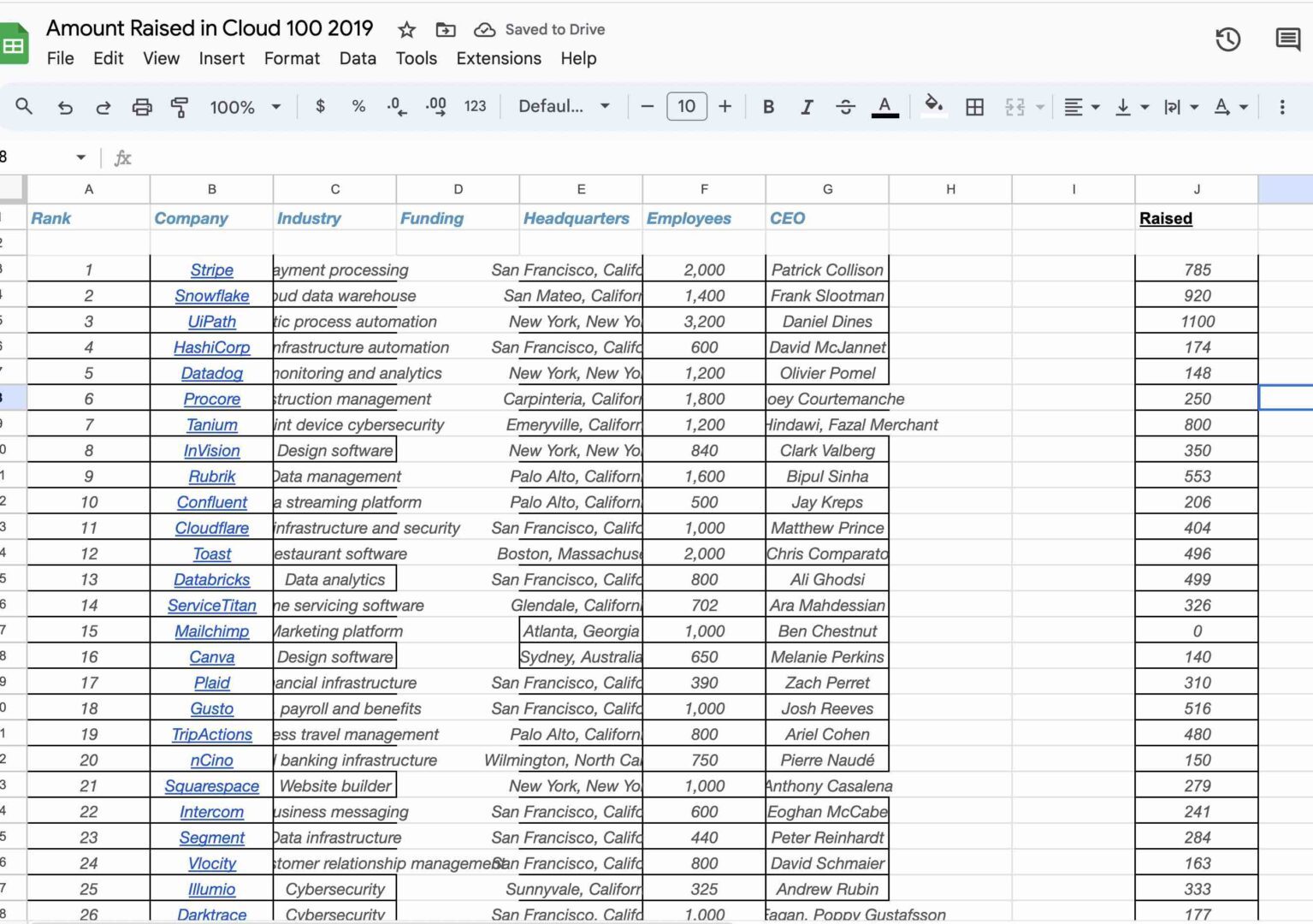

So I fired up the 2019 Forbes Cloud 100, which isn’t all private unicorns by any stretch. But it’s at least a good cross-section.

And in the Forbes Cloud 100 list of the “top” private SaaS/Cloud companies, just 7 were bootstrapped ($0 in listed primary capital) or almost bootstrapped:

- Mailchimp. Closing in on $1,000,000,000 in ARR and 1,000+ employees with no outside capital raised. That’s impressively efficient. Maybe GOAT in the end.

- Yardi. A software oldie in property management. With 6,650 employees, that’s some impressive bootstrapping.

- Sitecore. 1,300 employees and bootstrapped, apparently.

- Cloudinary. An incredible team (many worked on parts of EchoSign back in the day — thanks guys!!), more than halfway to $100m in ARR.

- BambooHR. A long-time bootstrapped HR success story out of Utah, with 477 employees.

- Zoho. Another long-time Cloud leader, based out of the U.S. and India, with $300m+ in ARR and 7,000 employees.

- Zapier. Zapier raised $10m to get to about $50m in ARR so far. Close to bootstrapped with 250 employees. A Unicorn after raising at $4B in a secondary. This one may not count as truly bootstrapped, but it’s close.

The other 93/100 in the Cloud 100 all raised capital … generally a lot of it. The average Cloud company in the top 50 of the Cloud 100 has raised ~$370,000,000:

You can check out the data here:

And the average raised by all 100 in the Forbes Cloud 100, including the bootstrappers, is $280,000,000.

This list isn’t everything. And we can easily find a lot of unicorns not on it, and many other amazing boostrapped companies that were missed. But it is one third party list that at least partially presents the current state of 100 leading private unicorns and pre-nicorns. So it probably gives you a rough sense at least in 2019 of how many of the fastest growing SaaS/Cloud companies are bootstrapped, and how many aren’t.

In addition, there are others I’d call “Semi-Bootstrapped”. For example, on the public side, both Atlassian and Qualtrics waited a loooong time before raising, and didn’t need to.

Lastly, note that some bootstrapped companies have raised secondary liquidity that hasn’t been extensively disclosed, i.e. the founders sold shares directly, without the company issuing shares to raise investment capital.

Now, $370,000,000 sure sounds like a lot of venture capital. But to understand it, we have to ask, How Much Is the Average SaaS/Cloud IPO Worth? As public market valuations have gone up, and it makes sense CEOs would raise more.

So next, I fired up the BVP Cloud Index and simply averaged the market caps of the SaaS/Cloud IPOs of the last 5 years. I grabbed the data here.

Here’s what I learned:

- The average Cloud/SaaS public company is worth $9.43 billion, if we exclude Adobe, Microsoft and Salesforce (the oldies) on the BVP Cloud Index.

- The median Cloud/SaaS public company is worth $5.5 billion. Maybe the more relevant metric.

So if the median SaaS/Cloud IPO is worth $5.5 billion, then raising almost $400,000,000 on the way to an IPO is, including dilution, roughly 10% of that pre-IPO valuationb. That sort of makes sense.

So in 2020+, you can clearly raise a ton if you are a SaaS leader. In fact, 93/100 of you will raise a ton.

And in return, you are committing to a $5.5 billion IPO down the road.

That’s the contract back.