Deciding to create an LLC is the right step for many small business owners. You enjoy the same personal liability protection as corporations, without all the formalities involved in running a corporation. Starting an LLC is a lot easier than most people think. This is especially true if you use a formation service. I’ll take you through everything you need to know about forming an LLC in Georgia.

Why Starting an LLC in Georgia Is Worth It

Georgia is one of the best states to start a business. The state offers several financing options, tax credits, tax relief, and other benefits for startups. Why should you specifically choose to start an LLC there?

One of the best things about LLCs is their liability protection. Just like a corporation, LLCs enjoy limited liability protection. This means that the business owners aren’t liable for the business’s debts, losses, or lawsuits. As a result, your personal assets are legally separated from your business liabilities.

Secondly, LLCs enjoy what is known as “pass-through” taxation. Unlike corporations that are taxed at the federal level, LLC members file taxes on their personal returns. This situation helps to avoid double taxation, which is common with corporations.

Similarly, LLCs enjoy a lot of flexibility come tax season. An LLC can elect to be taxed as a sole proprietorship, a C corporation, or an S corporation. A tax attorney can help you decide the best filing status for your business. Sole proprietorship and partnership don’t offer this kind of tax flexibility.

Finally, LLCs are less complicated to structure and manage. For example, corporations must have a board of directors, shareholders, and officers. But, members of LLCs can choose to run the day-to-day operations of the company. LLC members can also assign each other roles and responsibilities in the operating agreement. In short, LLC owners have more freedom to structure and manage their company as they wish.

The Investment Needed To Start an LLC in Georgia

The actual cost of starting an LLC in Georgia can vary. Some of the costs are mandatory, while others are optional. But even the optional costs for starting your LLC go a long way in making the process smoother and faster.

The first obvious cost is the filing fee. You’ll need to file an Articles of Organization with the Georgia secretary of state. You’ll need to pay $100 if you’ll be filing online or $110 if you’ll be mailing your forms.

Filing your Articles of Organization takes anywhere from five to seven business days if you file online. The process could take up to two weeks by mail. But, you can expedite the process by paying an additional $100. In this case, you can file your Articles of Organization in two days. You can make the process even faster by paying an extra $250 for same-day filing.

You may also opt to use an LLC formation service to help you register your business. I highly recommend this route. You’ll be able to avoid errors that can complicate the process unnecessarily. This cost can vary. But ZenBusiness, our top pick for an LLC filing service, starts as low as $0 plus state fees.

You’ll also need to appoint a registered agent to form an LLC in Georgia. Again, you can choose yourself or another member of the LLC. You can avoid the cost of a commercial registered agent this way. Commercial registered agent costs vary.

You can also choose to reserve your LLC name with the Georgia secretary of state. Again, this cost is optional. It’ll cost you $25 to book your business name online or $35 if you choose the paper filings option.

The final cost will be an annual $50 registration fee. In addition, it is mandatory to file an annual report to update your LLC records with the secretary of state.

6 Steps To Start an LLC in Georgia

Here’s how you go about setting up an LLC in Georgia, step-by-step.

Step 1 – Choose an LLC Formation Service

Although optional, I highly recommend using an LLC formation service to help you register your business. If nothing else, these companies have experts to look over your documents. The experts ensure that all the information is correct and detect errors or omissions that may delay the process.

Additionally, LLC formation services have contacts in the secretary of state office. These contacts can help to speed up the formation process, even if you haven’t paid for expedited filing.

I recommend using ZenBusiness for this step. The service is very affordable, starting at only $0 plus state filing fees. ZenBusiness also offers premium packages. Just in case you need additional services like an operating agreement or help obtain an Employer Identification Number (EIN).

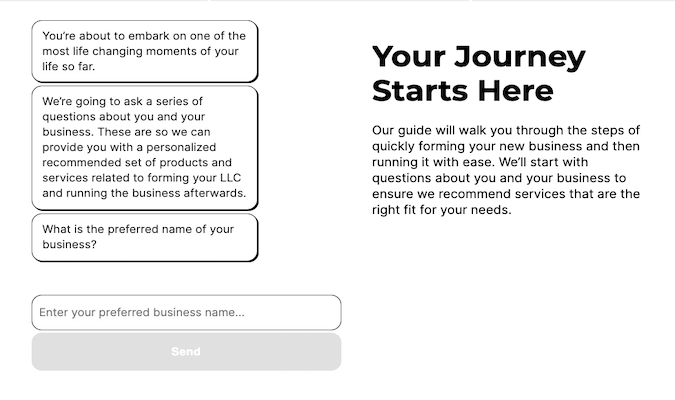

Simply go to this link to sign up for the formation service and get your ZenBusiness account.

Next, you’ll be presented with three packages to choose from, including:

- Starter – Starts at $0 per year

- Pro – $199 per year

- Premium – $299 per year

The Starter plan is good enough if you already have an EIN or don’t mind obtaining one yourself. Otherwise, the Pro plan has some great add-ons, including helping you get your EIN and expedited filing.

Please note that these prices do not include the state filing fee.

Then, enter the requested information to complete the signup process.

Step 2 – Choose a Name for Your LLC

You’ll need a unique business name before you can register your LLC in Georgia. In addition, you’ll need to make sure that the name is distinguishable from any other name in the secretary of state records. This rule applies to all entity types. For example, your LLC name cannot be the same as a sole proprietorship, partnership, or corporation currently registered with the Georgia Secretary of State.

Additionally, some names are restricted or require consent from the secretary of state. For example, you’ll need to file a letter of approval to use words like “insurance,” “reassurance,” “fidelity,” or “indemnity.” Similarly, you’ll need written authorization to use the word “bank,” including variations like “banker,” “Banque,” “trust,” and “savings & loan.”

Finally, the name must contain LLC, L.L.C, LC, limited liability company, or limited company. You can find the complete list of Georgia LLC naming guidelines here.

You can find out whether the name is available by searching it on the Georgia Corporations Division database.

Be sure to do a domain name search to find out if the domain name is taken. If not, now’s a good time to claim it.

Step 3 – Reserve Your LLC Name

Although not mandatory, it is a good idea to reserve your LLC name. Things change quickly, and someone might register your name while you’re still going through the filing process. The filing process can take up to two weeks in some instances, so it is better to be safe.

You can reserve your business name by mailing in a completed name reservation request form. You can also fill out and submit the form online. Finally, you’ll need to pay a $25 fee to reserve your name.

Step 4 – Choose A Georgia Registered Agent

You must have a registered agent to register your LLC in Georgia. A registered agent is a go-between for your business and the secretary of state. Primarily, the agent is responsible for receiving important legal documents on behalf of the company.

You can elect to be your own registered agent. But, there are several conditions. First, you must be a resident of Georgia. Additionally, you should be available at your place of business during regular business hours, i.e., 9 am to 5 pm.

Indeed, there are benefits to hiring a commercial registered agent. The agent will receive legal documents, including service of process documents. This means you do not risk being served in front of your family, employees, or customers.

Additionally, the registered agent’s address is public information. This situation can be problematic if you operate your business out of your home.

Step 5 – Draft an Operating Agreement

It is worth noting that you don’t need an operating agreement to register an LLC. You won’t include the operating agreement in your documentation. But, this is an excellent time to make sure that all LLC members are on the same page before creating a legal business entity. An operating agreement will help clear up the LLC’s ownership and management structure. This precaution can help avoid complications once the company has been registered with the secretary of state.

Some of the details to highlight in your operating agreement include:

- Each member’s responsibilities

- The procedure for admitting new members

- How members may terminate or transfer their membership

- How the LLC profits will be distributed

Remember, your LLC will be subjected to your state’s default rules if you don’t have an operating agreement. For example, most states determine that an LLC must be dissolved if one of its members leaves or dies. So, it is prudent to include a clause on how members may terminate or transfer membership.

Additionally, most states don’t legally require LLCs to have an operating agreement. But, it is still a crucial document worth considering seriously. ZenBusiness premium plans come with an operating agreement template to simplify drafting your document.

Step 6 – File The Articles of Organization

You don’t need to worry about this process if you use the ZenBusness formation service. The company will take care of all the paperwork, including preparing and filing your Articles of Organization with the Georgia Secretary of State. You’ll get a call in case of any missing information, just to ensure that the paperwork is correct.

But, if you’re going to file the document manually, you can do so online or via mail. You can visit this link to file your documents online. Georgia has one of the most straightforward Articles of Organizations forms of any state. You’ll only need to provide your LLC name, the effective filing date, your role in forming the LLC, and your signature.

Alternatively, you can download Georgia Form CD 030 to mail in a hard copy of the Articles of Organization. You’ll need to include a transmittal form as well if you’re filing via mail. You can send your paperwork to:

Corporations Division 2

Martin Luther King Jr. Dr.

SE, Suite 313 West Tower

Atlanta, GA 30334

Also, you’ll be notified if there’s an error or missing information on the paperwork. If you hope to keep the initial business formation date, you’ll need to correct the issue and file the document again within 30 days.

Finally, you’ll receive physical paperwork confirming that your LLC has been approved. You can also find the paperwork in your ZenBusiness dashboard if you use the formation service. Be sure to file the paperwork with other crucial business documents like the operating agreement, contracts, and member certificates.

Next Steps

There are a few things still left to do after registering your company. Firstly, you’ll need an Employer Identification Number (EIN). You will need an EIN if your LLC plans to hire employees or if you’re required to file excise taxes. Also, all multi-member LLCs are required to have an EIN.

Next, find out the business licenses and permits you need to operate in Georgia. For example, you’ll need to apply for an alcohol license if you plan to sell alcoholic drinks in your bar, restaurant, or grocery store. Similarly, you’ll need a seller’s permit if you sell goods subject to a sales tax. You can find more information about permits and licenses at the Georgia Professional Licensing Boards Division website.

Finally, be sure to open a business bank account, even if you are a single-member LLC. You can lose personal liability protection by mixing your personal and business financial accounts. For example, accepting business payments or purchasing business supplies with your personal credit card or checking account can leave you vulnerable to piercing the corporate veil. So, don’t forget a company credit card along with your business bank account.

Below are two more related posts to help you along in your journey: