Table of Contents

If you’re running a subscription or SaaS business, you know that at the end of the day your chief metric is monthly recurring revenue (MRR). And you’d be right to spend your time and resources tracking it.

MRR gives your company that forward looking measurement and predictive revenue to actually grow your business. Arguably the biggest factor standing in the way of consistent monthly revenue is your customer churn rate.

Churn occurs when an existing subscription is canceled, downgraded, paused, or becomes delinquent. When talking about churn, most people would think to focus on voluntary churn (a customer cancelling a subscription).

However, there’s another often forgotten form. That’s involuntary churn and if your company doesn’t zero in on it, it can cause a lot of problems.

You may be thinking, “How bad can it be?”

According to our data, SaaS and subscriptions businesses lose around 9% of their MRR due to failed payments on average.

Think about that. Nine percent of your revenue is potentially just being left on the table month after month. Thankfully, there’s a way to not only drastically reduce involuntary churn, but grow your business while you’re at it.

Introducing: a successful dunning process.

In this guide, I’ll be taking you through what a dunning process looks like, the importance of dunning, why credit cards actually fail, and the keys to successful dunning campaigns.

What is a dunning process?

A dunning process is the manner you go about recovering your customers’ failed payments.

What makes the SaaS business model one of the fastest growing markets out there is the convenience of recurring payments and subscription based billing. Yet you and I both know that credit cards are bound to fail eventually.

The very thing that makes SaaS great can also be it’s kryptonite. Which is why having a dunning process in place is necessary to not miss out on revenue or lose a customer.

Let’s be real. When a payment fails, only two things typically happen:

- The payment fails and nobody from your team follows up to the point the customer churns.

- Your team follows up and payment is recovered.

In my experience, most companies are going the option #1 route. How’s that old adage go? “If it ain’t broke, don’t fix it?” Well, I think something is broke and it’s time your company does something about it.

Before you go and spam 50 customers with emails demanding payments, let’s first talk about why dunning is important.

The importance of dunning

If you know anything about the rep that dunning has, you know that typically it isn’t something that most business owners or customers like. This isn’t because the process itself is useless.

In the past, it’s been associated with companies’ approach to dunning overall and not their process. Dunning can easily bring the ‘cold-hearted debt collector’ approach out of anyone who doesn’t watch out.

Despite how companies have carried out dunning in the past, it can be a huge boost to your business if done right. It’s essential to understand just what your company gains from having a successful dunning process.

Avoid a loss in MRR

As stated before, growing your monthly recurring revenue is the name of the game. In this case, it’s avoiding a loss in revenue to begin with.

Not only is losing revenue every month disheartening in and of itself, but when it comes to SaaS, growing your MRR isn’t an easy task to begin with.

That ever glamorized “hockey stick growth” you see all over Twitter and elsewhere tends to be a long shot for you and the majority of businesses (no offense).

With that being the case, retaining the revenue you do have by avoiding losses isn’t necessarily sexy, but it does keep you afloat.

More customer touch points

Before coming to the SaaS world, I spent years in non-profits spending a good majority of that time raising funds for organizations. Funny enough, what’s important to any SaaS business is important to all nonprofits as well: happy donors.

Happy donors equals consistent donations. Same for you, happy customers equals loyalty to your product. In any business, consistent revenue can be tied to one very important factor: customer satisfaction.

The reality is that once someone buys your product or service, it shouldn’t take a failed payment to be the thing that sparks the first touchpoint…ever. Yet a lot of times that might be the case (no shame).

Investing time into a dunning process means more customer touch points for you, and the beginning of a relationship as well.

Don’t leave money on the table

The final key benefit of dunning is the fact that you’re actively leaving no money on the table. What do I mean?

When a customer’s payment fails and you don’t do something to recover it, you’re essentially letting a sale that you’ve already closed go by the wayside. Why?

It’s time to think differently about dunning all together. Rather, start looking at it as you would selling something — it’s a chance to create (well actually recover) revenue for your company.

Want to Reduce Your Churn?

Try our dunning tool to recover your failed payments and boost your MRR!

3 common reasons why credit cards fail

Now that you understand the what and the why of having a dunning process, it’s important to understand one critical element first before getting to the how: why credit cards fail in the first place.

Here are the three most common reasons:

Incorrect card details

Card issuer declines happen very frequently. The first reason is the card information is incorrect. That can be anything from the address associated with the card, card number, or expiration date aren’t accurate or filled out in the first place.

Due to fraud being common, a card issuer will manage this activity by having customers provide details like CVC and postal codes. These details do drastically decrease the declines your company may be experiencing.

The best means to handle these kinds of card failures is to guide your customer to the error or simply use a different card or payment method.

Status of the card

A second reason (frankly the most common) for cards failing is the status of the card. Simply put, it’s either expired or cancelled all together.

Additionally, some cards may also have restrictions on the type of purchases that can be made. For example, FSA/HSA cards are often limited to certain types of businesses (e.g., healthcare providers), so any other type of purchase would be declined.

In these instances, your customer must contact their card issuer to check for any restrictions that may be in place or have a new card issued.

Geographic location

The third and final reason a credit card may fail is due to the geographic location of a cardholder in contrast to your company.

If your customers are using a card issued in a different country, your company may experience an increased rate of declines. The quickest way to resolve this is for your customers to contact their issuing bank to authorize the charge.

Having an understanding as to why a customer’s credit card is failing to begin with will only inform you on the best course of action. Now the only missing piece to the puzzle is putting a successful dunning process in place to recover delinquent payments.

The keys to a successful dunning process

Hopefully you’ve come to the conclusion that your company needs a dunning process, like yesterday. If that’s you, let’s get to it!

Although being successful at dunning may seem pretty straight forward, there are definitely best practices to put into place. In order to maximize MRR recovered from your campaigns, here are a few things that will ensure success:

Utilize a dunning management tool

Most of us have enough individual emails to send every day to begin with. So if you’re not looking for dozens more, I’d consider investing in a dunning management software to handle all your dunning needs.

Let’s be real, I couldn’t sit here and mention dunning tools without mentioning our very own here at Baremetrics, Recover.

Recover is a one-stop-shop dunning software developed by us. From customized email campaigns, to in-depth analytics on recovery rates, to in-app customer reminders, Recover provides you with the most in-depth dunning tool experience.

Don’t just take our word for it. See what others have to say about Recover:

And here’s one more for good measure:

Just in case you’re interested, here are some other dunning software options:

- Recurly dunning

- Chargebee dunning

- Stripe dunning

Seriously though, coming from someone who has run dunning campaigns without a dunning tool: save yourself the time and stress. In the end you’ll recover more with a fraction of the time spent.

Get your email templates right

The goal of any email should be to get the recipient to at the very least read it.

Considering Mailchimp has found that the average email coming from a software company gets a 2.45% click-rate, you’ll need to be very particular about the content of your dunning emails.

The goal of a great dunning email isn’t just to get read, it’s to get billing information updated. To do so, there are key principles to follow:

- Subject line: get your customer to open your email

- Email body: be concise and to the point. Tell them what they did & how to fix it.

- Closing the email: sometimes this doesn’t always work. Plan for the worse by providing another option like calling a support team member to talk about their subscription.

If you want a more in depth look & examples, check out our blog on writing effective dunning emails.

Be sure to follow up

Up to this point, you’ve set up a dunning software and nailed a great dunning email, what now? Arguably the most important step is simply being consistent. Emails are easily missed, it happens.

Companies begin to lose out on recovering payments when they simply don’t follow up with customers. At the outset, I’d commit to a certain number of emails you’ll send throughout with a certain amount of time between each.

My recommendation would be to send at most 6 emails with a 4-6 day window between each (if no reply). Be empathetic and understanding throughout, but don’t be afraid to be forward either as you get later in the campaign.

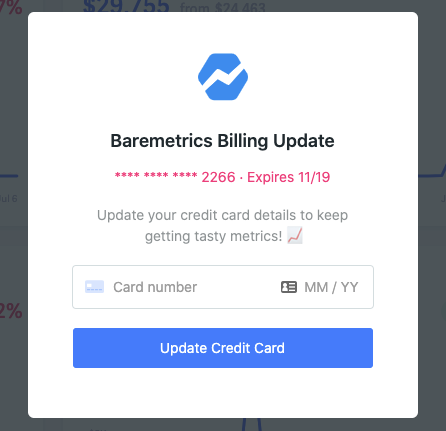

Simplify updating billing information

How horrible is it when you receive an update that a payment of yours failed, you go to fix it, and the process to do so is more complicated than the original sign up?

When it comes to updating billing information, you want to make it as simple of a process as possible. If it takes more than two clicks for your customers to update their billing information, that’s too many.

There are two ways to make this happen:

- Create a link to be sent via email that takes someone directly to a credit card form

- Create an in-app reminder that allows the customer to update their information directly in the form that pops up

Moral of the story? Sign up for Recover & kill two birds with one stone.

Your dunning process is about the customer

I can sit here and talk until I’m blue in the face (which I will) but the fact still remains: not having a dunning process in your business is a recipe for disaster.

This doesn’t have to be a mind-numbing experience either. Going with a tool like Recover or the others mentioned gives you a competitive advantage that most businesses choose to ignore.

At the end of the day, the goal of your dunning process should be to help your customer. By avoiding any disturbance in service or creating a great customer experience, your business wins.

Not to mention, you get to keep more of that hard earned cash in your company’s pocket with a successful dunning process.