By PandaDoc Marketing Specialist Travis Tyler

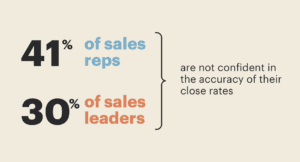

Even before a global health crisis slammed into the world economy this year, global sales leaders were already pretty shakey about the current state of deals.

We know this because hundreds of them told us so in a joint study PandaDoc did with G2 in January of 2020. The results culminated in a comprehensive research report titled: 2020 The State of Deals Report.

Here’s a quick summary of what those findings were:

Now for the good news.

Despite the lack of confidence among sales leaders, our research also uncovered something that really surprised us. When we looked closely at our top-performing customers, they shared striking similarities that led them to be both more confident and better prepared to meet or even exceed their quota compared to other sales teams.

It turns out, that what separates these elite revenue organizations from everybody else is an entirely new framework for uniting seller efforts with buyer needs.

Treat deals as dynamic

In today’s fast-paced B2B marketplace of instant communication and process automation, businesses cannot afford to rely on the classic definition of a deal.

If you’re following along, then you can probably guess what elite sales teams have done.

They tossed that old definition in the trash.

That’s because the traditional understanding of a deal fails to represent the intricacies and continuous actions executed by the entire revenue team within an organization to “hit the number.” So, we decided to redefine it based on how elite sales teams operate.

|

Merriam-webster defines a deal as: |

|

|

Modern elite sales teams define a deal as: |

| “To sell or distribute something as a business.” | “A continual exchange of value between you and your customer before, during, and after the agreement and throughout the entire customer lifecycle.” |

On average, 7.59 people at a seller’s company touch a deal, which is almost 2 people more than the buyer’s side. Additionally, 97% of sellers have experienced a stakeholder being added post-proposal, with an average of 3+ revisions being made before signing.

Even though buyers and sellers are aware of all these changes and additions, many sales teams are not using tools to improve efficiency in their process. Only 27% of vendors report using a software tool to aid in creating, editing, sending, or tracking their sales docs.

Combine the high rate of deal changes with a glaring lack of implemented solutions, and we can finally understand why there’s such a pervasive gap between buyers and sellers.

Said another way, when revenue organizations define deals as dynamic, it’s like they dropped a giant suspension bridge over troubled sales waters.

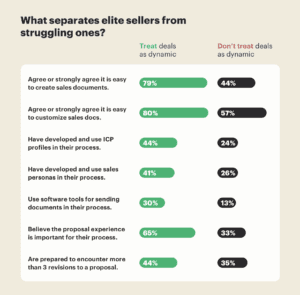

Let us also direct your attention to this next chart.

See how the teams that treat deals as dynamic fare against those that don’t?

We harp on dynamic deals so much because elite sellers are using this new definition to build well-oiled revenue engines. These teams turn out to be more prepared and better performing than (you guessed it) those that don’t treat deals as dynamic.

Our recommendation: rethink how you’re defining deals within your organization before you do anything else. Only then can you start to put in place the right tools and processes to become more efficient.

Personalize Customer Journeys

If treating deals as dynamic was the scaffolding of bridging buyer-seller gaps like it’s 2020, then consider personalization to be where we lay the fresh pavement. Yes, we are going all-in on these bridge metaphors.

We know that personalization has been a “hot-topic” for over a decade. Yet surprisingly, sellers are still not delivering a tailored and exclusive buying experience.

Our research found one of the notable gaps was that sellers are still significantly underestimating the wants of their buyers. They are not putting enough emphasis on personalizing their sales process even though buyers indicate that this part is crucial.

We aren’t the first to say this, but you can’t talk about buyer-seller gaps without touching on the fact that buyers expect more personalization.

We’ll say it again for the people in the back.

Buyers expect more personalization.

To be crystal clear, personalization goes beyond segmentation and customer personas (although that’s a great start).

Sellers must craft a deeply unique sales experience that leaves customers feeling valued and appreciated during every interaction.

But won’t this will take a lot of time and resources to do?

Nope!

Here are a few steps revenue organizations can take to personalize an experience right now.

- Invest in the top tools for your sales team.

- Implement these tools with thoughtful training.

- Establish clear, smart processes (CRM integrations) with these tools for easy adoption.

- Leverage document templates to speed-up creation and increase brand compliance.

- Build, send, track, and collaborate on these documents with your prospects.

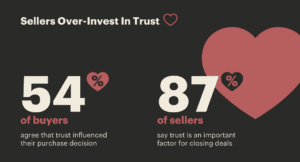

Another important part of bridging buyer-seller gaps also has to do with how much time and effort goes into relationship building.

Surprisingly, our research suggests that sellers over-invest in building “trust” with buyers.

Rather than work on rapport-building, it is up to the seller to adapt the sales process to put more value on personalization over trust-building with buyers.

We hypothesize that because buyers have more power than ever with search engines, review sites, influencers, and video content -they are building trust in their own time and in new ways.

Or perhaps personalization has become its own form of trust-building for the buyer. Either way, we recommend pulling back on trust and doubling-down on personalization.

Multi-threading deals

Admittedly, one of the biggest buyer-seller gaps our research uncovered is actually a result of having too many cooks in the kitchen (or too many cranes on the construction site).

That’s our last bridge reference. We promise.

Seriously though, one of the biggest changes a deal will go through in its lifespan is the number of people and the type of people involved.

On average, a buying process includes about 5.6 people (regardless of company size).

That’s 5.6 people a seller needs to get consensus from.

In case you were curious, here are the teams most involved when making a purchase decision for technology or software:

- Technical Specialists – 47%

- Executive Leadership – 43%

- Finance – 38%

- Operations – 36%

- Legal – 23%

- Client services – 22%

- Marketing – 21%

- Procurement – 18%

We call this phenomenon: purchasing through committee consensus.

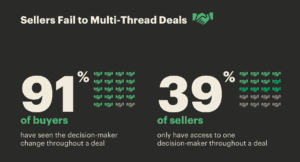

Here’s the tough part about committee consensus: 91% of buyers and 98% of sellers say they have seen the decision-maker change throughout their sales process.

Sales leaders preach that reps must find the decision-maker(s). Yet, many reps fail to multi-thread their prospective accounts. Just an FYI - Multi-threading is when you (as a seller) establish multiple relationships with multiple people for a single deal.

So, who is to blame for the lack of multi-threading? In short: everyone on the seller’s side.

To bridge the buyer-seller gap, teams need to have access to tools that enable them to identify the right buying committees, or else they’re completely in the dark when the decision-maker changes.

Sales reps need insights in order to multi-thread!

Sales managers, we want you to take a second look at this graphic. Really let it soak in.

When a champion exits the deal (from promotion or layoff or whatever) you must give your reps the best chance to close.

It’s your responsibility to adopt the right technology into your process in order to ensure your team has access to all those interchanging decision-makers. You have the power to help your reps multi-thread the sale by having

Money under the bridge

According to our study, 45% of sellers consider deals at their company to be cumbersome and 47% believe their deals are complicated. So, what’s making deals so difficult to close?

Maybe it’s because they aren’t treating deals as dynamic? Or perhaps, a lack of personalization on customer journeys? Then again, it could be the inability to multi-thread a deal.

Regardless, we hope the answers are clear on how to bridge buyer-seller gaps like it’s 2020. If you can build this buyer-seller bridge, we know you’ll find a whole bunch of money flowing. Our advice is, of course, only if you want to be considered an elite sales team.

For more insights, get your copy of the State of Deals 2020 Report