SaaS Sales tax in the U.S. can be complicated, to say the least. It’s no coincidence that the word ‘taxing’ means burdensome and exhausting.

While the inherent SaaS business model allows for easy selling across the globe, it also adds complexity to understanding the nuances of global/local tax laws.

When a SaaS company sells its product, it must follow the tax laws in the region where the product was purchased. That’s sales tax laws in every state, province, county, or region where they sell products.

Sounds daunting, right?

Let’s break down the SaaS sales tax rules in the U.S. and what you can do to ensure compliance with U.S. laws. This post will cover:

- How does the U.S. sales tax work?

- Is your SaaS taxable?

- What are the tax thresholds?

- What is an economic nexus?

- How to register for sales tax?

- How to calculate sales tax?

- Sales tax and SaaS accounting

- Sales tax checklist

How does the U.S. Sales Tax Work?

There is no federal sales tax in the USA, meaning individual states have rules and processes for sales tax eligibility and filing.

When it comes to software, the United States breaks them into three categories:

- Tangible software

- Downloadable software

- Software accessed via the cloud

If you have software hosted on a server and customers use it via the cloud, you have a SaaS product.

However, the taxability of your SaaS depends on the state you’re selling it in. That brings us to the following question:

Is your SaaS Taxable?

States where SaaS is taxable classify SaaS into two primary categories:

- Tangible personal property: For example, the state of New York includes canned or prewritten computer software in its definition of ‘tangible personal property’. In New York, SaaS constitutes the sale of canned or prewritten computer software and thus is taxable as a sale of ‘tangible personal property’.

- A computer or data processing service: This is taxable in various states. For example, SaaS transactions are treated as a taxable data processing service in Texas.

Due to such varying definitions and categorizations, it’s tedious to understand the state SaaS Sales Tax laws for your business.

Here’s a summary of the state SaaS Sales Tax rules:

| SaaS is taxable | Alabama, Arizona, Hawaii, Iowa, Maine, Mississippi, New Mexico, New York, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, Washington D.C., West Virginia |

| SaaS is not taxable | Arkansas, California, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, New Jersey, North Carolina, Oklahoma, Vermont, Virginia, Wisconsin, Wyoming |

| Personal/ business use | SaaS for personal use is taxable in Louisiana, Maryland, Massachusetts SaaS for business use is taxable in Nevada, North Dakota, Ohio Both: Connecticut (SaaS for personal use is taxed at full state rate, and for business use is taxed at 1% only) |

Click on each state above to explore the specific sales tax guidelines in detail.

What are the Tax Thresholds?

Now that you know whether your SaaS business is taxable or not, the next step is to calculate the tax liability. This depends on the sale amount, method of selling, and where your business is based.

In the U.S., the ‘South Dakota vs. Wayfair’ decision paved the way for a new sales tax era. The state governments can now rule that remote/online sellers are liable for it. This applies only to sellers who have a substantial amount of their total sales or transactions coming from that particular state.

The states now have to define a “nexus”. This nexus defines your tax liability, known in some countries as a ‘tax registration threshold’.

So, SaaS companies may be taxable in some new jurisdictions where they do not have a physical presence but meet the threshold for sales or transactions.

What is Economic Nexus?

An economic nexus determines your tax liability depending on the sales revenue coming from a particular state.

Essentially, a nexus signifies a commercial connection to the state. Each state defines a nexus as having a physical presence or an economic connection.

An annual sales of $100,000 is the standard threshold. Based on the sales revenue, some states have additional thresholds. Here’s a complete breakdown of the state-wise economic nexus thresholds.

How to Register for Sales Tax?

Now that you know how much your tax liability is, just one more step (Sigh!) before you start collecting the sales tax. In each state where you have a nexus, you must get a valid U.S. sales tax permit. Failure to do so is considered tax fraud.

Most states allow online registration for the permit. If you’re old school, you can even do so by snail mail.

Alternatively, you can register under the ‘Streamlined Sales Tax (SST) Registration System’. SST was created to simplify sales tax collection. Currently, 24 states adhere to the Streamlined Sales and Use Tax Agreement.

Once you have registered, you will get the necessary I.D. and permit.

Calculating and Collecting Sales Tax

You are now ready to collect the sales tax from your customers. Follow these steps:

Step 1: Check your buyer’s location.

Step 2: Calculate the tax rate for the location based on the state law.

Step 3: Check for all applicable tax rates. There is a possibility of different tax rates for a county, city, or other local sales.

These steps may be deceptively simple. It’s advisable to always go through the tax authority websites of each state to avoid getting tangled in any of the complexities.

Recording Sales Tax

If you’re going through all that trouble to calculate and collect taxes, it only makes sense to also maintain accurate records and documentation for it. That includes:

– Tax-compliant invoices and receipts

In the event of an audit, these include all the information relevant to the tax authorities, such as details of the buyer, items bought, unique invoice reference number, date, and the tax breakup. Also, if you are filing any tax deductions, tax receipts are required as documentation.

-Refunds and credit notes

In case of full or partial refunds, you must issue a credit note to document the refund. This will help you avoid taxes that you don’t owe anymore.

It is advised to keep secure digital records for several years. This will help you easily produce any records during audits.

Filing Sales Tax Returns

You can file sales tax returns separately for each state on their Department of Revenue website.

Ensure that you note:

-Frequency of returns

-Deadlines for filing the returns

-Breakdown of the tax reporting (county, city, locality-wise)

You still have to file returns, even if you didn’t collect any taxes in a jurisdiction where you have a tax permit. In such cases, you must file a ‘zero taxes’ return.

SaaS Sales Tax and SaaS Accounting

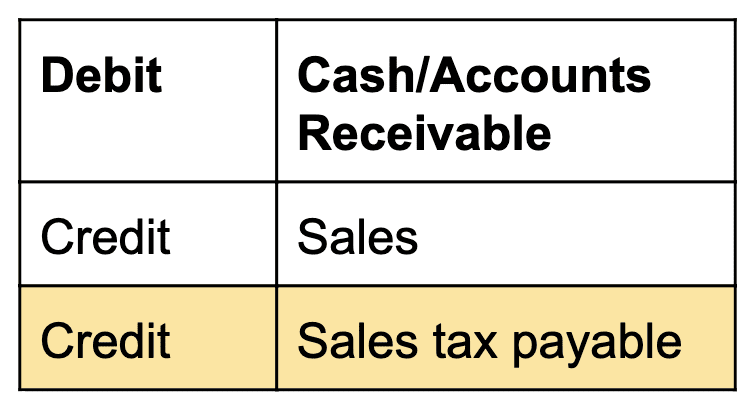

Since businesses collect sales tax on behalf of tax authorities, tax cannot be recorded as revenue. Sales tax is reported in a journal entry. The accounting entry for sales involving sales tax will look like this:

When the sales tax is remitted, you can debit the ‘sales tax payable’ and credit ‘cash’. For a deep dive, head to our comprehensive guide on SaaS Accounting.

SaaS Sales Tax Checklist

With so many steps involved, I don’t really have to make a case for why you need a checklist for SaaS sales tax compliance! So, I’m summarizing the key points in a checklist to make your life a little bit easier:

- Understand how your business is categorized under the sales tax law

- Understand the state-wise sales rules

- Find states where you have an economic nexus

- Register for a sales tax permit

- Calculate and collect the sales tax

- Maintain tax-compliant documents such as invoices and credit notes

- File sales tax returns

- Maintain accurate books accounting for the sales tax

Want to be rid of SaaS Sales Tax headaches?

Chargebee allows you to seamlessly manage your subscriptions on one hand and automates your taxes on the other.

Start a free trial now or schedule a demo to see how we can save your time and manual effort in tax management.