A Lannister always pays his debts. But not everyone is a Lannister.

Managing receivables can be a challenge even when it’s business as usual. Add a global pandemic in the mix and we have a perfect storm for businesses, leaving them grappling with countless challenges about their receivables. This could ultimately put a screeching halt to their growth or in extreme cases, to the viability itself.

My customers are affected by the global slowdown and can’t pay on time. How do I maintain positive cash flow?

How do I ensure the Accounts Receivable (AR) process is ready to survive this pandemic and thrive after it?

These are some of the questions that businesses face. The answer lies both in the “here and now” and in the “future-forward” thinking and actions. What businesses must realize is that a reactive approach can help them survive, and hence react they must. But parallelly, they also need to have a proactive action plan to ensure that they thrive.

Accounts Receivable management is all about ensuring customers pay their invoices on time, with least amount of effort from your end – thereby improving your cash flow while keeping the cost of collections low. And of course without sacrificing your customer’s experience. When these collections start to pile up, they tend to add to the risk of defaults and soon you might end with a liquidity crisis that could eventually impact your growth and profitability.

But how do you measure the effectiveness of your collection methods?

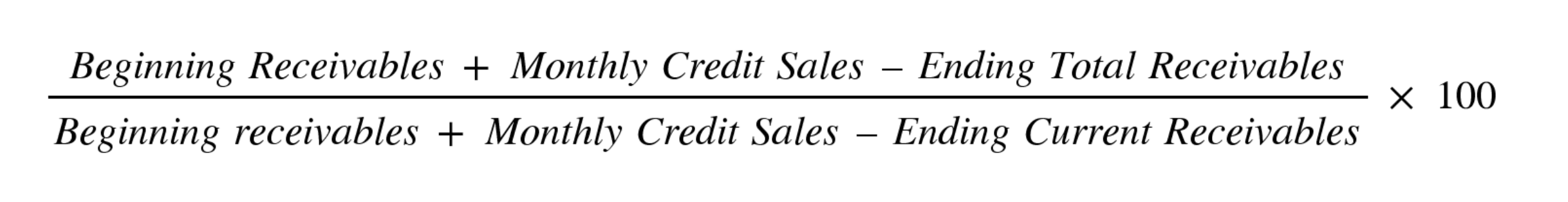

Collections Effectiveness Index (CEI)

Collections Effectiveness Index (CEI) is a measure of a business’s ability to retrieve their receivables. CEI compares the beginning receivable at the start of the month and the amount collected in the given month. Here’s how you can calculate CEI:

‘Ending total receivables’ include current as well as overdue ARs, whereas ‘ending current receivables’ don’t include outstanding ARs.

Collections Effectiveness Index of 80% or above is an indication of a highly effective collection process.

At a more granular level, a measure to see how your AR is doing can be Accounts Receivable Turnover Ratio. Receivables turnover ratio is calculated as:

Accounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable

Net credit sales constitute the revenue generated from sales where cash is to be collected later, minus any sales returns. ‘Net credit sales’ are used instead of net sales because cash sales don’t lead to receivables. Credit sales lead to receivables.

A high Accounts Receivable Turnover Ratio indicates efficiency in the company’s collection of receivables. It may also mean that the business operates more on cash sales than credit sales.

Let’s look at some actionable steps that can help you get a better hold on your receivables in times like these:

- Managing Customers

- Tweaking AR Processes

- Improve Operational Rigour

- Measuring KPIs that Matter

- Leveraging Tools and Technology

Managing Customers

These are times of crisis for your customers too, so being empathetic is important across all your touchpoints and decisions. It is advisable to segregate your customer-base on the basis of likeliness to pay. Transactional (eg invoices, payments) and the client behavioral data (delays, broken payment promises, etc) can come in handy. This will help in prioritizing the collection efforts and designing your communication plan.

If you have a diverse customer base, remember that one-size-fits-all approach for receivables management simply doesn’t work. Revise your collection strategy depending on the size of your customer (large corporates, SMEs, or start-ups). Large corporates are process-intensive and require rigorous follow-up and communication with top management is critical. Small-medium businesses might be more severely impacted by the crisis and require a more data-driven approach. Devising strategies for these businesses can be done on a case-by-case basis.

Incentivize Upfront Payments

In times like these, you want that sweet, sweet cash to hit your accounts as soon as possible. If you can afford it, offer discounts on early or upfront payments. In certain cases, even deep discounts can be a better alternative to receiving no payment at all. This is a win-win situation for both you and your customers. A word of caution though: keep tabs on the impact that the discounts have on your bottom-line.

Create a Payment Plan

Flexible payment terms are great for retaining customers. Net D is a payment term that refers to the period (10, 15, 30, 45 or 60 days) within which a customer has to pay for their outstanding invoice (net amount) for the service/product received. This helps your customers know how long they have to pay for your invoice, among the umpteen other bills they receive every month. And for you, it serves as a gentle reminder and helps you walk the thin line between polite requests and badgering.

If you see that the payments are getting overdue, or are at risk of default, create a payment plan to ease some burden from your customers. But closely monitor the “Promise to Pay” dates – so that the customer is aware of the fact that your flexible plans do have an end date!

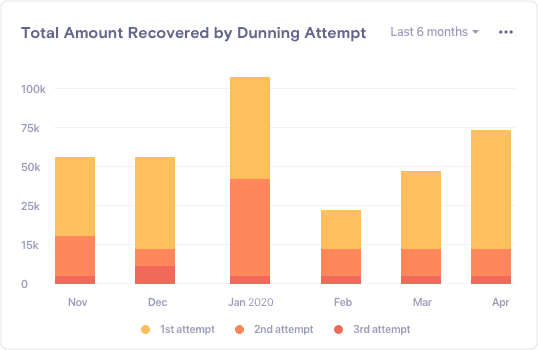

Have a Robust Dunning Plan

Dunning is the process of methodically communicating with the customer to ensure that your AR is collected. Starting from a simple invoice acknowledgment or a gentle reminder it can go up to escalations of overdue payments. In the case of online payments, dunning is useful with failed payments and declined credit cards. Now is a good time to A/B test your dunning emails and recovery schedules. But even in case of offline or payments involving credit days, dunning can be used to ensure that your payments are at the top of the pile.

At the same time, ensure that the dunning emails carry a lot of empathy – since the times might not be great for your customer either. It will not just help you collect better, but will also get you a lot of brownie points!

Further, creating a dashboard of the dunning reports will give you a picture of the effectiveness of your dunning plan and give actionable insights to alter it.

Tweaking AR Processes

Given the current circumstances, it is imperative that you relook your account receivables workflows to anticipate and account for more delays than usual. Receivable exposure management (REM) is critical. Businesses with multiple product lines or subsidiaries need to be treated a little more cautiously – with a little more due diligence. More often than not, they sell to the same customer – increasing their own exposure.

If you don’t already have a risk-based segmentation of exposure in your product lines, now is the right time to do it.

Monitor your Customers

Customer responses are a goldmine of insights. Are your customers responding to your communication? What are the reasons for the delays? Are you asking for the promise-to-pay dates? Ensure that they are getting recorded at a customer level and are getting analyzed regularly. This analysis can be useful for reworking your credit policy.

It was a quarterly or maybe an annual affair to check on the customer credit before. But in these volatile times, you constantly need to be aware of the credit profile of your customers. Any changes in your credit profile should trigger your next step.

Resolve Disputes Rapidly

From the silly to the serious, from timely to the untimely, from genuine to sometimes ingenuine, disputes are one of the top reasons for non-payments and those dreaded Days sales outstanding (DSOs) going up. Monitor disputes, understand the reasons behind them and try to resolve them as soon as possible. Remember, a delayed resolution will only result in further delays!

Improve Operational Rigour

Remote working is only going to add to the challenges for your receivables! Clear communication and expectations setting is crucial for your remote teams to do what they do best – strengthen your relationship with customers.

Here’s how you can help your teams:

- Map out processes across teams in finance, sales, customer success, operations, or any other related department to ensure seamless collaboration.

- Review the progress of operational metrics week on week. What can be measured, can be improved.

- Automate redundant tasks to increase time for customer engagement. Ensure your teams are trained on the tools that they need to use.

- Establish ownership and accountability.

Measuring KPIs that Matter

No one likes analysis paralysis, right? However, when the odds are disproportionately stacked, analysis can go a long way in helping you succeed. Measuring just what matters and when it matters is important. During uncertain times, truths of last week may need recalibration this week. These are some KPIs that you should track week on week, to keep a close watch on your receivables:

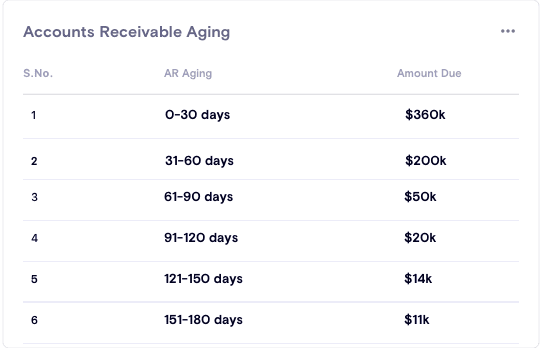

A/R Aging

The A/R aging report specifies the time period for which an invoice is outstanding. This is a data point you should be tracking week on week. Given that most customers might be freezing their budgets, you might want to ensure that you close payments on your receivables sooner than later. In uncertain times, a conservative credit policy can prove beneficial.

At-risk Revenue

You should be proactively looking at at-risk revenue from customers whose cards are about to expire. As mentioned earlier, experiment with your dunning strategy to see what works best for different types of customers.

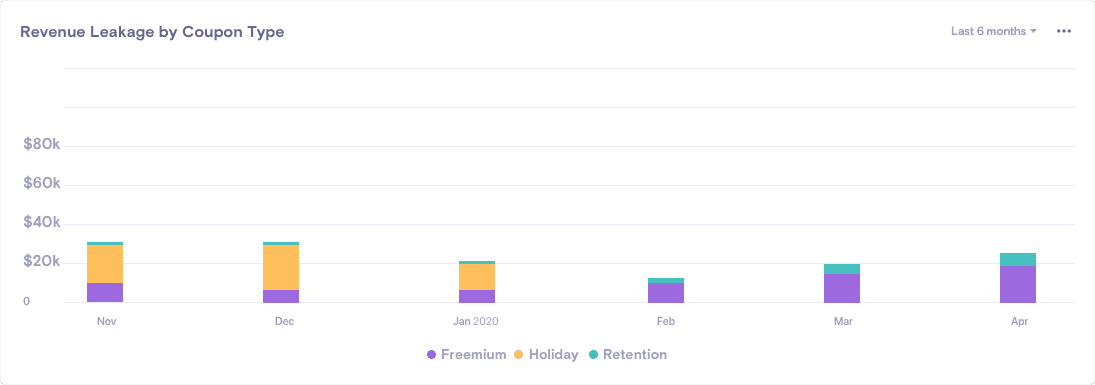

Impact of Discounts

It is advised to keep an eye on the impact of credits, coupons, and discounts you’ve offered to customers. You don’t want to be in a situation where the sales team is closing seemingly big numbers, but all the heavy discounts gnaw away your total revenue.

Customer Payment Process

This will take some effort to come by. But knowing this will pay for itself (pun intended!). If you don’t have this information, there are strong chances that you are baking in delays in your payment cycle. This is especially true if you have large corporates as your customers and/or have an offline payment setup. Track whether all the required documents have been submitted to the customer’s payables teams – and within the right timelines.

Leveraging Tools and Technology

DSOs have a way to creep up and give nasty surprises. It’s time for you to evaluate some technology interventions that will help your team save time and make their lives easier.

Automation

Start with automating basic customer communication. Remote or not, you don’t want to be late while expecting the customer to pay you on time. Evaluate specific AR management tools.

Integration with Online Payment Gateways

This is the need of the hour. Accelerate payments by 20-30% by enabling your customers to pay through Payment Gateways (PG) – right out of your reminder emails. B2B PGs can operate on flat costs, irrespective of the amounts transferred. Incentivize your customers to pay online.

AR Analytics and Dashboards

Look at your Accounts Receivable trends to identify leading indicators and recurring patterns. Set up dashboards for your AR analytics for easy tracking. Your discipline and rigor in creating the right KPIs and understanding the trends will be the difference between a healthy and a not-so-healthy cash-flow!

The process of managing money-in, is something that has been such a ‘day-to-day’ and ‘done to death’ task, that the challenges it has are hidden in plain sight. External uncertainty demands that we change that. It’s time to evaluate some of the interventions and technologies that can help you augment what you already have – and then take it to the next level. Since the well being – if not the survival itself – of the business, is at stake.

Chargebee Receivables is a smart Accounts Receivable and Collections automation platform that will help you do just that, and more. You can book a quick demo here.