It’s our jobs as operators of our business to take calculated risks, but we also don’t want to blindly throw away hard-earned cash. When approaching a new investment, we must gather key inputs and assumptions from our team.

Your SaaS CFO then performs her magic to scrutinize that investment. Does it pass or fail?

An important business moment that requires SaaS CFO scrutiny is moving away from founder-led sales. Hopefully, every SaaS founder faces this pivotal moment where they can hang up his or her sales hat.

It’s finally time to move away from founder-led sales. It’s very exciting and also scary. Can we create a repeatable sales process that will scale our company?

This post also provide an opportunity to introduce a new SaaS metric that Tomas Tunguz pointed out in Rippling’s pitch deck. It’s called the Month Zero Cash-on-Cash Payback (CCP) for your sales team.

Analyzing the Sales Investment

Moving way from founder-led sales is very scary if you don’t apply a financial framework to your new sales investment. I created a forecast model (of course!) to help you analyze your sales team expense and the resulting cash burn.

In this analysis, we need to size up the sales investment versus the expected output. Output in our case is net new ARR or MRR in our SaaS business.

I’ll guide you through the costs considerations when investing in a sales team and how to use the Cash-on-Cash Payback metric in your business, a great metric when you need to keep a tight eye on cash.

The Cash-on-Cash Payback is a great metric when you need to keep a tight on cash.

Sales Investment

Where do we start? First, we need to itemize what exactly we are investing in. And, of course, we need people. Here’s a list of sales roles that come to mind. We might not need all in our scenario, but we will probably start with quota carriers and sales development reps (SDR’s) and scale the team from there.

People

- Quota carriers (i.e. sales reps)

- Sales Development Reps

- Sales Engineers

- Sales Managers

- Sales Directors

- Sales VP

Think about your first couple sales hires. What would they be? Next, we need to outline the operating parameters of our sales team. What is the commission rate, for example? Ramp time of new reps?

Sales Operations Parameters

Next, we need to make a bunch of informed guesses on the operating parameters around our sales team. These inputs are required to accurately forecast your sales expense and incoming cash.

- Annual quota

- Quota attainment

- Sales ramp time to full productivity

- Productivity during ramp

- Commission rate

- Timing of commission payments

- Wage rate

- Timing of customer payments

Sales Team Cash Inflow/Outflow

With inputs in hand, we can forecast our cash outflow and inflow from our sales team. This output forms the basis in calculating the Cash-on-Cash Payback (CCP) for our sales team.

Cash Outflow

- Wages, taxes, benefits

- Commissions

- Miscellaneous expense assumptions (CRM, travel, training, etc.)

Cash Inflow

- Customer payments

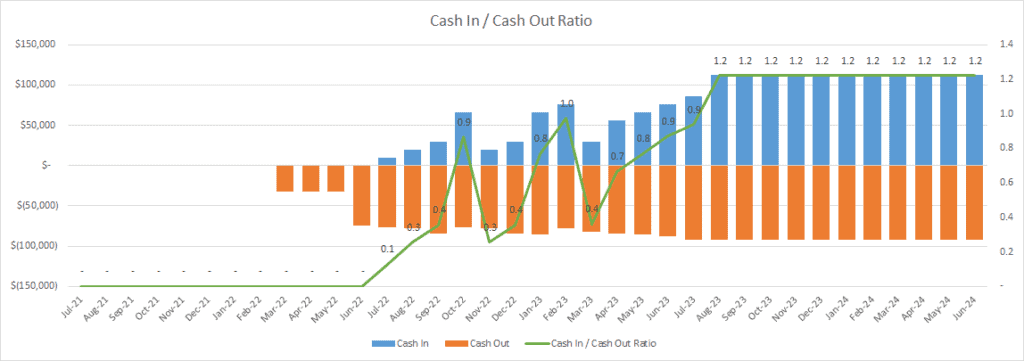

The chart below is from my Excel model. You can chart the cash in and cash out each month and also calculate the CCP metric.

Bridging the Cash Flow Gap

What are trying to get out this analysis? There are three important answers that I’m solving for in this analysis.

- First, how much cash do we need to invest in a new sales team?

- Second, what is the cash drain on our business as our new sales team becomes productive?

- Third, what is the return on investment (ROI) of our sales team?

For this third point, there are many ways to measure the financial performance of our sales team. One of my favorites is the Cost of ARR (aka SaaS CAC Ratio). In this post, I’ll focus on the cash return performance of our sales team via Rippling’s CCP metric.

Month Zero Cash-on-Cash Payback Payback

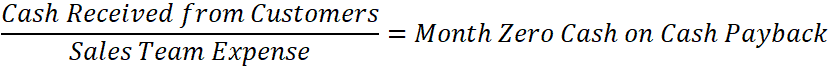

Wow, that is a mouthful of words. I’ll call it CCP. CCP measures the gross cash burn from your sales team (cash out) versus the cash in from customer payments on new deals.

Cash out covers sales team headcount expenses. Headcount expenses include wages, taxes, benefits, and commissions.

Cash in includes customer cash received in that month. This can include upfront payments on annual deals and/or the monthly payment on a monthly payment. It’s not clear to me if this includes every monthly payment, but I would assume it’s only the first monthly payment.

The CCP formula goes like this:

How to Interpret the CCP Metric

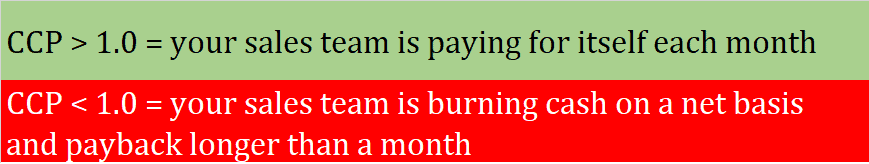

We are striving for a metric above 1.0. When greater than 1.0, your sales team is paying for itself. It’s not burning cash to reach productivity. Rippling goes farther to say that increasing sales headcount will immediately reduce cash burn.

Again, I believe this statement assumes that you stay above 1.0 when adding sales headcount.

A CCP less than zero indicates that your sales team is burning cash on a net basis. The sales team is not paying for itself and will continue to consume cash if it stays below 1.0. However, this would not be uncommon if you have a major ramp in sales headcount that operate under a longer sales cycle.

Next Steps

Need to forecast the build up of your sales team? Download my model below. You can forecast your CCP metric.

I include the ability to forecast more than just headcount expense if desired. You can manually input travel expense or contractors, for example.

When moving from a founder-led sales model, it’s important to understand your gross and net cash burn of your sales team.

Compare this net inflow/outflow of sales team driven cash to your current cash forecast. This will help you plan appropriately so that you don’t find yourself in a cash pinch.

Don’t want to take on this analysis yourself? Check out my SaaS CFO services. Click here. Need a great SaaS pitch deck template for your raise? Check out my completely redesigned pitch deck here.

Download the model below.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.