You’ve bootstrapped your SaaS business to thousands or millions of dollars in revenue. You feel like you have more potential to grow, but you are limited by the cash in your bank account. You need capital, but where do you start?

We are all familiar with the traditional path of equity financing, exchanging ownership in your company for cash. But what if you are not ready to give up ownership? Well, don’t worry, because alternative methods to finance your SaaS business are a hot niche today.

In this post, I will walk you through the process to secure debt financing. This won’t be a theoretical post, either. I interviewed Nathan Latka, who has helped SaaS Founders raise $160M in venture debt financing since 2016.

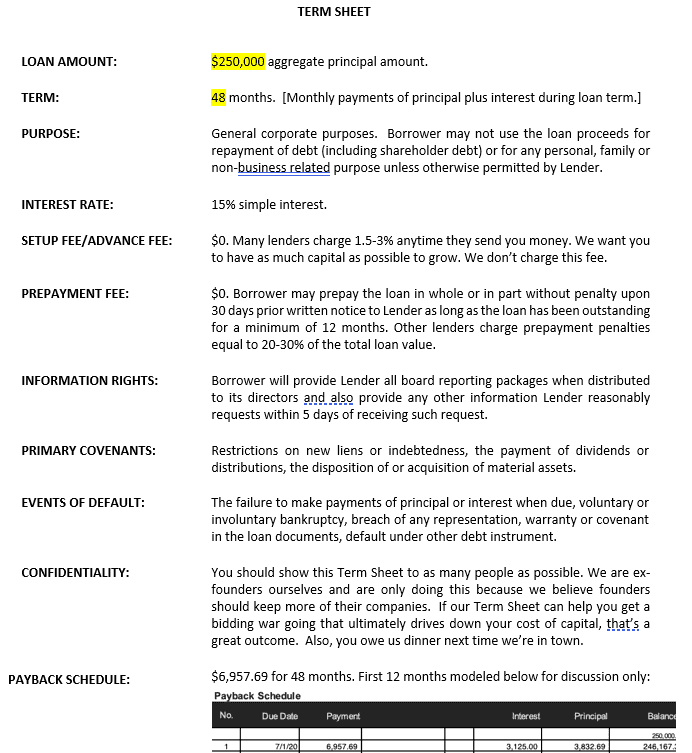

After seeing so many debt capital term sheets, he wanted to simplify the process and launched Founderpath.com to get SaaS founders up to $1M in financing in under seventy-two hours. You can take a look at FounderPath’s term sheet at the bottom of this post.

Debt Financing

There are more options than ever today to finance your business without giving up equity. One of the main draws with debt financing is that you don’t give up an ownership stake (many caveats here; convertible debt, default, etc.) in your company.

You receive a lump sum of cash and agree to pay back the principal and interest over time. Previously, we would knock on the door of our local bank for a term loan. Today, we call this alternate financing, because bank financing is being supplemented (maybe, replaced?) by “alternative” lenders.

Alternative lenders such as FounderPath, Espresso Capital, and BigFoot Capital understand the SaaS business model. They offer forms of debt financing such as term loans and/or revenue-based financing (RBF) that fit your cash flow dynamics. They analyze the health of your recurring revenue to determine if you would be good fit for funding. Through their revenue analysis of your business, they can calculate how much capital to offer you.

What is a Term Loan?

First, let’s start with the basics. A term loan is a lump sum of capital borrowed from a lender. The borrower agrees to repay the funds at a fixed internal over a fixed period of time. The interest payments can be at a set rate or a variable rate.

If you’ve had a student loan, car loan, or home mortgage, these are examples of term loans. Although the mechanics of repayment stay the same, today’s SaaS lenders are more creative on to how to determine eligibility and how much capital to unlock for your business.

Term Loan Application Process

I will use FounderPath’s application process as a real-life example to secure debt funding for your SaaS business. FounderPath offers two options for term loans. The first option is a traditional term loan which you will pay back monthly over four years at a fixed interest rate.

You can receive 6 to 12x your current monthly recurring revenue (MRR) at a fixed rate starting at 15%. The rate is dependent on your SaaS Credit Score as calculated by FounderPath. It takes five to six days to work through the application process and complete the paperwork.

The second option is a short-term term loan paid back over twelve months. This is branded as “Founder Payments.” The amount of funding is based on your current MRR. Up to 1x your MRR can be advanced via this option immediately.

As you build history with Founderpath.com, you unlock more capital at cheaper rates. However, Nathan was quick to point that this option is not revenue-based financing (RBF), because you pay back the Founder Payout at a fixed amount each month. There is no “repayment cap” of 1.4-1.9x like you see with most RBF’s.

A Founders Payment term loan can be closed in as quickly as five minutes. The magic behind the quick close is FounderPath’s algorithm. The algorithm integrates to your customer and revenue data to calculate an on-the-spot credit profile.

SaaS Credit Score

FounderPath assigns a credit score by analyzing over two hundred metrics from your revenue data. It integrates to popular invoicing and payments software such as Chargebee, Zuora, Stripe, and PayPal.

The credit score is based on a points system. A perfect score is 1,000, a really good score is 700+, and passing score is 400+. Nathan points out that some metrics have more weighting that others. For example, a key metric programmed into the algorithm is month thirteen retention. It carries more weight than some of the other metrics.

Month thirteen retention captures both monthly retention and your first annual renewal. It helps assess the stickiness of your SaaS application. A poor month thirteen churn number has an impact on your credit score.

FounderPath’s algorithm is constantly changing as does your credit score. The more history you build with FounderPath (assuming it’s good history), the better your credit score and the better your interest rate. You can unlock increments of capital and continue to work on improving your credit score. Once your credit score has improved, you can unlock more capital at a better interest rate.

Founder Life Post Funding

If you have previously taken on traditional debt, you know that the compliance can be burdensome. It involves monthly and quarterly reporting packages, covenant calculations, and calls with the banking team. Don’t forget the 100+ page loan document that you have to read and sign.

FounderPath has shrunk the debt agreement down to a manageable thirteen-page loan service agreement (LSA). In addition to signing the term sheet below, you will need to sign the LSA to close the deal.

So what’s life like post funding using an alternate lender? Nathan states that he “wants to blend into the background” and not annoy the founder. He can stay in the background by letting his algorithm do the work of monitoring your revenue data in real-time.

Don’t expect “how’s it going” calls. Do expect a call if your revenue materially drops in one month. Your data running through his tool will alert him to any red flags in your revenue profile.

The majority of founders use Founderpath.com for our metrics and SaaS Credit Score. We want to help them build better SaaS companies even if they don’t take capital from us.

Nathan Latka, FounderPath.com

A Lot of Capital Out There

With the proliferation of alternate financing sources, there is a lot competition for a founder’s attention. With no equity upside in your company, you may think that debt providers do not care if your company grows.

But it’s quite the opposite attitude that will differentiate alternate debt lenders. Just as you would interview venture capital and private equity firms for a cultural and operational fit, so should you assess your debt provider.

When I built and sold my first SaaS company in 2015, I was always looking for new ways to grow. Now at Founderpath, we’re giving founders ideas of new ways to grow directly in the interface. Dedicated email sends using Paved.com for example.

Nathan Latka

In FounderPath’s case, it wants you to secure funding faster and cheaper but also help you spend your capital where you will get the most return. Automated emails are sent with updates on your credit score and how close you are to unlocking another round of capital at a cheaper rate. You can also take advantage of Nathan’s distribution channels such as his SaaS CEO Podcast with founders, email list, and guest TV appearances.

With the growing number of capital sources, it’s not just about the money. Find a venture debt lender who fits your operating perspective and can lend expertise to grow your SaaS business.

FounderPath Term Sheet

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.