Dear SaaStr: How Much Equity Should a CEO Have in a Startup?

There’s no magical answer, but for venture-backed start-ups, for years VCs have aligned on around 6%-8% equity for a non-founder / outside CEO. As you approach IPO and very late stage, that often goes down.

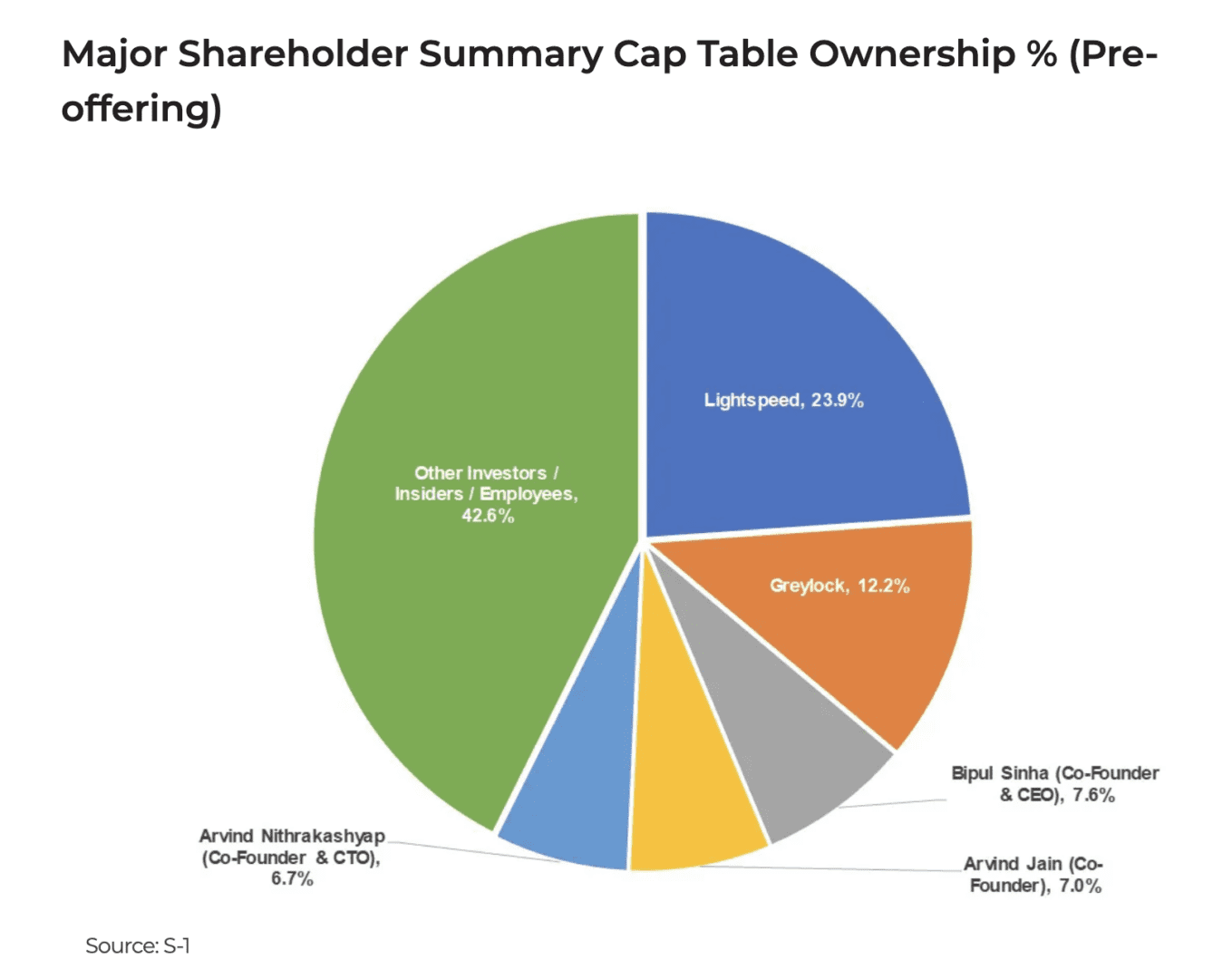

And as a rough rule, all the founders together at IPO, if you raise multiple rounds of venture capital, will likely share about 20%-25% as a group. Here’s a nice chart for Rubrik that Meritech made illustrating that, the latest SaaStr / Cloud leader to file to IPO:

A few other examples, first for outside CEOs:

Dev Ittycheria joined MongoDB as CEO after the Series B, and had 6.3% at IPO:

Jennifer Tejada joined PagerDuty as outside CEO, similarly had 6.4% at IPO as well:

Gregg Schott joined Mulesoft as CEO after founder Ross Mason, and going into the IPO had about 3%:

For founders, there’s less of a formula. It’s more a function of how much dilution a start-up takes, and that can vary wildly based on # rounds, valuation, etc.

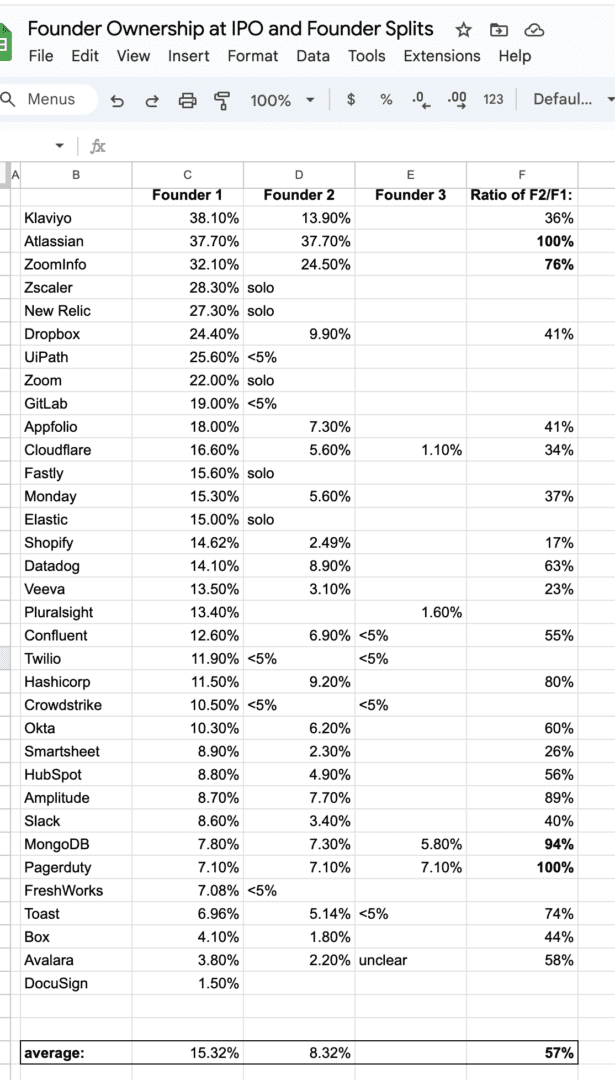

Based on an analysis I did a little while back here, the average Founder-CEO ends up owning about 15% at IPO, and the average top 2 co-founders owning 24%

And a bit more here: At the Top SaaS Companies, Most Co-Founders Are Not Equal (And That’s OK) | SaaStr