Our Proposals to the Senate Banking Committee

We are at the threshold of the third generation of the internet: web3. Given the pace of innovation in this space, it has been challenging for many policymakers to keep up. That’s why we were so heartened by the Senate Banking Committee’s call for feedback on clarifying laws around digital assets and decentralized technology. Maintaining America’s innovation and financial edge has always depended on business leaders and policymakers collaborating to ensure that the private sector can experiment and build, while appropriate regulatory regimes help manage the real downside risks that might otherwise harm individuals.

We were happy to answer the Committee’s call. Since we believe the only viable path forward is bipartisanship, we shared our ideas with the office of each Senator on the Committee for their review. And, in the spirit of openness and transparency, we also want to share our proposals with the wider community, in the hope that this can help catalyze a conversation around the future of digital asset legislation and regulation.

Each of our four proposals is designed to stand on its own, but taken together, they represent the start to a comprehensive approach to supervision, oversight, and taxation in a decentralized environment. We have provided a short, plain English summary of the recommendations below, and the full text of our submission can be found here.

Of course, this is merely a small part of an ongoing dialogue with policymakers, civil society leaders, and other stakeholders. We look forward to your feedback on how we can do more to jointly advance decentralized technology and policy priorities such as expanding economic opportunity, consumer protection, and financial inclusion.

- Consumer Protection and Inclusion. As the number of decentralized projects grows, and as these projects become increasingly integral to our economy, policymakers need to establish a cohesive strategy for advancing consumer protection in the sector. This proposal creates a simple disclosure-based supervision regime under the Consumer Financial Protection Act, providing regulatory clarity by standardizing the existing disclosures that many projects already provide and ensuring that consumers are getting the information that they need to participate in such projects on a level playing field.

- Decentralized Autonomous Organizations. DAOs are the cornerstone of a new way to manage and coordinate human activity. But they still lack uniform legal recognition to conduct basic organizational functions such as filing and paying taxes, opening bank accounts, signing legal agreements, and limiting liability for DAO members. This proposal pulls together existing laws related to unincorporated associations and tax reporting status to create a lightweight framework around the off-chain legal status of DAOs. It also harmonizes the regulatory approach to DAOs across a number of federal agencies.

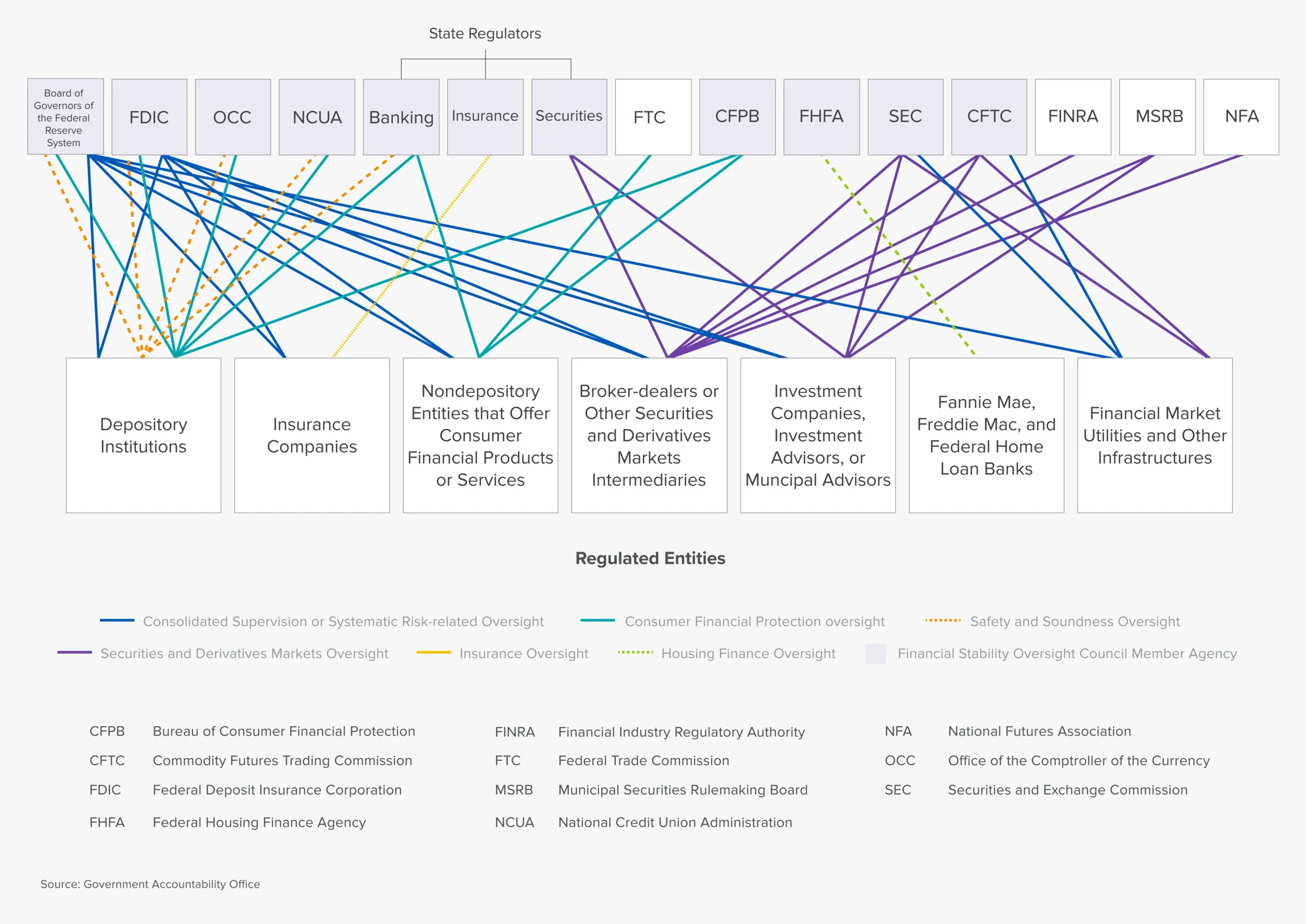

- Comparing Jurisdictional Harmonization, SROs, and Nonprofit Corporations. In 2016, the Government Accountability Office found that, “Fragmentation and overlap have created inefficiencies in regulatory processes, inconsistencies in how regulators oversee similar types of institutions, and differences in the levels of protection afforded to consumers,” and recommended that Congress consider whether changes to the financial regulatory structure were needed to reduce or better manage fragmentation and overlap. Shoehorning decentralized technology into this framework is challenging for both innovators and regulators. This proposal would direct the GAO to conduct a study comparing the costs and benefits of three approaches: (1) jurisdictional harmonization among agencies; (2) the establishment of an industry self-regulatory organization, ideally with multi-stakeholder participation; and (3) the establishment of a nonprofit corporation for technical oversight and standards-setting for decentralized technology (similar to ICANN).

U.S. Financial Regulatory Structure (click to expand)

- Tax Reporting and Related Issues of Blockchain Ecosystems. The United States tax and regulatory environments are designed for centralized operations. Yet, as currently drafted, the infrastructure bill pending in Congress would impose tax reporting requirements on a wide array of actors who would have no ability to comply. We raised this issue in a letter a16z sent to Senate leadership earlier this year. This proposal builds on the work already underway with the infrastructure bill and in other legislation to clarify sensible rules of taxation as it relates to digital assets.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.