Q: Why do SaaS companies bill annually up front?

Perhaps they shouldn’t.

A lot of SaaS pricing originally comes from classic enterprise software. In the old days, a customer would pay a large fee for the software upfront, and then a smaller maintenance fee for years to come. The big upfront fee was naturally paid up front, like other software you buy.

SaaS then remixed this model by charging less in Year 1 for a “subscription”, but often more over time, especially by Year 3. You no longer bought. You rented :). Salesforce perfected this is the enterprise.

But, the model didn’t really keep up with the times. Today’s buyer is as much influenced by Slack, Zoom, and even B2C apps as how someone used to pay for Oracle.

Fast forward to 2021, and many SaaS and similar products don’t really charge upfront fees:

- 50% of Zoom customers pay monthly

- The majority of Shopify revenue is from payments and merchant services, not even software.

- Vertical SaaS leader for construction Procore at $500m ARR charges per project volume and per product, not per seat.

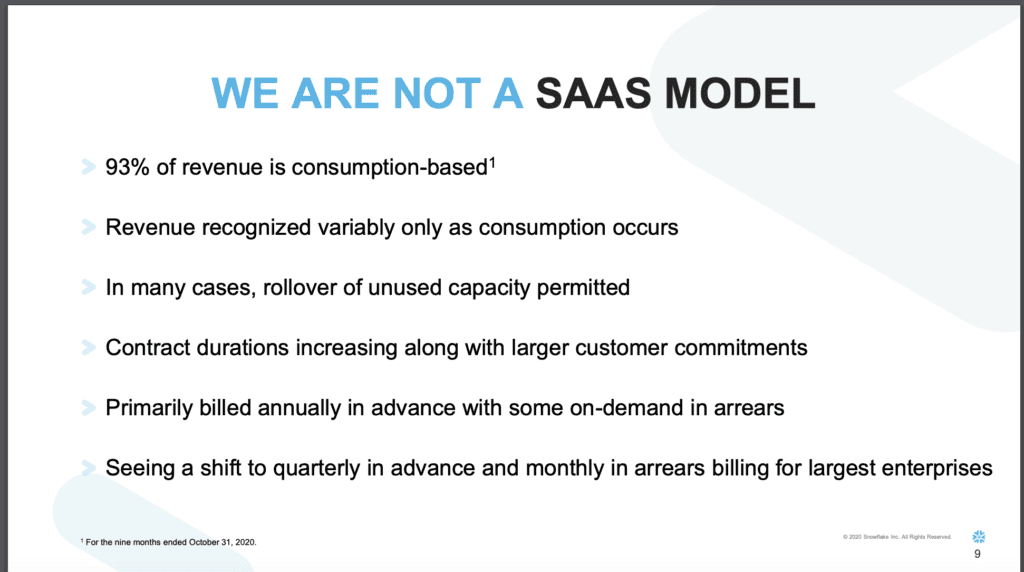

- Many API companies charge on a usage basis, in whole or in part, from Twilio to Stripe and more. See, e.g. Snowflake, one of the hottest IPOs of recent times. This can include committed minimums, which are often billed upfront, however. So some convergent evolution there.

Of course, the more enterprise you are, the more common the traditional model is. ServiceNow does primarily 3 year, $1M+ contracts, for example. All of Qualtrics’ almost $1B in ARR is on annual contracts.

So the upfront payment for a year isn’t dead. And in the early days, it can definitely help with cash flow, up to a point. But it isn’t as common as it was just a few years ago.

The real lesson: do what works for your customers. Look at what the most beloved vendors do in your space around pricing models. And either just copy their model(s), or better yet, improve on them.

…..

From Snowflake’s IPO: