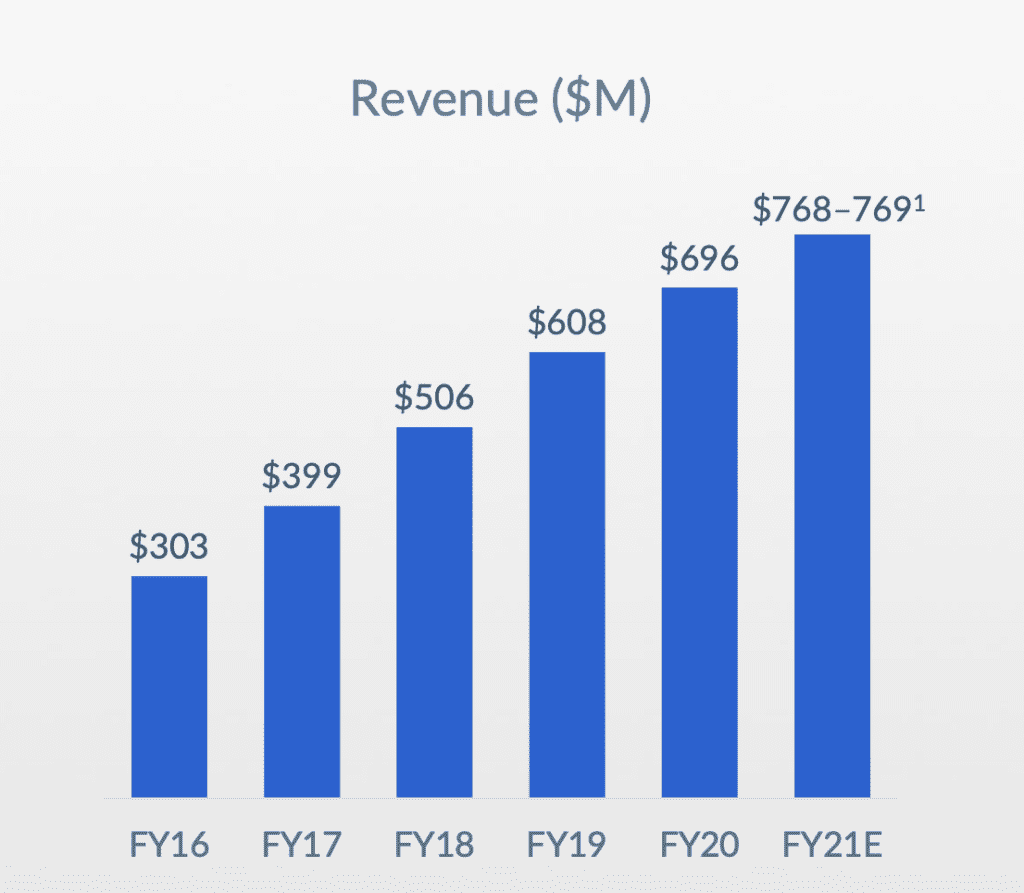

Box has been an important part of SaaStr almost since the beginning. Aaron Levie was kind enough to come to our first SaaStr Annual in 2015, just a week after their IPO. And when we wrote in 2014 that Box would surely cross $1B in ARR, many at the time didn’t quite get SaaS yet — or the power of recurring revenue. Well, soon enough indeed, Box will be there.

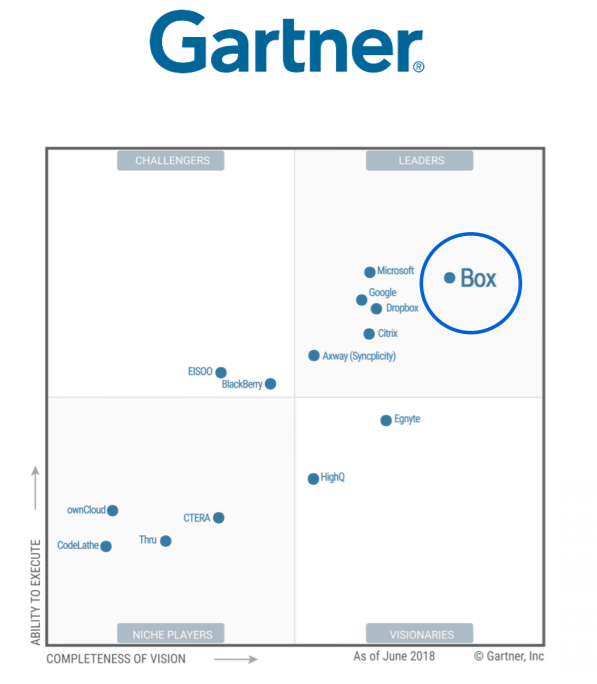

But we haven’t done a deep dive on new learnings from Box at scale. It’s especially interesting as its core market has matured, and Box has moved aggressively to expand its TAM to push growth to 19% YoY. New enterprise products have been critical to their recent growth.

So let’s take a look at 5 Interesting Learnings at ~$800,000,000 in ARR:

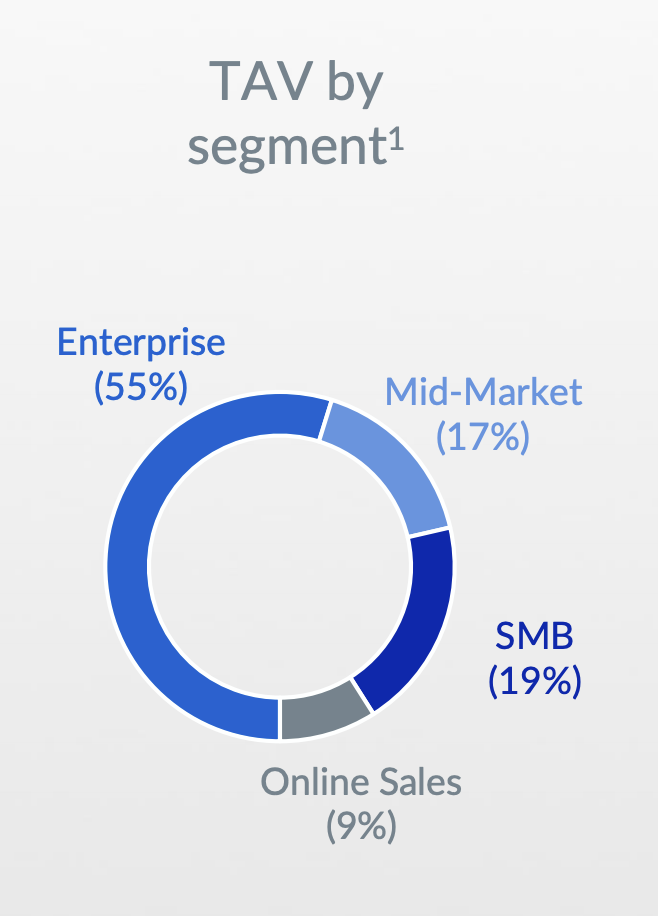

#1. Box went enterprise well over a decade ago, but 45% of its revenue is still from SMBs, Mid-Market and Self-Service. This surprised me a bit. Box went enterprise early to break out from the pack, but it proves that if your app can provide value to businesses of every size, then businesses of every size will still adopt you.

#2. 9% of sales are non-sales driven, which means almost $80m of ARR is still basicaly freemium / self-service. Box’s smallest channel yes, but still material even as revenue approaches $1B in ARR.

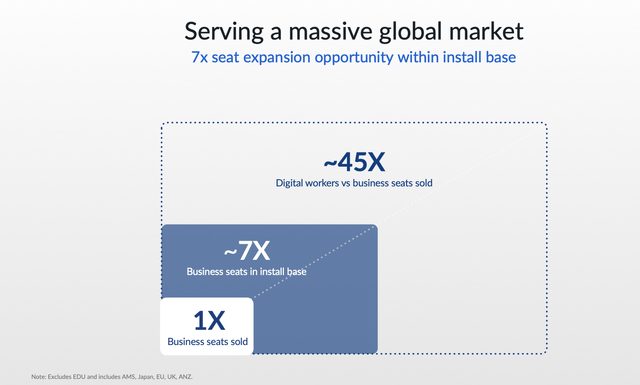

#3. The majority of Box’s growth is from its existing base of customers — both account expansion and price increases. This is a common theme from almost all SaaS leaders at scale. Box calculates 7x expansion from its existing installed base:

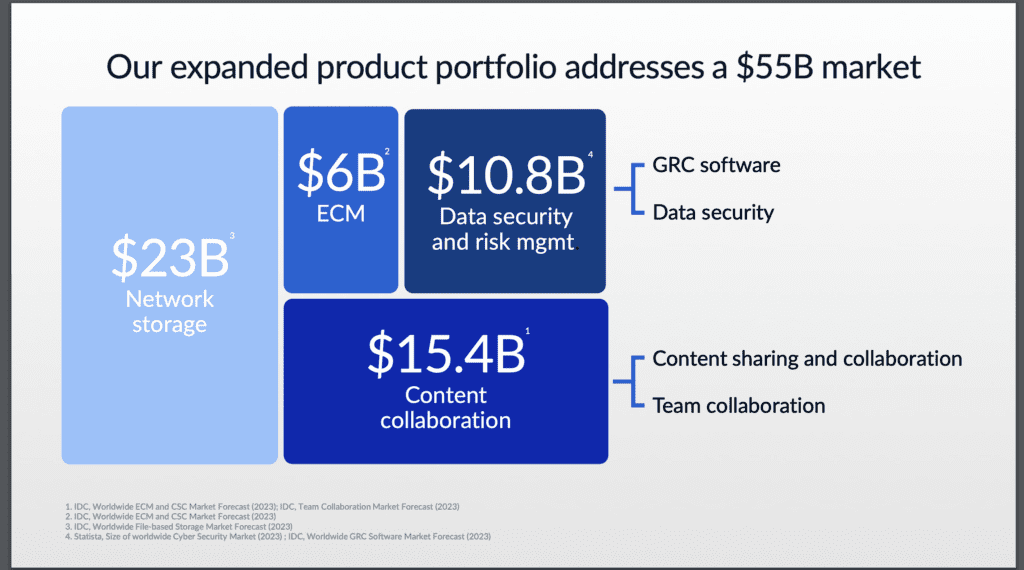

#4. A big push into security & compliance to grow its TAM. We talked with CEO Aaron Levie in depth with this at the SaaStr Enterprise 2020 above. With its ECM market quite mature, Box is aggressively pushing its roadmap and value proposition into content security and compliance:

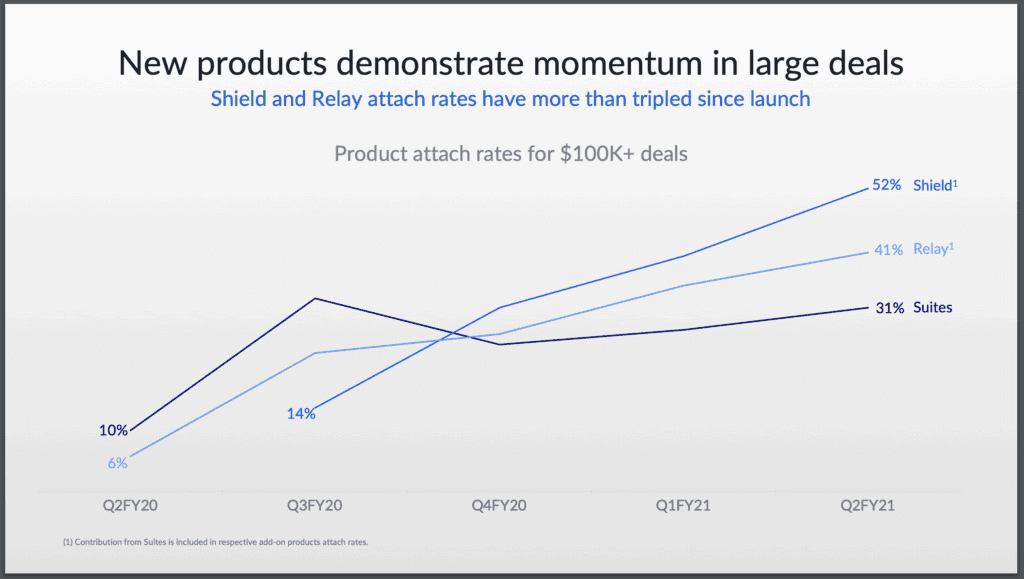

#5. A 30-50% attach rate with new products, and 125% NRR with multi-product customers (vs 90% with no add-on products). Box customers pay more, and stay longer, when they buy more than 1 product from Box. $100k+ deals have 30%-50% “attach” rates for new products, and just as importantly, have 125% NRR with 2+ add-on products, 110% with 1 add-on, and just 90% for no add-ons.

Box is a great case study to follow. In many ways, they “won” the Cloud enterprise content management segment. Now we’ll see how they expand it.

…

A few others in this series here:

- 5 Interesting Learnings From Zoom When It IPO’d

- 5 Interesting Learnings from Shopify at $3B ARR

- 5 Interesting Learnings From Bill.com’s IPO

- 5 Interesting Learnings From PagerDuty at IPO

- 5 Interesting Learnings From RingCentral. As It Approaches $1b in ARR.

- 5 Interesting Learnings from Zendesk. As It Crosses $1B in ARR.

- 5 Interesting Learnings from HubSpot as It Approaches $1 Billion in ARR

- 5 Interesting Learnings From Slack at $1B in ARR

- 5 Interesting Learnings from RingCentral as It Approached $1B in ARR