We put together a basic 50/50/25 VP of Sales Comp Plan early on at SaaStr, and it’s time again for an update.

Incentives are critical, and the VP Sales will likely be the Seemingly Most Expensive hire you ever make. That’s stressful. So let me tell you what I’ve done and learned both myself and across 30+ high growth startups I’ve invested in or advised. A plan and framework to make this first VP of Sales hire, hopefully, the most accretive hire you make.

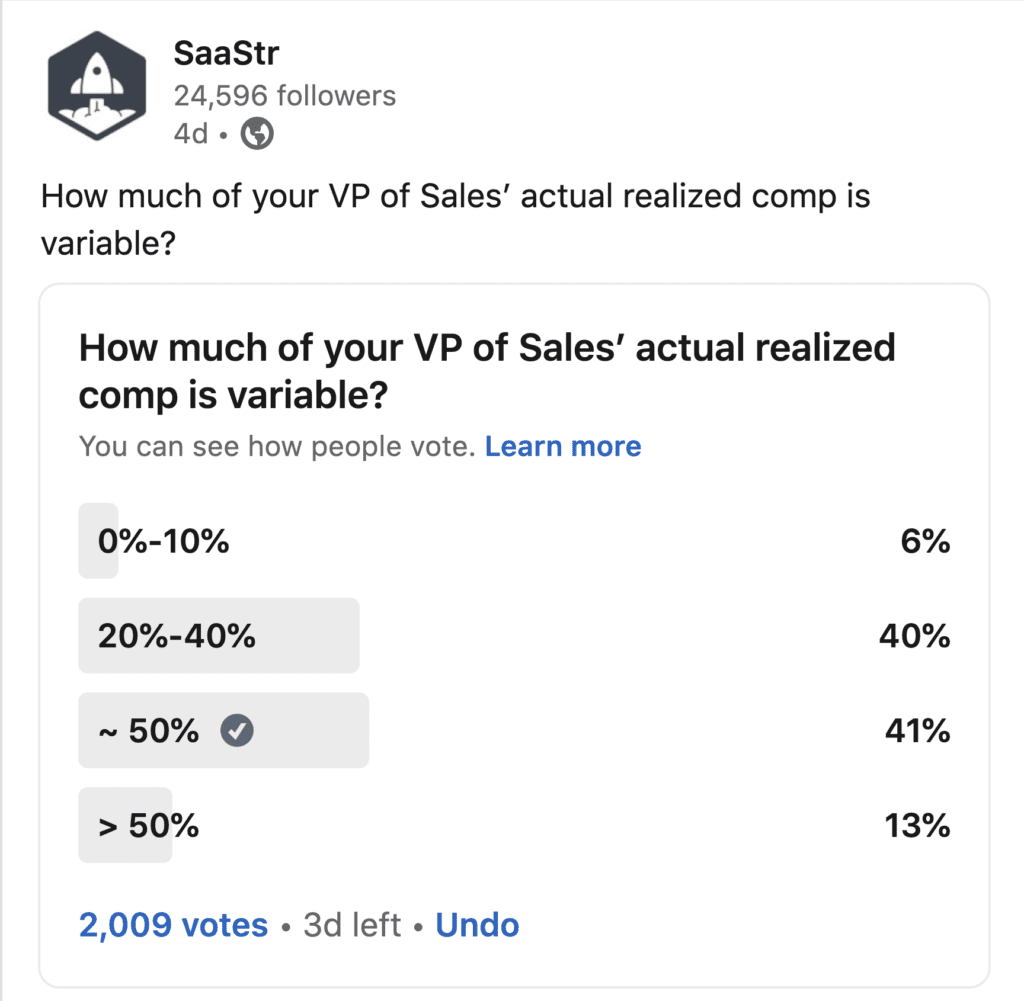

It’s still The 50/50/25+ plan. And as you can see if you look at the Boston Strategy Group chart below as usual, it’s just a little different from The Ordinary way to go. Not a lot different, but meaningfully so.

chart from here

A few basic ground rules so your VP of Sales is a guaranteed win-win hire – not a stressor:

- No best efforts cr*p. Even if you hire a VP Sales very early, there has to be a clear quota and a clear annual plan for him or her to hit. No best efforts stuff. I know it’s teamwork in a start-up. But sales is sales. Any VP of Sales candidate that says “it’s not about the money” or anything like that — pass. While it may be true, sales is about closing a lot of deals. Period.

- In a start-up, the VP Sales has to also be aligned to costs, not just revenue. It’s natural for a VP Sales not to care about costs — just new deals closed. Just to want a top-line number to meet and grab as many resources as possible to meet it. But costs are critical when you’re adding sales reps and then a VP Sales ahead of profitability. Sales just feels sooo expensive early on. So make sure you are agreed on how many hires she’ll need, how long it will take them to ramp (ideally, 1.5 or less sales cycles), and even more importantly, an overall budget for sales hiring and expenses for the year.

- The VP Sales has to somehow be accretive. This can seem almost impossible in the early days, unless you give her a big quota, which as we’ve discussed, doesn’t scale. So how can this big salary not just be a big drain on limited capital? How can the VP Sales not be a “tax”, at least from a financial plan perspective? The answer has to at least be that she increases sales by more than she costs. Ideally, significantly more. If you can’t make that math work, something is off and it won’t work out, or you are making the hire too early. For example, if you hire your VP of Sales at $2m ARR, and you were growing 100% … and you then grow 120% after making the hire … she’s increasing your revenue $400k+ right there. That should basically pay for her full OTE right then and there.

- The Good VPs of Sales have large OTE (On-Target Earnings) Expectations. You can’t get a great VP Sales for a nominal $1X0k salary. You can get a crummy one, however.

- Many candidates will tell you they want a guaranteed draw for 6+ months. Especially if they’re leaving something good for something risky. I.e., guarantee me my full bonus for 6+ months until I’ve built up a big enough pipeline to close enough revenue to hit my number. Sounds fair — on the surface.

It’s tough. And I got most of this wrong before I got it right personally.

So here’s what I’ve learned over time after doing this dozens of times:

- A Relatively High OTE is No Big Deal — if your VP Sales Hits Your Number. So don’t sweat it. Instead, align it. Do you really care if the OTE is $300k, or heck even $500k, if the VP Sales brings in $Xm more revenue than you expected? Of course you don’t. And an OTE with 50% based on hitting the plan means you don’t pay all that much of it if the plan isn’t hit.

- So back in the day we paid 50/50/25+, and I’ve found it works well again and again:

- 50% of OTE paid as base salary. Ideally, little to no draw (i.e., no guaranteed bonus for X months until you scale).

- 50% of OTE paid as bonus, with the target being the overall company revenue number / ARR for the year. Top-line revenue, inclusive of churn, inclusive of upsells, net of everything. The same number you and everyone else in the company is trying to hit. A number that’s hard to hit, but that you have say 50-60% confidence you can hit.

- 25% or more upside for exceeding that plan. Basically, we paid our VP Sales X% of every single dollar after we hit the plan for the year out. That % has to go down over time, but the basic idea was if the Stretch Plan was hit (Stretch for us = plan that I had 25% confidence in hitting), then there would be a 25% boost on top of the OTE. If the Stretch Plan was exceeded, the comp goes up from there.

- No cap. A great motivator for the best of them.

Our plan was that simple, and it’s worked again and again since then. And what it meant, like our sales rep comp plan, was if the VP Sales killed it — the money would follow. And if she didn’t, it didn’t, and the cost wasn’t that stressful. And since our VP Sales killed it, he made good money, was highly accretive, and in our cases, we even got to cash-flow positive at $4m in ARR paying our VP Sales well and paying our sales reps 25% of the deal size.

A few thoughts on the plan:

- Try to avoid, or at least minimize, a guaranteed draw. Sometimes, a draw is super important to a VP of Sales, and it can make sense to do a minimal one. But the thing is, if you pay your VP Sales in full-on hitting the plan, it shouldn’t matter if that gratification is delayed a few months, so long as the real OTE is high. What I see again and again is a draw often ends up being an excuse for laziness or a slow ramp. It just sucks some of the hunger out. And it lets the candidate blame others for their own First 90 Days issues. {Yes, I know some will disagree and this is controversial. Just my view.} Or if you end up doing a draw, try to keep it short (e.g., one quarter) and make the VP Sales have to “make it up” in sales quota payments by the year-end. Or even better, don’t do a draw, but ratchet down expectations for the first quarter to make OTE initially.

- But do pay well when they kill it — against a sane plan. And don’t cap the upside. That’s the trade-off. No or limited draw, no huge salary for just showing up. But you have to pay very well when a realistic plan is hit (not a ridiculous one), and you have to pay very, very well when you exceed it. This will appeal to a great VP Sales on the way up. It won’t appeal to a mediocre one or one on the way down.

- Pay bonuses out monthly. The flip side of the no guaranteed draw. No delayed gratification here. It’s hard enough to come into something new as VP Sales and make magic happen. Once it does — pay now. Not later. Don’t wait them wait to get paid if they’ve delivered.

- In the beginning, consider bonuses and goals that match the overall company ARR goals (not just sales’ net new bookings). My VP Sales and I both worked toward the same goal as everyone else in the company — the end-of-the-year revenue goal. We had a self-service component, and the Client Success team managed churn, and upsells were split between Sales and Client Success. You could make an argument the VP Sales should only be responsible for net new revenue from sales. And that may be the way to go later. But until you are at $Xm in sales, I say everyone should have the same revenue goal where practical. One overall revenue goal for the founders and VPs and everyone. It also incents the VP Sales to work with the other functional areas, e.g. support, product, customer success, etc. Later, when you are bigger, it can make sense to tie VPS comp just to new bookings, but rarely much before $20m-$30m ARR or so.

What’s Different Today (since our original post on the topic)?

- VPs of Sales Are Often Asking for a Lot, Lot More Equity These Days. That may be fair, although pushed too far it’s also … tough. The cap table only adds up to 100%. Just do your best here. In the end, a 4-5 year vesting period does address some of the issues here. A mediocre VPS won’t be there on Month 12 anyway (i.e., after their cliff), so in a sense the problem often solves itself (the best VPs of Sales early the big grant, the mediocre ones leave early anyway). So more equity than expected may be OK in the end at a practical level. If nothing else, brace yourself for an aggressive ask here.

- VPs of Sales Are Asking for Bigger Draws. Notwithstanding the advice above, more and more VPs of Sales now push for a draw, i.e. their bonus guaranteed for the first say 3-6 months. It’s not the end of the world, but if the sales plan is sane, they shouldn’t need it, or need it very much. A good compromise is just designing a plan for the initial 3-6 months that can be met, i.e. that is just a smidge more growth than the company is currently experiencing. I just see again and again a lack of urgency when VPs of Sales are given a full 6-month draw with no payback. Incentives matter.

- VPs of Sales Asking for Cash and Equity If They Are Terminated in Year 1. This newer trend is one I’m struggling with. It’s the opposite of alignment. But it’s more common these days. The reasoning is that VPS is such a risky role. But personally, I’d rather trade more equity with a cliff than a payoff to a VPS that doesn’t work out. I’d rather even have a 6-month cliff than have a VP of Sales know they are getting a big check and a bunch of cash if they exit quickly. In any event, this is a good reminder to whenever possible, get to know your potential VP of Sales over time. That de-risks things not just for you, but also just as importantly, them.

- Most Critically: Even Less Experienced VPs of Sales Are Often Waiting for startups that have crossed $10m+ ARR, or even $20m-$30m ARR. And the super-experienced are often waiting to join a start-up at $50m-$100m ARR!! This is the biggest challenge these days. Great candidates that a few years ago would take a risk on a $1m-$2m ARR start-up … are waiting. Waiting for a $10m ARR startup, or even later. And the proven ones that before waited to join at the Series B … may wait for the Unicorn round. It just makes sense for a proven VP of Sales. Same equity, same or more comp — and less risk. There is no great answer here, other than to realize that means even more you probably should aim for a great stretch VP of Sales vs. a proven veteran.

Good luck! I think anything works well here, as long as (1) you align interests, and (2) the plan is achievable.

Make sure if nothing else you have that. For real.

Much more here in our FREE guide to hiring a Great VP of Sales: