Behind the Round with SaaStr: Chorus.ai Raises $45 Million

This week Chorus announced its Series C round for $45 million, which was led by Georgian Partners. This brings the total amount raised to $85.2 million.

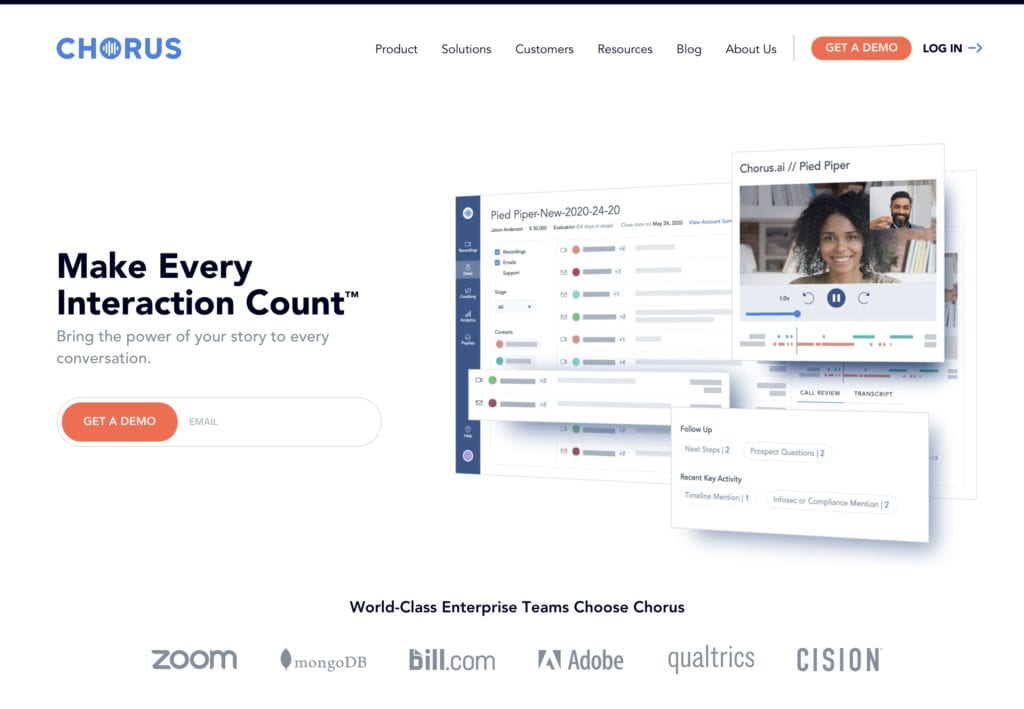

Founded in 2015, Chorus operates a SaaS platform that provides valuable insights from conversations – say with calls, video conferences, and emails — for revenue teams. The technology is based on leveraging AI (Artificial Intelligence) models and algorithms. And some of the marquee customers include MongoDB, Gitlab, and Qualtrics.

The funding comes at a point when Chorus is in the hypergrowth mode. Last year, the company doubled its headcount, tripled revenue and landed on G2’s Top 100 Global Software list.

“Within this niche, there are other vendors who operate within Conversation Intelligence, but Chorus’s unique mission to harness the customer’s voice and advanced AI stands out as a key differentiator,” said Jim Benton, who is the CEO of Chorus.ai. “Building technology for revenue teams requires both a 10,000-foot view of the industry and real-life experience. For us, that means including a clear understanding of the challenges and obstacles facing AEs, SDRs, CSMs and Revenue leadership. It’s because of our holistic understanding of the industry today, and what it will be tomorrow, that we can pioneer the space.”

Keep in mind that Conversation Intelligence is the fastest-growing segment in sales technology, with much traction in the enterprise. Over 1,500 companies have adopted this type of technology and the spending is over $250 million.

Yet the growth is likely to accelerate. With the impact of the COVID-19 pandemic, companies need clear and accurate insights on their deals and renewal pipelines. No doubt, Chorus provides this at scale. The NLP (Natural Language Processing) technology has even provided guidance on how to handle COVID-19 discussions with customers and prospects.

“There is an increased urgency in business – more risk, more potential, more importance on onboarding and customer success,” said Benton.

Chorus’s AI has reveled some interesting insights from the data. Here are just some of the metrics:

- Cold calls have dropped 20% overall.

- Connect rates have remained relatively steady at 9%, compared to 11% in January.

- There has been a pick-up in activity in the hardest-hit markets like NYC, Chicago and San Francisco.

The pandemic has also forced deals to come under much more scrutiny. There is more involvement with senior executives, like the CFO. This is an indication of the focus on the details of the deal structures and ROI. It’s all about the right numbers and finding real business value.

“Leadership has gotten more involved on both the buying and selling side for several reasons,” said Benton. “On the selling side, leaders help ensure the business problems buyers are trying to solve are well understood and their team is empowered to find creative solutions to drive deals over the line, like payments for example. On the buying side, as businesses evaluate expenses in a time where layoffs are more common, leaders are there to ask hard questions and help ensure their team can make a compelling business case for the purchase.”