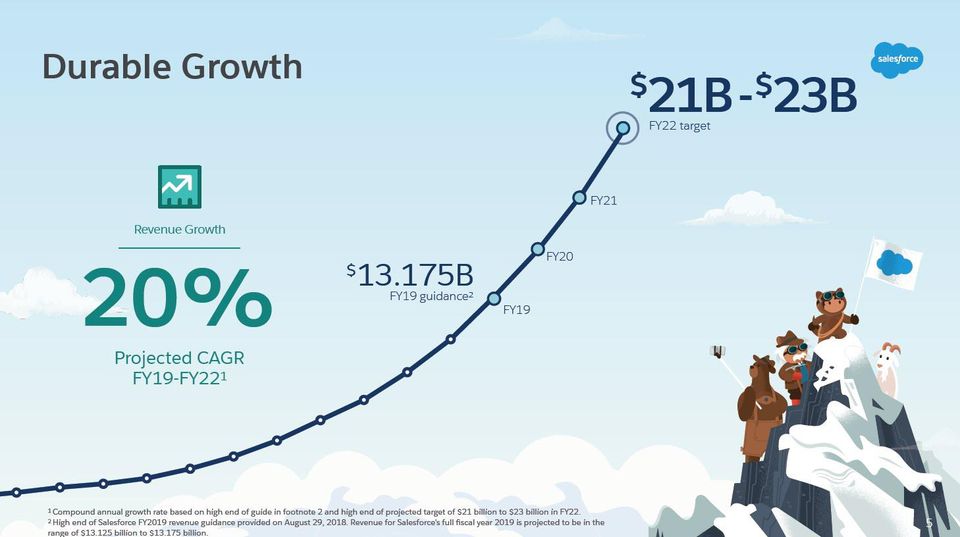

Salesforce Growth:

2021 $20.8B Guidance

2020 $17.1B

2019 $13.2B

2018 $10.5B

2017 $8.4B

2016 $6.7B

2015 $5.4B

2014 $4.1BThank you Ohana! ❤️

— Marc Benioff (@Benioff) August 25, 2020

Today, there are 5 $100B+ SaaS Companies, Salesforce, Shopify, Square, ServiceNow and Zoom. Five — so far. We could add older companies like Adobe, Microsoft, etc. but they aren’t pure SaaS plays.

But they won’t be the last. There are 25 more at $10B+ or close to it:

That’s enough that as crazy as it sounds, not only can you plan on becoming a Unicorn after say $10m ARR. You can now actually dream of building a $100b+ SaaS company. After all, while there are “just” 5 today, there are another 25+ working on it.

So let’s dig into some really interesting metrics and facts that Salesforce and other $10b+ companies have … that you can emulate and plan on:

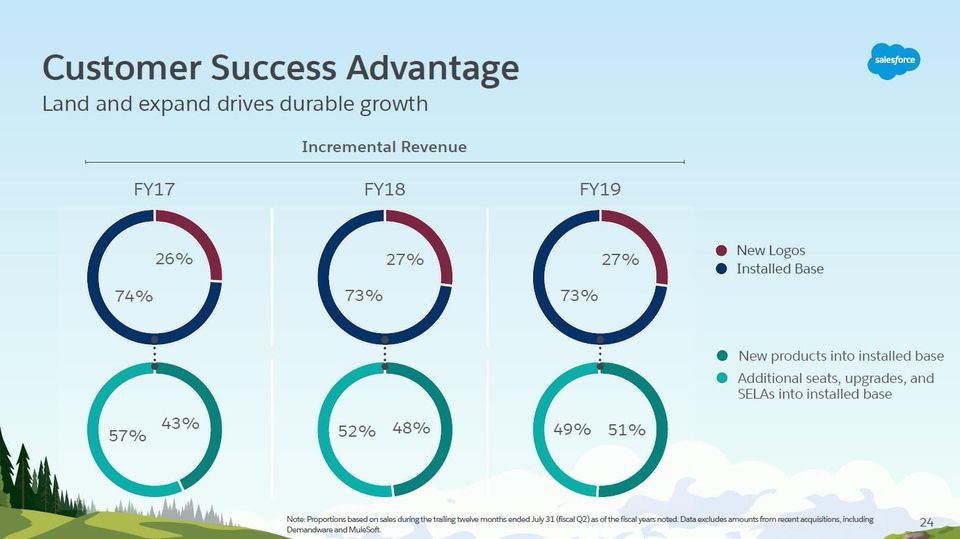

- 73% of Salesforce’s new bookings come from the installed base. Let that sink in. This is why in the end, Net Revenue Retention is the #1 most important metric in SaaS. This also means that Salesforce could basically still hit 73% of its plan for 2020 without even adding a single new customer. Customer Success > Sales, ultimately:

- Salesforce’s upsell is split about 50/50 between new seats and new products. In the early days, you’ll probably only have new seats to sell. But eventually, you’ll probably need a second or third product to sell. We talked about this re: Veeva, Twilio and more here:

- The more products you sell, really, the more problems you solve — the more you make. This is something a bit non-obvious. But Salesforce’s customers that buy > 1 product overall, spend 10x more. This skews a lot because the customers that buy more “Clouds” from Salesforce are bigger companies. Still, the more big problems you solve, the much more you make. Don’t just raise prices. Keep adding value. Lots more value. New editions. Much more powerful functionality. Solve more and more problems for your customers. And you’ll be able to capture more of the value you provide.

- Salesforce has ~2,000+ customers that spend $1m annually. That’s a lot more than the 500 in the “Fortune 500”. So as you begin to go upmarket, whether it is in the beginning or, like Shopify and RingCentral, later … assume you have at least 2000+ mega-accounts to target. No excuses.

- Salesforce’s largest customers are growing the fastest. Salesforce also has almost 200 Customers that spend $10m+ and ~40 spending $20m+ annually. The biggest customers are spending the most and growing the fastest. So when you start to go upmarket, lean in here. It can last for decades.

Probably we can’t all build $100B+ SaaS companies. But it’s no longer crazy to dream of it:

- Go Long in Customer Sucess. Drive Net Revenue Retention Up to 130%+. Zoom has, Slack has, Pagerduty has, you can. Ultimately, this may be your largest source of new bookings. If 75% of your revenue comes from your installed base, like Salesforce’s at $20b+ in ARR, you’ll be able to scale almost infinitely.

- If You Do Go Upmarket, Keep Going. There’s No Ceiling. Salesforce started with SMBs, and its fastest growth today is in its biggest accounts. You can capture more and more of their spend over time. Even at $20b+ in ARR, Salesforce’s biggest accounts are still getting bigger. A lot bigger.

- Don’t Get Distracted In the Early Days. But Later, Think About Your Second Product. Is it Shopify Plus? Is it Sendgrid? Is it Vault, like Veeva? You may not need a second product until $50m or even $500m in ARR. But thinking about it will help you think about what it takes to get to $10B ARR. And maybe even $100B ARR.

It worked for Salesforce. It’s working for Twilio, for Shopify, for Veeva, for Zoom, for Slack, for Cloudflare. It will work for you.